C Form 2019

What is the C Form

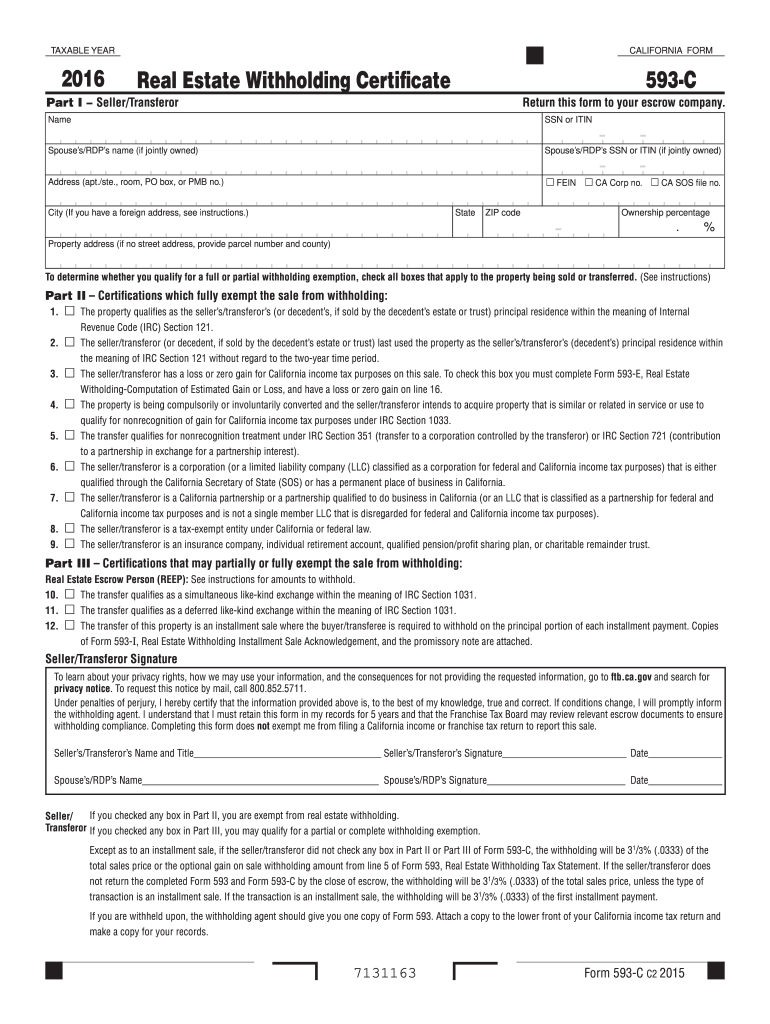

The C Form is a specific document used primarily for tax purposes in the United States. It is often utilized by businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and helps in the accurate reporting of income and expenses. Understanding the C Form is crucial for both individuals and businesses to maintain proper tax records and avoid penalties.

How to use the C Form

Using the C Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it carefully for any errors before submission. It is advisable to retain a copy for your records. Depending on your preference or requirements, you can submit the C Form electronically or via traditional mail.

Steps to complete the C Form

Completing the C Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, such as income statements and expense reports.

- Fill out the form, ensuring to include all necessary information, such as your business name, address, and tax identification number.

- Double-check all entries for accuracy, including numerical figures and personal details.

- Sign and date the form to validate your submission.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the C Form

The C Form must be used in compliance with IRS regulations to be considered legally valid. This includes adhering to guidelines regarding the accuracy of reported information and the timeliness of submissions. Failure to comply with these regulations can result in penalties or legal repercussions. It is important to understand the legal implications of submitting the C Form and to ensure that all information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the C Form are critical to avoid penalties. Typically, the C Form must be submitted by a specific date each year, often aligned with the tax filing season. It is essential to stay informed about these deadlines, as they can vary based on your business structure and the specific tax year. Mark these dates on your calendar to ensure timely submission.

Required Documents

To complete the C Form accurately, certain documents are required. These typically include:

- Income statements detailing revenue generated during the tax year.

- Expense receipts to substantiate deductions claimed on the form.

- Previous year’s tax returns for reference and consistency.

- Any additional documentation required by the IRS specific to your business type.

Who Issues the Form

The C Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines on how to obtain the form, complete it, and submit it correctly. Understanding the role of the IRS in the issuance of the C Form is essential for ensuring compliance with tax regulations.

Quick guide on how to complete c 2016 form

Complete C Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without interruptions. Manage C Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign C Form with ease

- Locate C Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign C Form and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct c 2016 form

Create this form in 5 minutes!

How to create an eSignature for the c 2016 form

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is a C Form and why is it important?

A C Form is a crucial document in business transactions, often used for tax exemption for interstate sales. Understanding its significance can help companies save money and ensure compliance with tax regulations.

-

How does airSlate SignNow facilitate the signing of a C Form?

airSlate SignNow provides a seamless platform for sending and eSigning C Forms. With its user-friendly interface, businesses can easily manage and track their documents, ensuring that the signing process is efficient and effortless.

-

What are the pricing options for using airSlate SignNow to manage C Forms?

airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. These plans are designed to provide flexibility and affordability for managing C Forms, allowing companies to choose an option that best fits their budget.

-

What features does airSlate SignNow offer for C Form management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for C Forms. These tools empower businesses to optimize their document workflows and enhance productivity.

-

Can I integrate airSlate SignNow with other applications for C Form processing?

Yes, airSlate SignNow offers seamless integrations with various applications, streamlining the C Form processing. Businesses can connect their existing tools and create a more efficient document management system.

-

What benefits does airSlate SignNow provide when handling C Forms?

Using airSlate SignNow for C Forms enhances operational efficiency and reduces the risk of errors. The platform ensures that all documents are securely signed and stored, providing peace of mind for businesses.

-

Is it easy to collaborate on C Forms with airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on C Forms in real-time. This feature makes it simple for teams to review, edit, and finalize documents together, regardless of location.

Get more for C Form

Find out other C Form

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU