Form 540NR California Nonresident or Part Year Resident Income Tax Return Form 540NR California Nonresident or Part Year Residen 2022

What is the Form 540NR?

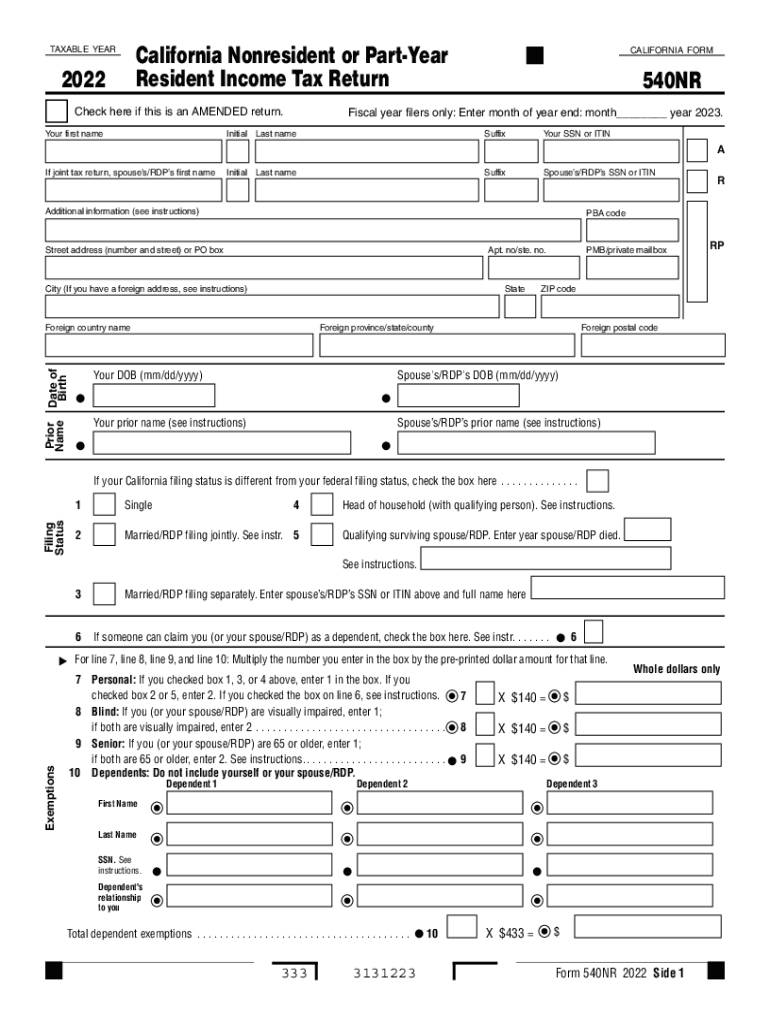

The Form 540NR, officially known as the California Nonresident or Part-Year Resident Income Tax Return, is a tax document required for individuals who earn income in California but do not reside in the state for the entire year. This form is essential for reporting income earned from California sources, ensuring compliance with state tax laws. It is specifically designed for nonresidents and part-year residents, allowing them to accurately calculate their tax obligations based on the income earned while in California.

Steps to Complete the Form 540NR

Completing the Form 540NR involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and any other sources of income.

- Calculate your California-adjusted gross income by adjusting your total income based on California-specific rules.

- Determine your deductions and credits applicable to your situation.

- Calculate your tax liability based on the income reported.

- Sign and date the form before submission.

How to Obtain the Form 540NR

The Form 540NR can be easily obtained through the California Franchise Tax Board (FTB) website. It is available for download in PDF format, allowing taxpayers to print it for completion. Additionally, the form may be accessible at various local government offices or tax preparation services. Ensure you have the correct version for the tax year you are filing, as forms may vary from year to year.

Legal Use of the Form 540NR

The Form 540NR serves a critical legal function in the tax system for nonresidents and part-year residents. Filing this form accurately is necessary to comply with California tax laws. Failure to file or inaccuracies in reporting can lead to penalties and interest on unpaid taxes. The form must be signed and submitted by the appropriate deadline to avoid legal repercussions.

Filing Deadlines for the Form 540NR

Timely filing of the Form 540NR is crucial. The standard deadline for submitting the form is typically April 15 of the year following the tax year. However, if you are unable to meet this deadline, you may request an extension, which allows for an additional six months to file. It is important to note that while an extension to file may be granted, any taxes owed must still be paid by the original deadline to avoid penalties.

Key Elements of the Form 540NR

Several key elements must be included when completing the Form 540NR. These include:

- Personal identification information, such as your name and Social Security number.

- Income details from all sources, including California and non-California income.

- Deductions specific to California tax law.

- Applicable tax credits that may reduce your overall tax liability.

Understanding these elements is essential for accurate completion and compliance with tax obligations.

Quick guide on how to complete 2022 form 540nr california nonresident or part year resident income tax return 2022 form 540nr california nonresident or part

Accomplish Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen with ease

- Locate Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as an ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 540nr california nonresident or part year resident income tax return 2022 form 540nr california nonresident or part

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 540nr california nonresident or part year resident income tax return 2022 form 540nr california nonresident or part

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the California Form 540NR instructions?

The California Form 540NR instructions provide detailed guidelines for individuals who are non-residents of California but earn income in the state. These instructions outline how to accurately fill out the tax form, what income to report, and any deductions or credits that may apply. Following these instructions is crucial for compliance and to avoid any potential penalties.

-

How can airSlate SignNow assist with California Form 540NR instructions?

airSlate SignNow simplifies the process of eSigning and sending documents related to the California Form 540NR instructions. Our platform allows you to upload, sign, and share your tax forms securely and efficiently. This ensures that you can focus on completing your taxes without the hassle of printing and scanning.

-

Is there a cost associated with using airSlate SignNow for California Form 540NR instructions?

airSlate SignNow offers a cost-effective solution for your document management needs, including those related to California Form 540NR instructions. We provide various pricing plans based on your business requirements, ensuring that you have access to essential features without breaking the bank. You can choose a plan that suits your workflow best.

-

What features does airSlate SignNow offer for handling tax documents like the California Form 540NR instructions?

Our platform includes features such as customizable templates, real-time collaboration, and secure cloud storage to help you manage your tax documents, including California Form 540NR instructions. The intuitive interface makes it easy for anyone to navigate through the document signing process, ensuring you meet your tax filing deadlines.

-

Are there any integrations available with airSlate SignNow to assist with tax preparation and California Form 540NR instructions?

Yes, airSlate SignNow offers integrations with several accounting and tax preparation software that can facilitate a smoother process for completing California Form 540NR instructions. These integrations help streamline your workflow by allowing seamless data transfer between platforms, making tax preparation more efficient.

-

What benefits does eSigning provide for documents like the California Form 540NR instructions?

eSigning offers numerous benefits for documents such as the California Form 540NR instructions, including speed and convenience. With airSlate SignNow, you can sign documents electronically from anywhere, eliminating the need for physical signatures and paperwork. This method also helps reduce the time spent on administrative tasks, allowing you to focus on your finances.

-

How secure is the airSlate SignNow platform for handling sensitive documents like the California Form 540NR instructions?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like California Form 540NR instructions. Our platform uses advanced encryption and secure data storage measures to protect your information. This commitment to security ensures that you can send and receive your documents without worrying about unauthorized access.

Get more for Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen

- Buyers home inspection checklist south dakota form

- Sellers information for appraiser provided to buyer south dakota

- Legallife multistate guide and handbook for selling or buying real estate south dakota form

- Subcontractors agreement south dakota form

- Option to purchase addendum to residential lease lease or rent to own south dakota form

- South dakota uniform

- South dakota prenuptial form

- Amendment to prenuptial or premarital agreement south dakota form

Find out other Form 540NR California Nonresident Or Part Year Resident Income Tax Return Form 540NR California Nonresident Or Part Year Residen

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online