Form 568 Limited Liability Company Return of Income 2019

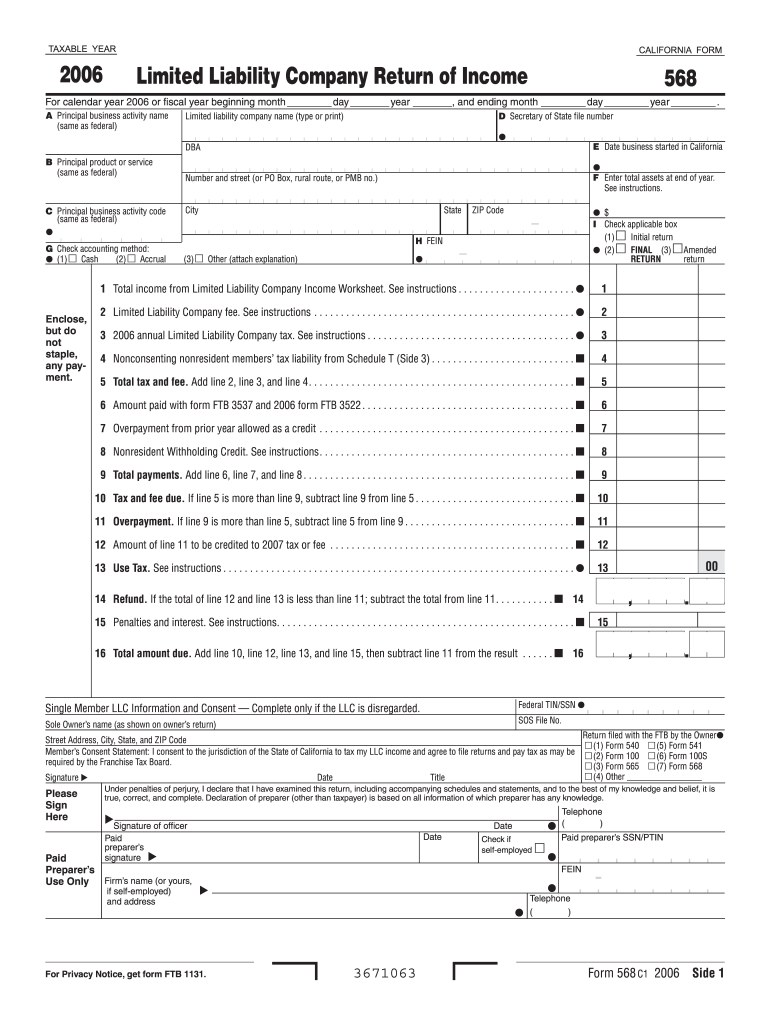

What is the Form 568 Limited Liability Company Return Of Income

The Form 568 Limited Liability Company Return Of Income is a tax form used by limited liability companies (LLCs) in California to report income, deductions, and credits. This form is essential for LLCs classified as partnerships or disregarded entities for federal tax purposes. It provides the California Franchise Tax Board with necessary information about the LLC's financial activities during the tax year. Proper completion of this form ensures compliance with state tax regulations and helps avoid penalties.

How to use the Form 568 Limited Liability Company Return Of Income

Using Form 568 involves several steps to ensure accurate reporting of your LLC's income. First, gather all financial records, including profit and loss statements, balance sheets, and any relevant tax documents. Next, fill out the form by entering your LLC's name, address, and identification number. Report total income, deductions, and credits in the appropriate sections. After completing the form, review it for accuracy before submission. It is advisable to consult with a tax professional to ensure compliance with all regulations.

Steps to complete the Form 568 Limited Liability Company Return Of Income

Completing Form 568 requires careful attention to detail. Start by entering your LLC's basic information at the top of the form. Then, proceed to report your total income, including all revenue sources. Next, list allowable deductions, such as business expenses and losses. After calculating the net income or loss, complete the sections for credits and taxes owed. Finally, sign and date the form, ensuring all required information is accurate and complete before submission.

Filing Deadlines / Important Dates

The filing deadline for Form 568 typically aligns with the due date for the LLC's tax return, which is usually the 15th day of the fourth month after the end of the taxable year. For most LLCs operating on a calendar year, this means the form is due on April 15. It is important to be aware of any extensions that may apply, as well as any changes to deadlines announced by the California Franchise Tax Board. Timely filing helps avoid late fees and penalties.

Legal use of the Form 568 Limited Liability Company Return Of Income

Form 568 serves a legal purpose in documenting an LLC's income and tax obligations in California. Properly filing the form ensures compliance with state tax laws and helps protect the LLC's legal status. Failure to file or inaccuracies can result in penalties, interest on unpaid taxes, and potential legal issues. Therefore, it is crucial for LLCs to maintain accurate records and file the form in accordance with California regulations.

Penalties for Non-Compliance

Non-compliance with Form 568 requirements can lead to significant penalties. These may include late filing fees, interest on unpaid taxes, and potential loss of good standing for the LLC. The California Franchise Tax Board may impose a penalty for failure to file the form or for filing inaccurate information. To avoid these consequences, it is essential for LLCs to adhere to filing deadlines and ensure that all information reported is correct and complete.

Quick guide on how to complete form 568 2006 limited liability company return of income

Prepare Form 568 Limited Liability Company Return Of Income with ease on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, edit, and electronically sign your documents quickly without delays. Manage Form 568 Limited Liability Company Return Of Income on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Form 568 Limited Liability Company Return Of Income effortlessly

- Locate Form 568 Limited Liability Company Return Of Income and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and eSign Form 568 Limited Liability Company Return Of Income and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 568 2006 limited liability company return of income

Create this form in 5 minutes!

How to create an eSignature for the form 568 2006 limited liability company return of income

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Form 568 Limited Liability Company Return Of Income?

Form 568 Limited Liability Company Return Of Income is a tax return form required for LLCs operating in California. This form reports the income, losses, and deductions of the LLC and ensures that it complies with state tax obligations. Filing this form accurately is crucial for avoiding penalties and ensuring smooth business operations.

-

How does airSlate SignNow assist with Form 568 Limited Liability Company Return Of Income?

airSlate SignNow streamlines the process of filling out and eSigning Form 568 Limited Liability Company Return Of Income. Our user-friendly platform allows you to manage necessary documents efficiently, reducing the time spent on paperwork. With our solution, you can focus on growing your business instead of getting bogged down in tax processes.

-

Is airSlate SignNow a cost-effective solution for handling Form 568 Limited Liability Company Return Of Income?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 568 Limited Liability Company Return Of Income. Our pricing plans are designed to accommodate various business sizes and needs, ensuring you receive great value while handling your compliance documents. Invest in our service to make tax season smoother and more manageable.

-

Can I integrate airSlate SignNow with other accounting software for Form 568 Limited Liability Company Return Of Income?

Absolutely! airSlate SignNow supports integrations with various accounting software to make handling Form 568 Limited Liability Company Return Of Income easier. By automating your document flow and eSigning, you can ensure that all necessary information is accurate and readily available, thereby enhancing your overall workflow.

-

What features does airSlate SignNow provide for creating Form 568 Limited Liability Company Return Of Income?

airSlate SignNow offers numerous features tailored for creating Form 568 Limited Liability Company Return Of Income, including templates, user authentication, and real-time collaboration. You can customize your documents, track changes, and securely share them, making the entire filing process straightforward and efficient. These features help ensure compliance and accuracy in your submissions.

-

How secure is airSlate SignNow when handling Form 568 Limited Liability Company Return Of Income documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and compliance measures to safeguard your Form 568 Limited Liability Company Return Of Income documents. You can rest assured that your sensitive information remains confidential and protected against unauthorized access.

-

Can airSlate SignNow help remind me of deadlines for Form 568 Limited Liability Company Return Of Income?

Yes! airSlate SignNow can send you reminders and notifications for deadlines related to Form 568 Limited Liability Company Return Of Income. Keeping track of important tax dates is crucial for compliance, and our automated reminders ensure you never miss a filing deadline.

Get more for Form 568 Limited Liability Company Return Of Income

Find out other Form 568 Limited Liability Company Return Of Income

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free