Form 10f Hdfc

What is the Form 10F HDFC

The Form 10F HDFC is a tax-related document used primarily for claiming benefits under the Double Taxation Avoidance Agreement (DTAA) between India and other countries. This form is essential for non-resident taxpayers to certify their residency status and claim tax exemptions or reductions on income earned in India. The form is issued by HDFC Life Insurance Company and is often required for individuals and entities receiving income from investments or policies held in India.

How to use the Form 10F HDFC

To effectively use the Form 10F HDFC, individuals must first ensure they meet the eligibility criteria for claiming benefits under the DTAA. The form needs to be filled out accurately, providing details such as the taxpayer's name, address, and country of residence. After completing the form, it should be submitted to the relevant tax authorities or financial institutions in India to process any claims for tax relief. It is advisable to retain a copy for personal records.

Steps to complete the Form 10F HDFC

Completing the Form 10F HDFC involves several key steps:

- Gather necessary information, including personal details and tax residency status.

- Fill in the required fields, such as name, address, and country of residence.

- Include any applicable tax identification numbers and relevant details about the income being claimed.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the appropriate authority or financial institution.

Legal use of the Form 10F HDFC

The legal use of the Form 10F HDFC is governed by the provisions of the Income Tax Act and the DTAA between India and the taxpayer's country of residence. To be legally valid, the form must be filled out correctly and submitted within the stipulated time frames. Non-compliance with the requirements may lead to the denial of tax benefits or penalties. Therefore, understanding the legal implications is crucial for ensuring the form's proper use.

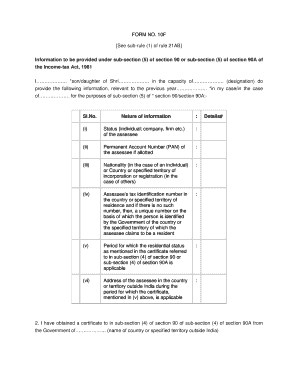

Key elements of the Form 10F HDFC

Key elements of the Form 10F HDFC include:

- Taxpayer Information: Name, address, and country of residence.

- Tax Identification Number: Essential for tax purposes.

- Income Details: Types of income being claimed under the DTAA.

- Signature: Required to validate the information provided.

Required Documents

When submitting the Form 10F HDFC, certain documents may be required to support the claims made within the form. These may include:

- Proof of residency in the foreign country, such as a tax residency certificate.

- Identification documents, like a passport or national ID.

- Details of the income earned in India, including tax statements or investment documents.

Quick guide on how to complete form 10f hdfc

Complete Form 10f Hdfc effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Administer Form 10f Hdfc on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 10f Hdfc without any hassle

- Find Form 10f Hdfc and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to transmit your form, by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Alter and eSign Form 10f Hdfc and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10f hdfc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 10f hdfc used for?

The form 10f hdfc is a crucial document utilized for claiming benefits under the Double Taxation Avoidance Agreement (DTAA) for HDFC Bank clients. Completing this form accurately helps ensure you receive the correct tax benefits and avoid unnecessary tax deductions.

-

How can airSlate SignNow help in signing the form 10f hdfc?

With airSlate SignNow, you can easily eSign the form 10f hdfc in a secure and efficient manner. Our platform allows you to upload the document, add eSignature fields, and send it for signing, all within a user-friendly interface.

-

Is there a cost to use airSlate SignNow for form 10f hdfc?

airSlate SignNow offers various pricing plans, and using it for the form 10f hdfc is included in our offerings. We recommend reviewing our pricing page to find a plan that fits your needs while taking advantage of the cost-effective solutions we provide.

-

What features does airSlate SignNow offer for the form 10f hdfc?

Our platform includes features that enhance the eSigning experience for the form 10f hdfc, such as customizable templates, reminder notifications, and secure document storage. These features not only streamline your signing process but also ensure compliance and security.

-

Can I integrate airSlate SignNow with other applications for form 10f hdfc?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, allowing you to manage the form 10f hdfc alongside your existing tools. Popular integrations include popular CRM systems and cloud storage services, ensuring a streamlined workflow.

-

What are the benefits of using airSlate SignNow for form 10f hdfc?

Using airSlate SignNow for the form 10f hdfc provides numerous benefits, such as reduced turnaround times and enhanced document security. Additionally, our platform simplifies the paperwork process, allowing you to focus more on your business and less on administrative tasks.

-

How secure is airSlate SignNow for managing the form 10f hdfc?

airSlate SignNow prioritizes security by employing advanced encryption methods and compliance with global security standards. This means that managing your form 10f hdfc on our platform is not only efficient but also highly secure.

Get more for Form 10f Hdfc

Find out other Form 10f Hdfc

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation