Form 540NR California Nonresident or Part Year Resident Income Tax Return Ftb Ca 2019

What is the Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

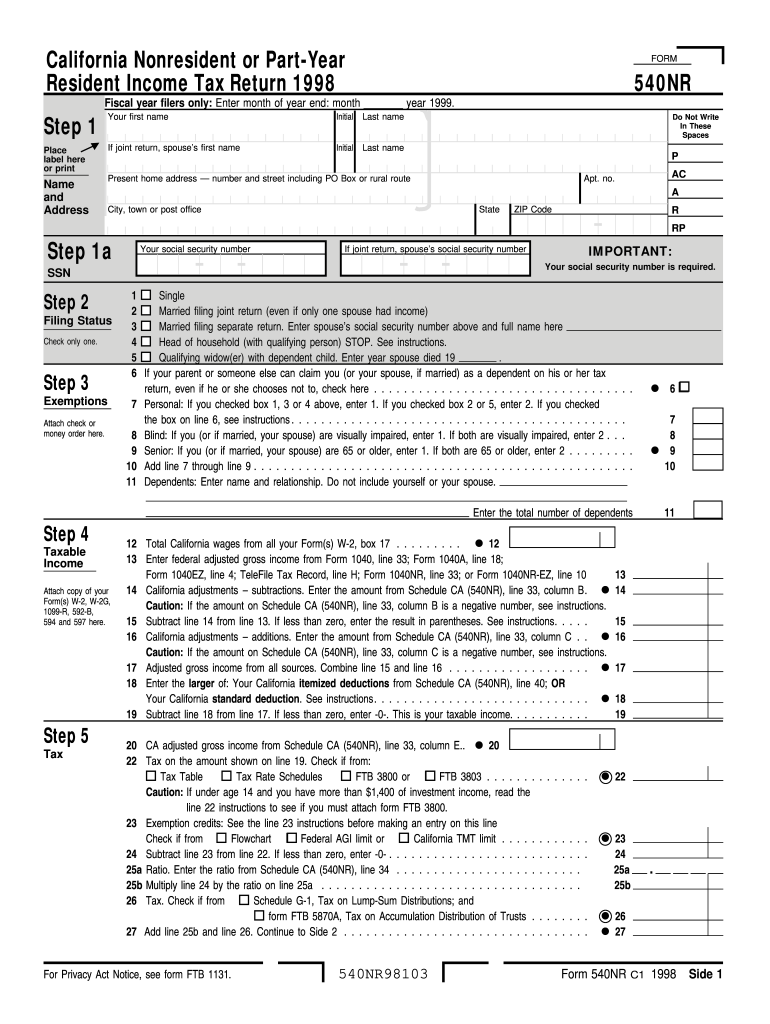

The Form 540NR is specifically designed for individuals who are nonresidents or part-year residents of California. This income tax return allows these taxpayers to report income earned within the state while also claiming any applicable deductions and credits. It is essential for ensuring compliance with California tax laws, especially for those who may have income from multiple states. The form captures various income types, including wages, interest, and dividends, and helps determine the appropriate tax liability based on California's tax rates.

Steps to complete the Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

Completing the Form 540NR involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income by listing all sources of income earned in California. After calculating your total income, apply any deductions or credits you may qualify for. Finally, review the form for accuracy, sign it, and submit it according to the specified guidelines.

How to obtain the Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

The Form 540NR can be obtained through several channels. It is available for download directly from the California Franchise Tax Board (FTB) website. Additionally, taxpayers can request a physical copy by contacting the FTB or visiting a local office. Many tax preparation software programs also include the Form 540NR, allowing for easy electronic filing. Ensuring you have the most current version of the form is crucial, as tax laws and regulations may change from year to year.

Key elements of the Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

Several key elements are integral to the Form 540NR. These include personal identification information, income reporting sections, and areas for deductions and credits. The form also contains specific instructions for calculating tax liability based on residency status. Understanding these elements is vital for accurately completing the form and ensuring compliance with state tax laws. Additionally, the form provides sections for reporting any tax payments made and for requesting refunds if applicable.

Legal use of the Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

The legal use of the Form 540NR is essential for nonresidents and part-year residents to fulfill their tax obligations in California. When completed correctly, the form serves as a legally binding document that reports income and calculates tax liability. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or audits. Utilizing a reliable e-signature solution can enhance the legal validity of the form when submitting electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540NR are crucial for compliance. Typically, the deadline for submitting the form coincides with the federal tax filing deadline, which is usually April 15th. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to filing dates, especially in light of special circumstances or extensions granted by the California Franchise Tax Board. Keeping track of these dates helps avoid late fees and penalties.

Quick guide on how to complete 1998 form 540nr california nonresident or part year resident income tax return ftb ca

Effortlessly Prepare Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

- Find Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from the device of your choice. Modify and electronically sign Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1998 form 540nr california nonresident or part year resident income tax return ftb ca

Create this form in 5 minutes!

How to create an eSignature for the 1998 form 540nr california nonresident or part year resident income tax return ftb ca

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca is a tax form designed for individuals who earned income in California but were not residents for the full year. It allows nonresidents and part-year residents to report their income, calculate their tax liability, and claim applicable deductions and credits. Understanding this form is crucial for compliance with California tax regulations.

-

How can airSlate SignNow assist with Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

airSlate SignNow streamlines the process of preparing and submitting your Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca by providing an intuitive eSignature solution. Our platform allows you to fill out, sign, and send the form electronically, saving time and ensuring accuracy. This ease of use is especially beneficial during tax season.

-

What are the costs associated with using airSlate SignNow for Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Using airSlate SignNow is cost-effective, with various subscription plans that cater to different needs. Customers can choose a plan that fits their budget while enjoying unlimited access to features that facilitate the signing and management of documents, including Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca. Pricing is transparent, and options are available for individuals and businesses.

-

Are there any features in airSlate SignNow that help me complete Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Yes, airSlate SignNow provides various features designed to simplify your tax document management, including templates for Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca. Our platform offers tools for easy editing, collaborative signing, and document tracking to ensure your tax filing is efficient and organized.

-

Can I integrate airSlate SignNow with other applications for handling Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, such as accounting software and cloud storage solutions. This allows for easy access and management of your documents, including Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca, ensuring a smooth workflow throughout the tax filing process.

-

What benefits does airSlate SignNow offer for businesses managing Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

For businesses, airSlate SignNow offers signNow advantages when managing Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca, including enhanced efficiency and reduced turnaround times for document completion. The platform ensures compliance and accuracy by enabling electronic signatures and document sharing within a secure environment. Additionally, the ability to track document status helps in managing deadlines and submissions.

-

Is airSlate SignNow secure for handling sensitive information like Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Yes, airSlate SignNow prioritizes security and employs advanced encryption protocols to protect sensitive information such as Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca. We implement robust security measures, including two-factor authentication and secure data storage, to ensure that your documents remain confidential and protected throughout the signing and submission process.

Get more for Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

Find out other Form 540NR California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later