Ftb Poa Exempt Organizations Form 2017

What is the Ftb Poa Exempt Organizations Form

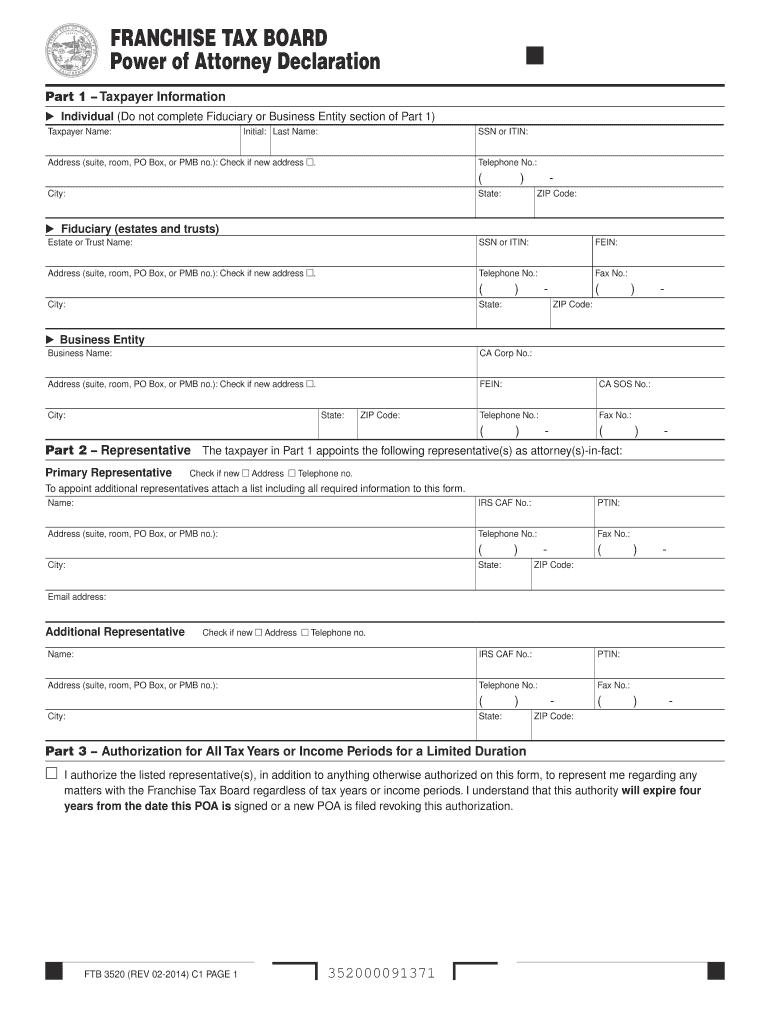

The Ftb Poa Exempt Organizations Form is a specific document used by exempt organizations in California to designate an individual or entity to act on their behalf regarding tax matters. This form is essential for organizations that wish to authorize someone to handle their tax-related affairs with the California Franchise Tax Board (FTB). By completing this form, an organization can ensure that its designated representative has the authority to receive confidential information and represent the organization in various tax matters.

How to use the Ftb Poa Exempt Organizations Form

Using the Ftb Poa Exempt Organizations Form involves several straightforward steps. First, the organization must accurately fill out the form, providing necessary details such as the organization's name, address, and the representative's information. After completing the form, it must be signed by an authorized individual within the organization. Once signed, the form can be submitted to the FTB, either electronically or via mail. It is important to keep a copy of the submitted form for the organization's records.

Steps to complete the Ftb Poa Exempt Organizations Form

Completing the Ftb Poa Exempt Organizations Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the California FTB website.

- Fill in the organization’s name, address, and tax identification number.

- Provide the name and contact information of the designated representative.

- Ensure that the form is signed by an authorized person within the organization.

- Review the completed form for accuracy before submission.

- Submit the form to the FTB, either electronically or by mailing it to the appropriate address.

Legal use of the Ftb Poa Exempt Organizations Form

The legal use of the Ftb Poa Exempt Organizations Form is governed by California tax laws. This form must be completed accurately to ensure that the designated representative has the authority to act on behalf of the organization. Failure to properly execute the form can lead to complications in communication with the FTB and potential delays in processing tax matters. It is crucial for organizations to understand the legal implications of the form and ensure compliance with all relevant regulations.

Key elements of the Ftb Poa Exempt Organizations Form

Key elements of the Ftb Poa Exempt Organizations Form include the following:

- Organization Information: This section requires the name, address, and tax identification number of the organization.

- Representative Details: The form must include the name and contact information of the individual or entity designated as the representative.

- Signature: An authorized individual from the organization must sign the form to validate it.

- Effective Date: The form may include a section to specify when the authorization becomes effective.

Form Submission Methods (Online / Mail / In-Person)

The Ftb Poa Exempt Organizations Form can be submitted through various methods. Organizations may choose to submit the form online via the California FTB's electronic filing system, which offers a convenient and efficient way to process the form. Alternatively, the completed form can be mailed to the appropriate address provided by the FTB. In some cases, organizations may also have the option to deliver the form in person at designated FTB offices. Each submission method has its own requirements and processing times, so organizations should choose the method that best suits their needs.

Quick guide on how to complete ftb poa exempt organizations 2014 form

Prepare Ftb Poa Exempt Organizations Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Ftb Poa Exempt Organizations Form on any platform using airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to modify and eSign Ftb Poa Exempt Organizations Form with ease

- Locate Ftb Poa Exempt Organizations Form and then click on Get Form to initiate the process.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal authenticity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worries of lost or disorganized documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ftb Poa Exempt Organizations Form and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb poa exempt organizations 2014 form

Create this form in 5 minutes!

How to create an eSignature for the ftb poa exempt organizations 2014 form

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the Ftb Poa Exempt Organizations Form?

The Ftb Poa Exempt Organizations Form is a required document for exempt organizations to designate a representative for filing purposes in California. This form simplifies the process of managing tax-related matters by allowing designated persons to act on behalf of the organization, ensuring compliance with state regulations.

-

How can airSlate SignNow help with the Ftb Poa Exempt Organizations Form?

airSlate SignNow offers an easy-to-use platform that allows users to electronically sign and send the Ftb Poa Exempt Organizations Form. By utilizing our eSignature solution, organizations can streamline their submission process, ensuring that the form is filled out accurately and sent promptly.

-

Is there a cost associated with using airSlate SignNow for the Ftb Poa Exempt Organizations Form?

Yes, airSlate SignNow operates on a subscription model with plans that cater to different business needs. The cost-effective pricing allows organizations to efficiently prepare, sign, and manage the Ftb Poa Exempt Organizations Form without overspending on traditional paper-based processes.

-

What features does airSlate SignNow offer for handling the Ftb Poa Exempt Organizations Form?

airSlate SignNow provides essential features such as electronic signatures, document tracking, and templates specifically designed for the Ftb Poa Exempt Organizations Form. These tools enhance efficiency and ensure that all submissions comply with legal standards and are easily accessible from anywhere.

-

Are there any integrations available for airSlate SignNow when working with the Ftb Poa Exempt Organizations Form?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications and services, enhancing your workflow when managing the Ftb Poa Exempt Organizations Form. Whether you use CRM systems or other document management tools, our platform ensures a smooth transition of data across systems.

-

What benefits does eSigning the Ftb Poa Exempt Organizations Form provide?

By eSigning the Ftb Poa Exempt Organizations Form, users save time and reduce the likelihood of errors associated with traditional paper forms. Additionally, electronic signatures are legally recognized and secure, providing reassurance that the form has been properly authorized and submitted.

-

Can multiple users collaborate on the Ftb Poa Exempt Organizations Form with airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration among multiple users when completing the Ftb Poa Exempt Organizations Form. Team members can edit, review, and sign the document in real-time, ensuring that everyone stays informed and that the process moves smoothly.

Get more for Ftb Poa Exempt Organizations Form

Find out other Ftb Poa Exempt Organizations Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors