Ftb 4803 Form 2014

What is the Ftb 4803 Form

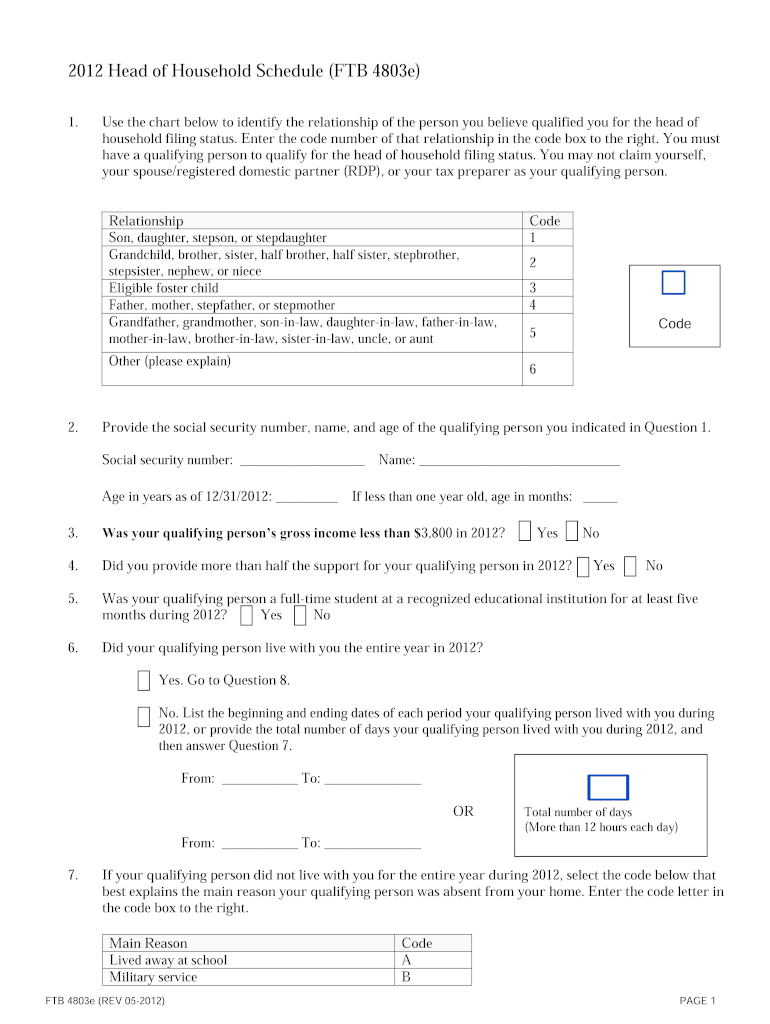

The Ftb 4803 Form is a specific document used by taxpayers in California to report certain tax-related information. This form is primarily utilized for the purpose of claiming a credit for taxes paid to other states. It is essential for individuals who have earned income in more than one state and wish to avoid double taxation. Understanding the purpose and requirements of the Ftb 4803 Form is crucial for ensuring compliance with California tax laws.

How to use the Ftb 4803 Form

Using the Ftb 4803 Form involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary documentation, including income statements from all states where income was earned. Next, the form must be filled out with precise details regarding income and taxes paid to other states. After completing the form, it is important to review all entries for accuracy before submission. This careful approach helps prevent errors that could delay processing or result in penalties.

Steps to complete the Ftb 4803 Form

Completing the Ftb 4803 Form requires a systematic approach:

- Gather all relevant income documentation from each state.

- Fill out personal identification information at the top of the form.

- Report income earned in other states in the designated sections.

- Calculate the credit for taxes paid to other states based on the provided guidelines.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Ftb 4803 Form

The legal use of the Ftb 4803 Form is governed by California tax regulations. It is essential for taxpayers to ensure that the information provided is accurate and truthful, as any discrepancies may lead to audits or penalties. The form must be submitted in accordance with the state’s filing deadlines to maintain compliance. Utilizing the form correctly can help taxpayers avoid double taxation on income earned in multiple states.

Form Submission Methods

The Ftb 4803 Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the California Franchise Tax Board's website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided in the filing instructions. In some cases, individuals may also have the option to submit the form in person at designated tax offices, ensuring that all submissions are handled securely and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 4803 Form are critical for compliance with California tax laws. Generally, the form should be submitted by the same deadline as the state income tax return, which is typically April 15. However, if an extension is filed for the state return, the deadline for submitting the Ftb 4803 Form may also be extended. It is advisable to keep track of these dates to avoid late fees or penalties associated with non-compliance.

Quick guide on how to complete ftb 4803 2012 form

Easily Prepare Ftb 4803 Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and safely store it in the cloud. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly and without delays. Handle Ftb 4803 Form on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

The Easiest Way to Edit and eSign Ftb 4803 Form Effortlessly

- Obtain Ftb 4803 Form and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of your documents or redact private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal weight as a conventional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Forget about missing or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Ftb 4803 Form and maintain effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 4803 2012 form

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Ftb 4803 Form?

The Ftb 4803 Form is a California tax form used to report income from California partnerships and limited liability companies. This form helps taxpayers accurately declare their share of income, deductions, and credits from these entities on their California tax return. Understanding the Ftb 4803 Form is crucial for proper tax compliance.

-

How can I complete the Ftb 4803 Form using airSlate SignNow?

You can easily complete the Ftb 4803 Form using airSlate SignNow by uploading the document to our platform and filling it out electronically. Our user-friendly interface allows you to input required information quickly and accurately. Plus, you can eSign the form and share it securely with your tax advisor or the relevant authorities.

-

What are the key features of airSlate SignNow for handling the Ftb 4803 Form?

AirSlate SignNow provides key features such as document editing, eSignature capabilities, and cloud storage which simplify the management of forms like the Ftb 4803 Form. You can collaborate with others in real-time and track the status of your documents. These features make the whole process faster and more efficient.

-

Is airSlate SignNow cost-effective for businesses needing to file the Ftb 4803 Form?

Absolutely! AirSlate SignNow offers a cost-effective solution for businesses needing to manage documents like the Ftb 4803 Form. With flexible pricing plans, you can choose an option that fits your needs, ensuring that you only pay for what you use while streamlining your document processes.

-

Can airSlate SignNow integrate with my existing software for filing the Ftb 4803 Form?

Yes, airSlate SignNow integrates seamlessly with popular software like CRM systems and accounting tools. This means you can manage your Ftb 4803 Form alongside other critical documents without having to switch between multiple platforms. Our integrations enhance productivity and simplify your workflow.

-

What benefits does using airSlate SignNow provide when handling the Ftb 4803 Form?

Using airSlate SignNow for the Ftb 4803 Form offers several benefits including increased efficiency, reduced errors, and improved security. By digitizing the process, you can save time and minimize the risk of typos or missing information. Additionally, our platform ensures that your documents are stored securely and accessed only by authorized users.

-

How do I get started with airSlate SignNow for the Ftb 4803 Form?

Getting started with airSlate SignNow for the Ftb 4803 Form is easy! Simply sign up for an account on our website, upload your Ftb 4803 Form, and begin editing right away. Our intuitive platform guides you through the process, enabling eSignatures and sharing with ease.

Get more for Ftb 4803 Form

Find out other Ftb 4803 Form

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement