Form Ct247 2020

What is the Form Ct247

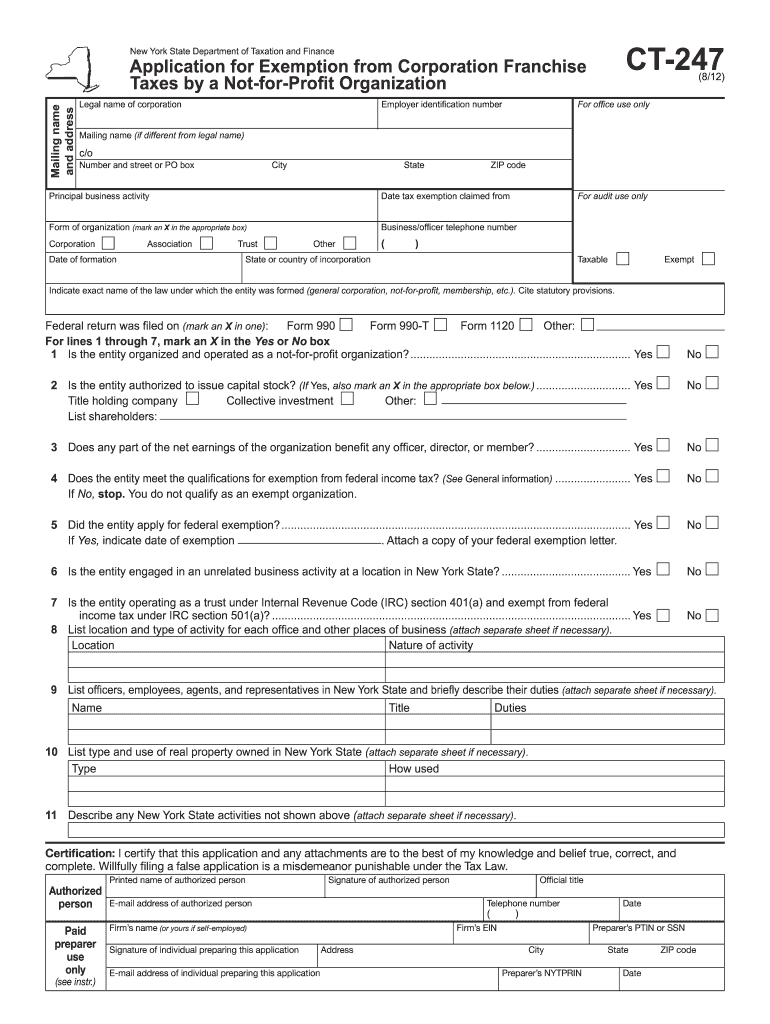

The Form Ct247 is a specific document used primarily for tax purposes in the United States. It serves as a declaration or application that allows individuals or businesses to report certain financial information to the relevant authorities. Understanding the purpose and requirements of this form is crucial for compliance and accurate reporting.

How to use the Form Ct247

Using the Form Ct247 involves several steps to ensure that all information is accurately reported. First, gather all necessary financial documents that pertain to the information required on the form. Next, fill out the form with precise details, ensuring that all sections are completed. After completing the form, review it for accuracy before submission. It is advisable to consult a tax professional if there are any uncertainties regarding specific entries.

Steps to complete the Form Ct247

Completing the Form Ct247 can be simplified by following these steps:

- Gather all relevant financial documents, such as income statements and expense records.

- Obtain the latest version of the Form Ct247 from the appropriate source.

- Fill in your personal or business information accurately.

- Provide any additional details required, including financial data and signatures.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Form Ct247

The legal use of the Form Ct247 is governed by specific regulations that ensure its validity. To be legally binding, the form must be completed accurately and submitted within the designated timeframes. Additionally, it must comply with relevant federal and state laws regarding tax reporting and documentation. Proper use of the form helps avoid potential legal issues and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct247 are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by a specific date each year, which aligns with the overall tax filing season. It is essential to stay informed about these deadlines to ensure timely submission. Missing the deadline may result in fines or other repercussions.

Required Documents

To complete the Form Ct247, certain documents are required to support the information being reported. These may include:

- Income statements, such as W-2s or 1099s.

- Expense receipts relevant to the financial reporting.

- Previous tax returns for reference.

- Any additional documentation requested by the form instructions.

Form Submission Methods

The Form Ct247 can be submitted through various methods to accommodate different preferences. Common submission methods include:

- Online submission through a secure portal.

- Mailing the completed form to the designated tax authority.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form ct247 2012

Complete Form Ct247 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It presents an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Form Ct247 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form Ct247 without hassle

- Find Form Ct247 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form Ct247 and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct247 2012

Create this form in 5 minutes!

How to create an eSignature for the form ct247 2012

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form Ct247 and how does it work with airSlate SignNow?

Form Ct247 is a customizable electronic form solution that integrates seamlessly with airSlate SignNow. It allows users to create, send, and eSign documents efficiently, ensuring compliance and security. By utilizing Form Ct247, businesses can streamline their document workflows and reduce turnaround times.

-

How much does it cost to use Form Ct247 with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to Form Ct247 at competitive rates. Depending on your business needs, you can choose a plan that fits your budget, making it a cost-effective solution for eSigning and document management. Check our pricing page for detailed information on available options.

-

What features does Form Ct247 offer for document management?

Form Ct247 includes a variety of powerful features such as customizable templates, automated workflows, and real-time tracking. These tools enhance document management by making it easier to collect necessary signatures and manage forms efficiently. With Form Ct247, users can expect a fully functional eSigning experience that meets their operational needs.

-

Can Form Ct247 integrate with other applications?

Yes, Form Ct247 can integrate with numerous third-party applications, enhancing its functionality within airSlate SignNow. This means you can connect it with popular platforms like CRM systems and cloud storage services to create a more cohesive workflow. Integration options make it easy to sync data and improve overall efficiency.

-

What are the benefits of using Form Ct247 for my business?

Using Form Ct247 improves productivity by allowing teams to send, receive, and sign documents swiftly and securely. It reduces the reliance on paper forms and cuts down manual processes, leading to fewer errors and faster completions. These benefits ultimately enhance customer experience and streamline operations for better business outcomes.

-

Is Form Ct247 secure for sensitive documents?

Form Ct247 incorporates advanced security features, including encryption and secure data storage, to protect sensitive information. airSlate SignNow complies with industry regulations to ensure that your documents are handled securely throughout the signing process. Choosing Form Ct247 means prioritizing your business's data security.

-

How can I get started with Form Ct247 on airSlate SignNow?

Getting started with Form Ct247 on airSlate SignNow is simple. You can sign up for a free trial to explore its features and functionality tailored to your business needs. After signing up, you can begin creating your forms and sending documents for eSigning in just a few clicks.

Get more for Form Ct247

- Form 10f hdfc

- Ace questionnaire pdf form

- Basketball permission slip form

- Pace transcript request form

- Preparticipation physical evaluation history form

- Peoples names and titles gordon collegehow to fill an online application form where it is mandatory to quorahow to fill an

- South africa cape town form

- Vortexonline form

Find out other Form Ct247

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form