it 203 D Form 2017

What is the It 203 D Form

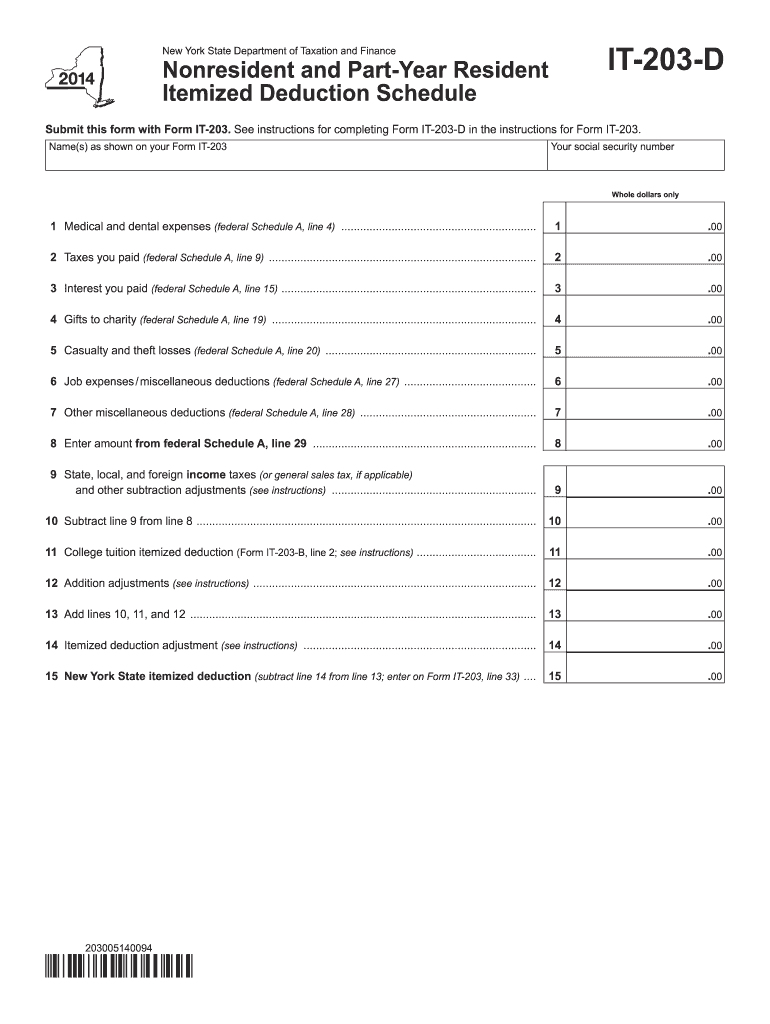

The It 203 D Form is a tax document used in the United States, specifically within New York State. This form is utilized by non-residents to report income earned in New York and to claim any applicable tax credits. It serves as a means for individuals who do not reside in New York but have income sourced from the state to fulfill their tax obligations. Understanding the purpose and requirements of the It 203 D Form is crucial for compliance with state tax laws.

How to use the It 203 D Form

Using the It 203 D Form involves several steps to ensure accurate reporting of income and tax credits. First, gather all necessary financial documents, such as W-2s and 1099s, that detail your New York-source income. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Be sure to report your income accurately and claim any credits for which you are eligible. After completing the form, review it for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to complete the It 203 D Form

Completing the It 203 D Form requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Provide your personal information at the top of the form.

- Report your New York-source income in the designated sections.

- Calculate any tax credits you may qualify for, following the instructions provided.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the It 203 D Form

The It 203 D Form is legally binding when completed and submitted according to New York State tax regulations. It must be filed by the due date to avoid penalties. The form must accurately reflect your income and any deductions or credits claimed. Failure to comply with the legal requirements can result in fines or additional tax liabilities. It is essential to ensure that all information is truthful and complete to maintain compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the It 203 D Form are crucial for compliance. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines that may occur due to state regulations or extensions.

Required Documents

When completing the It 203 D Form, certain documents are required to ensure accurate reporting. These include:

- W-2 forms from employers detailing wages earned.

- 1099 forms for any freelance or contract work.

- Records of any other income sourced from New York.

- Documentation for any tax credits or deductions you plan to claim.

Examples of using the It 203 D Form

There are various scenarios in which individuals may need to use the It 203 D Form. For instance, a non-resident who works remotely for a New York-based company and earns income would be required to file this form. Similarly, a freelance graphic designer living in another state but completing projects for New York clients must report that income using the It 203 D Form. Each of these examples highlights the importance of accurate reporting for non-residents earning income in New York.

Quick guide on how to complete 2014 it 203 d form

Prepare It 203 D Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, enabling you to find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage It 203 D Form on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to modify and eSign It 203 D Form with ease

- Obtain It 203 D Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign It 203 D Form and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 it 203 d form

Create this form in 5 minutes!

How to create an eSignature for the 2014 it 203 d form

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the IT 203 D Form?

The IT 203 D Form is a tax document used in New York State for non-residents and part-year residents to report income earned within the state. It allows taxpayers to claim credits and deductions that they may be eligible for, ensuring accurate tax filings. Utilizing airSlate SignNow, you can easily eSign and send the IT 203 D Form securely and efficiently.

-

How can airSlate SignNow help with the IT 203 D Form?

airSlate SignNow streamlines the process of completing and sending the IT 203 D Form by providing an easy-to-use platform for eSigning and document management. With its cost-effective solutions, you can ensure that your form is filled out correctly and delivered on time. Additionally, our platform offers templates and automation features to make the process even smoother.

-

Is there a cost associated with using the IT 203 D Form on airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses alike. The investment in our platform provides you with valuable features to manage all your document needs, including the IT 203 D Form. You can start with a free trial to evaluate our services before committing.

-

What are the key features of airSlate SignNow for the IT 203 D Form?

Key features of airSlate SignNow for the IT 203 D Form include electronic signatures, document templates, secure cloud storage, and automated workflows. These features help ensure efficient processing and signing of your forms. Additionally, the platform is user-friendly, making it easy for anyone to use.

-

Can I track the status of my IT 203 D Form submissions on airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your document submissions, including the IT 203 D Form. You will receive notifications when your form has been viewed and signed, allowing you to keep tabs on its status. This feature enhances communication and keeps you informed throughout the process.

-

Are there integrations available for the IT 203 D Form with airSlate SignNow?

Yes, airSlate SignNow offers various integrations with popular applications and services to enhance your workflow when handling the IT 203 D Form. You can easily integrate with platforms such as Google Drive, Dropbox, and various CRM systems. This allows for seamless document management and ensures you have everything you need at your fingertips.

-

What benefits does airSlate SignNow provide for eSigning the IT 203 D Form?

By using airSlate SignNow to eSign the IT 203 D Form, you access a faster and more reliable signing process. This solution reduces paperwork and waiting time, allowing you to focus on more important tasks. Furthermore, it enhances security and compliance, ensuring that your sensitive information remains protected.

Get more for It 203 D Form

Find out other It 203 D Form

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation