540x Form 2016

What is the 540x Form

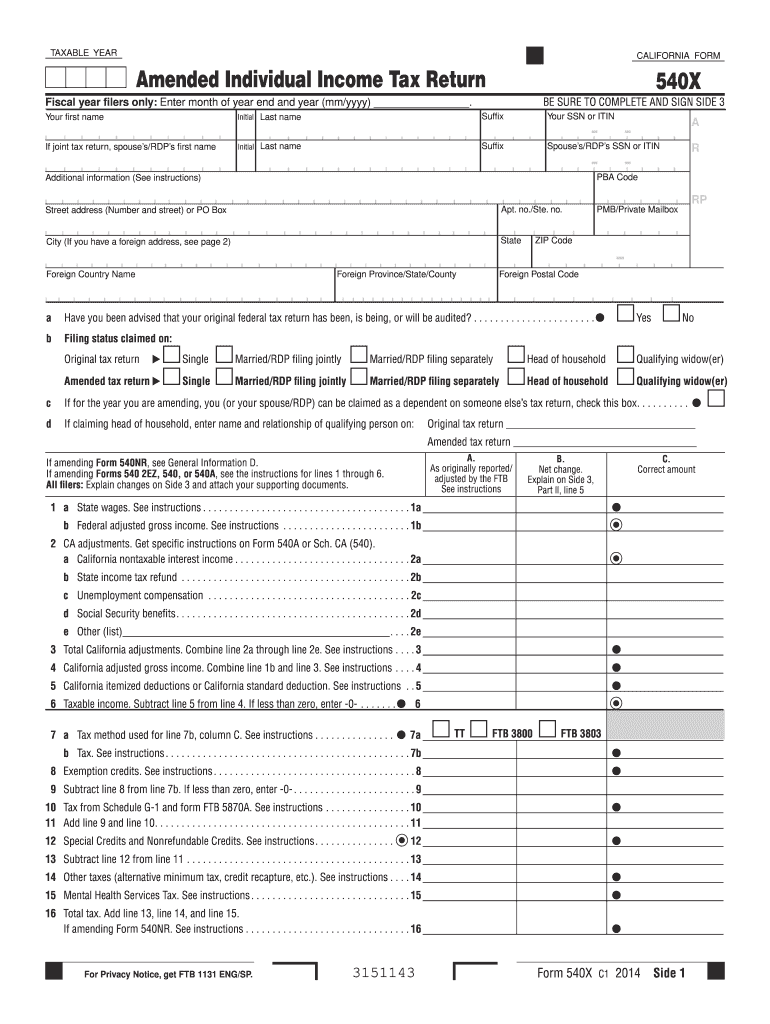

The 540x Form is an amended California income tax return used by taxpayers to correct errors or make changes to their previously filed California tax returns. This form allows individuals to adjust their income, deductions, or credits, ensuring that their tax obligations are accurate. It is essential for taxpayers who discover discrepancies after submitting their original returns, as it helps in rectifying any mistakes that may affect their tax liabilities or refunds.

How to use the 540x Form

Using the 540x Form involves several steps to ensure that amendments are processed correctly. Taxpayers should first gather all relevant documents related to the original return, including W-2s, 1099s, and any supporting documentation for the changes being made. Once the form is completed, it must be signed and dated. It's important to note that the amended return should be filed separately from the original return and sent to the appropriate address specified by the California Franchise Tax Board.

Steps to complete the 540x Form

Completing the 540x Form requires careful attention to detail. Here are the steps to follow:

- Obtain a copy of the 540x Form from the California Franchise Tax Board website or a tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- Provide details of the changes you are making, including the corrected amounts for income, deductions, and credits.

- Attach any necessary documentation that supports your amendments.

- Review the form for accuracy and completeness before signing and dating it.

Legal use of the 540x Form

The 540x Form is legally recognized as a valid method for amending a California tax return. To ensure compliance with state tax laws, it is crucial to follow the guidelines set forth by the California Franchise Tax Board. This includes submitting the form within the appropriate time frame, which is generally within four years from the original return's due date or the date the return was filed, whichever is later. Failure to comply with these regulations may result in penalties or denial of the amendment.

Filing Deadlines / Important Dates

When filing the 540x Form, it is important to be aware of key deadlines. Typically, amended returns must be filed within four years from the original due date of the return or the date it was filed. For example, if the original return was due on April 15, the amended return must be submitted by April 15 of the fourth year following that date. Additionally, if a refund is expected, it is advisable to file the amended return as soon as possible to expedite the processing of the refund.

Required Documents

To properly complete the 540x Form, certain documents are required. Taxpayers should have the following on hand:

- A copy of the original tax return that is being amended.

- Any relevant W-2s or 1099s that reflect income adjustments.

- Documentation supporting any changes to deductions or credits claimed.

- Any correspondence received from the California Franchise Tax Board regarding the original return.

Quick guide on how to complete 2014 540x form

Complete 540x Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents quickly and efficiently. Handle 540x Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign 540x Form with ease

- Obtain 540x Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your preference. Modify and eSign 540x Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 540x form

Create this form in 5 minutes!

How to create an eSignature for the 2014 540x form

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is a 540x Form?

The 540x Form is an amended individual income tax return form used in California. It allows taxpayers to make corrections to their previously filed tax returns. Using airSlate SignNow, you can easily eSign and send your 540x Form securely and efficiently.

-

How can airSlate SignNow help with the 540x Form process?

airSlate SignNow streamlines the process of completing the 540x Form by allowing users to eSign documents quickly. You can fill out the form online, sign it digitally, and share it with your accountant or tax authority. This saves time and ensures that your 540x Form is processed without delay.

-

Is there a cost associated with using airSlate SignNow for the 540x Form?

Yes, airSlate SignNow offers various pricing plans based on your needs. There are options for individuals as well as businesses that can also help facilitate the management of the 540x Form and other documents. Consider checking our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the 540x Form?

With airSlate SignNow, you get features like document templates, secure cloud storage, and robust tracking. These features enhance your ability to manage the 540x Form seamlessly, ensuring that you can access and edit your documents as needed. Additionally, it provides integration options for a comprehensive document management experience.

-

Can I integrate airSlate SignNow with other applications for the 540x Form?

Absolutely! airSlate SignNow can be integrated with various applications, such as CRMs and document management systems. This integration allows for enhanced workflow efficiency when preparing and submitting your 540x Form.

-

What are the benefits of using airSlate SignNow for electronic signatures on the 540x Form?

Using airSlate SignNow for electronic signatures on the 540x Form increases the speed at which documents are signed and processed. You can eSign from anywhere, reducing unnecessary delays, and enhancing document security with legally binding electronic signatures.

-

Is my information secure when using airSlate SignNow for the 540x Form?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and follow strict compliance regulations to protect your information when completing the 540x Form. Your data privacy is assured throughout the signing process.

Get more for 540x Form

- Rto form 27 sample filled

- Vestibular objective assessment biru vestibular objective assessment template for physiotherapists at princess alexandra form

- Chicago city sticker affidavit form

- One of these days story pdf form

- Alivuokrasopimus pohja word form

- Amart warranty form

- Accuro claim form

- Compliance form poea sample

Find out other 540x Form

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter