Form 5405 2022

What is the Form 5405

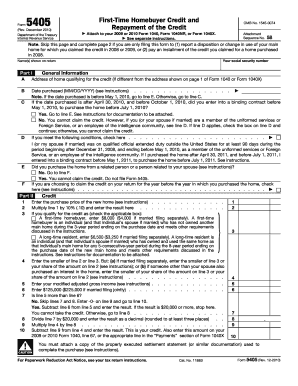

The Form 5405 is a document used by taxpayers in the United States to claim the First-Time Homebuyer Credit. This credit is designed to assist individuals who are purchasing their first home, providing them with a financial incentive to enter the housing market. The form is typically submitted with the taxpayer's federal income tax return and requires detailed information about the home purchase, including the address, purchase date, and the amount of the credit being claimed.

How to use the Form 5405

To effectively use the Form 5405, taxpayers should first ensure they meet the eligibility criteria for the First-Time Homebuyer Credit. After confirming eligibility, the next step is to accurately fill out the form with the required information. This includes personal details, information about the home being purchased, and any relevant financial data. Once completed, the form should be attached to the federal income tax return and submitted to the IRS. It is advisable to keep a copy of the form and any supporting documents for personal records.

Steps to complete the Form 5405

Completing the Form 5405 involves several key steps:

- Gather necessary information, including personal identification and details about the home purchase.

- Fill out Part I of the form, which includes your name, address, and Social Security number.

- Complete Part II, detailing the home purchase, including the purchase price and date.

- Calculate the credit amount in Part III, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Legal use of the Form 5405

The legal use of the Form 5405 is contingent on compliance with IRS regulations regarding the First-Time Homebuyer Credit. To ensure the form is legally binding, taxpayers must provide truthful information and adhere to all filing requirements. The form must be submitted within the designated tax year, and any discrepancies or false claims may result in penalties. Utilizing a reliable electronic signature tool can enhance the security and legality of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5405 coincide with the federal income tax return deadlines. Typically, individual taxpayers must submit their tax returns by April 15 of the following year after the tax year in question. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should be aware of any specific extensions that may apply to their situation, especially if they are filing for a prior year or if they are eligible for additional time to file.

Required Documents

When completing the Form 5405, taxpayers should prepare to provide several supporting documents, including:

- Proof of home purchase, such as a closing statement or settlement agreement.

- Documentation of eligibility, including prior homeownership history.

- Identification documents, such as a Social Security card.

Having these documents ready can streamline the filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete form 5405

Complete Form 5405 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Manage Form 5405 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and eSign Form 5405 effortlessly

- Find Form 5405 and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 5405 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5405

Create this form in 5 minutes!

How to create an eSignature for the form 5405

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 5405 instructions?

The form 5405 instructions provide detailed guidance on how to complete the IRS Form 5405, which is used to request a first-time homebuyer credit. It's essential to closely follow these instructions to ensure proper submission and compliance with IRS regulations.

-

How can airSlate SignNow assist with completing form 5405 instructions?

airSlate SignNow offers an intuitive eSignature platform that simplifies the process of completing form 5405 instructions. With features like document templates and real-time collaboration, users can efficiently fill out and sign required documents.

-

Is there a cost associated with using airSlate SignNow for form 5405 instructions?

Yes, airSlate SignNow offers various pricing plans, including a free trial, to cater to different business needs. These plans provide access to features that can help users navigate the form 5405 instructions more efficiently.

-

Can I save my progress while filling out the form 5405 instructions on airSlate SignNow?

Absolutely! airSlate SignNow allows users to save their progress when filling out form 5405 instructions. This ensures that users can return later to complete their submissions without losing any information.

-

What integrations does airSlate SignNow offer for managing form 5405 instructions?

airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage platforms. These integrations enhance the efficiency of managing form 5405 instructions along with your other business processes.

-

Are there any benefits to using airSlate SignNow for form 5405 instructions?

Using airSlate SignNow for form 5405 instructions streamlines the eSigning process, saving time and resources. Additionally, the platform enhances security and compliance, providing peace of mind during sensitive document handling.

-

How secure is the information when using airSlate SignNow for form 5405 instructions?

airSlate SignNow prioritizes the security of user information. The platform employs advanced encryption methods and complies with industry standards to ensure that all data related to form 5405 instructions is protected.

Get more for Form 5405

- Gssjc gold award project guide this document tells you everything you need to know about earning the gold award and includes form

- Product id 513 revision id 2027 date published 28 september 2018 date effective 28 september 2018 form

- Mobile crane pre use inspection form hoisting and rigging www group slac stanford

- Apa membership certificate order form american psychological apa

- Usbc adult special achievement award application usbcongress http internapcdn form

- Metalux skyridge 22sr 2 x 2 specification grade troffer spec sheet metalux skyridge 22sr 2 x 2 specification grade troffer spec form

- Hershey lodge reservation form penndelwomenofpurpose

- Em 130 declaration of emancipationafter hearing form

Find out other Form 5405

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors