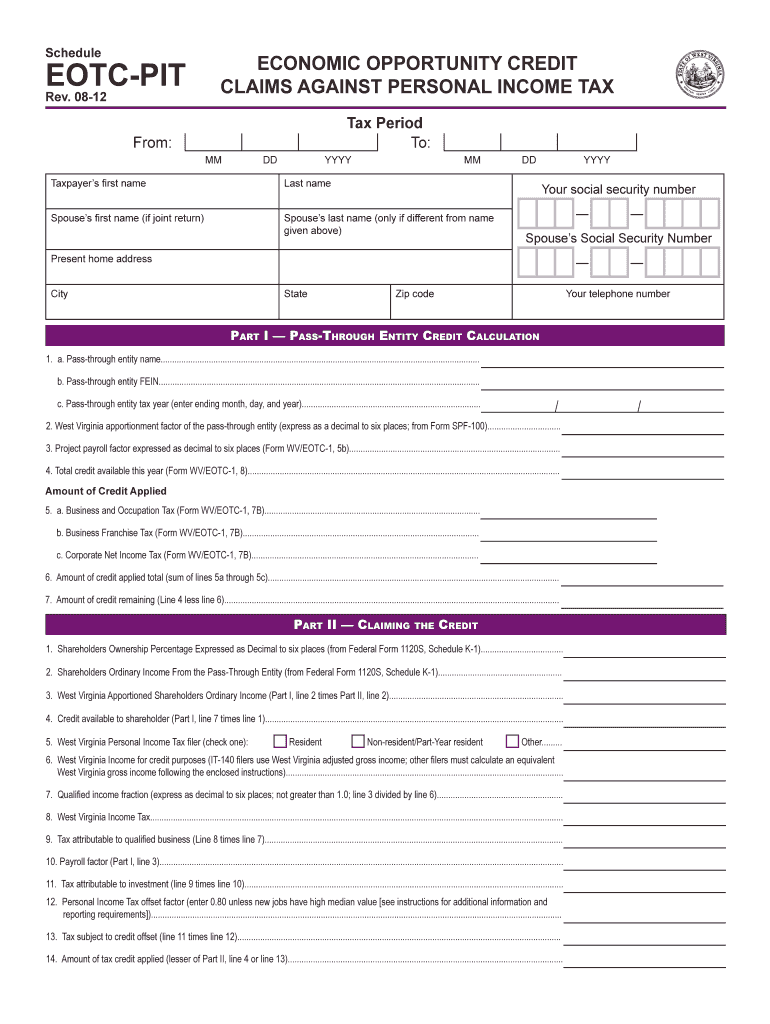

Wv Pit Form

What is the WV PIT?

The West Virginia Personal Income Tax (WV PIT) is a tax imposed on the income earned by individuals residing in West Virginia. This tax is calculated based on various sources of income, including wages, salaries, and investment earnings. The tax rates are progressive, meaning they increase as income levels rise. Understanding the WV PIT is essential for residents to ensure compliance with state tax laws and to take advantage of any available credits, such as the Economic Opportunity Tax Credit (EOTC).

How to Use the WV PIT

Using the WV PIT involves several steps, starting with determining your taxable income. Residents must gather all relevant financial documents, such as W-2 forms, 1099s, and other income statements. Once you have your income calculated, you can apply any deductions or credits applicable to your situation. The completed tax form can then be submitted electronically or via mail, depending on your preference. Utilizing digital tools can simplify this process and ensure accuracy.

Steps to Complete the WV PIT

Completing the WV PIT requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Calculate your total income and identify any deductions you may qualify for.

- Fill out the WV PIT form accurately, ensuring all information is current and complete.

- Review your form for any errors or omissions.

- Submit your completed form either online or by mailing it to the appropriate state office.

Legal Use of the WV PIT

The WV PIT must be filed in accordance with state laws and regulations. It is essential to ensure that all reported income is accurate and that any deductions or credits claimed are legitimate. Non-compliance with tax laws can result in penalties, interest, and potential legal action. Utilizing a reliable eSignature solution can help ensure that your submissions are secure and legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the WV PIT are crucial for residents to avoid penalties. Typically, the deadline for submitting your personal income tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any changes in deadlines due to state legislation or emergencies, which may be communicated by the West Virginia State Tax Department.

Required Documents

To complete the WV PIT, you will need several key documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year's tax return for reference

Having these documents ready will streamline the process and help ensure accuracy in your filing.

Quick guide on how to complete wv pit

Easily Prepare Wv Pit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It presents a superb eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Wv Pit on any platform using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The easiest way to edit and eSign Wv Pit effortlessly

- Obtain Wv Pit and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Wv Pit and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv pit

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the wv pit and how does it relate to airSlate SignNow?

The wv pit is a key feature of airSlate SignNow that allows for streamlined document signing and management. This solution simplifies the signing process, enabling businesses to efficiently handle documentation while ensuring compliance and security.

-

How much does airSlate SignNow cost for businesses looking to utilize the wv pit?

Pricing for airSlate SignNow varies based on the features you select, including access to the wv pit. Generally, plans start at a competitive rate that provides excellent value for businesses looking to enhance their document management and eSigning processes.

-

What features does the wv pit offer for document management?

The wv pit offers a variety of features including secure eSignature capabilities, template creation, and document tracking. These features are designed to improve workflow efficiency and provide an easy-to-use platform for businesses of all sizes.

-

Can the wv pit integrate with other software solutions?

Yes, the wv pit within airSlate SignNow is designed to integrate seamlessly with popular software solutions such as CRM systems and cloud storage services. This flexibility allows businesses to streamline their operations and improve document workflows.

-

What are the benefits of using the wv pit for eSignatures?

Using the wv pit for eSignatures provides businesses with enhanced security, reduced turnaround times, and improved customer experience. It allows for legally binding signatures without the need for physical paperwork, ultimately leading to increased efficiency.

-

Is the wv pit easy to use for individuals unfamiliar with eSigning?

Absolutely! The wv pit is designed with user-friendliness in mind, making it accessible even for those who are new to eSigning. The intuitive interface guides users through the process, ensuring a smooth experience for everyone.

-

How does the wv pit improve compliance for my business?

The wv pit incorporates features that ensure compliance with various eSignature laws and regulations. This helps businesses maintain legal standards while providing a reliable platform for managing important documents.

Get more for Wv Pit

Find out other Wv Pit

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself