Delaware Quarterly Withholding Form W1q 9701 2020

What is the Delaware Quarterly Withholding Form W1q 9701

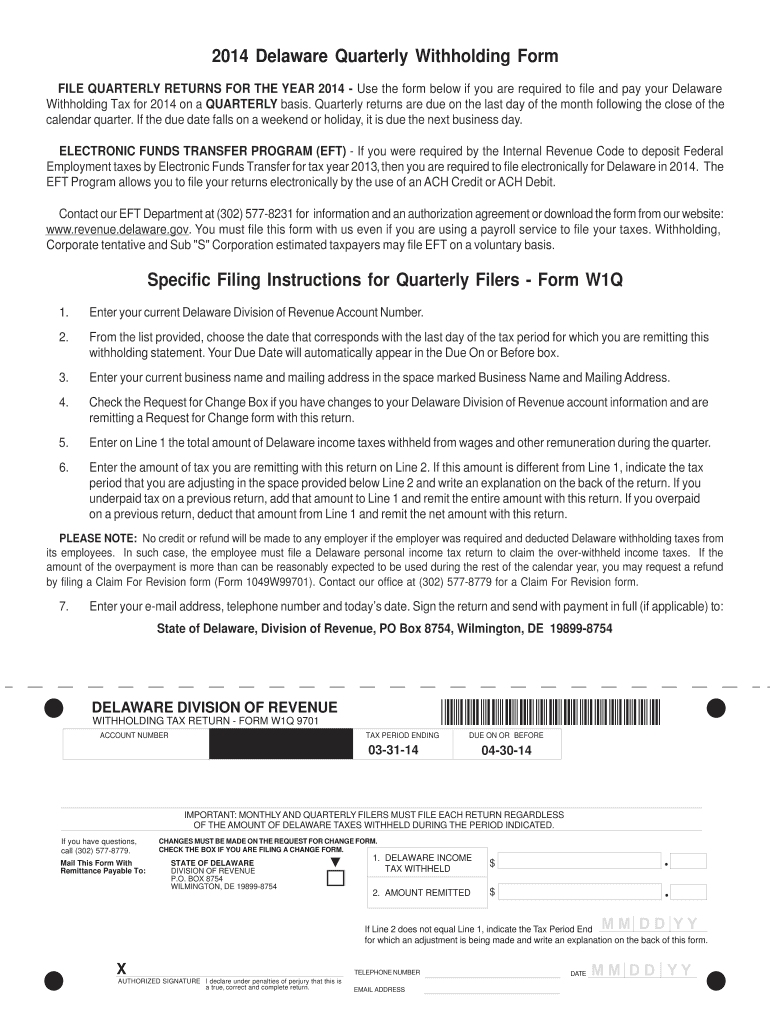

The Delaware Quarterly Withholding Form W1q 9701 is a tax document used by employers in Delaware to report and remit state income tax withheld from employees' wages. This form is essential for compliance with state tax regulations and ensures that the appropriate amount of tax is collected and submitted to the Delaware Division of Revenue. Employers must accurately complete this form to reflect the total wages paid and the amount withheld during each quarter.

How to use the Delaware Quarterly Withholding Form W1q 9701

Using the Delaware Quarterly Withholding Form W1q 9701 involves several key steps. Employers should first gather all necessary payroll information for the quarter, including total wages paid and the corresponding tax withheld. After completing the form, it must be submitted to the Delaware Division of Revenue either electronically or via mail. It is crucial to ensure that the information is accurate to avoid penalties for incorrect reporting.

Steps to complete the Delaware Quarterly Withholding Form W1q 9701

Completing the Delaware Quarterly Withholding Form W1q 9701 requires careful attention to detail. Follow these steps:

- Gather payroll records for the quarter.

- Fill in the employer's information, including name, address, and identification number.

- Report total wages paid to employees during the quarter.

- Indicate the total amount of state income tax withheld.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Delaware Quarterly Withholding Form W1q 9701. The form is due on the last day of the month following the end of each quarter. For example, the deadlines are typically April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Late submissions may result in penalties.

Legal use of the Delaware Quarterly Withholding Form W1q 9701

The legal use of the Delaware Quarterly Withholding Form W1q 9701 is governed by state tax laws. Employers are required to file this form to comply with Delaware tax regulations. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. Ensuring compliance with these legal requirements is essential for maintaining good standing with state authorities.

Form Submission Methods (Online / Mail / In-Person)

The Delaware Quarterly Withholding Form W1q 9701 can be submitted through various methods. Employers have the option to file electronically using the Delaware Division of Revenue's online portal, which is often the most efficient method. Alternatively, the completed form can be mailed to the appropriate address provided by the Division of Revenue. In-person submissions may also be possible at designated state offices, although this method is less common.

Quick guide on how to complete 2016 delaware quarterly withholding form w1q 9701

Complete Delaware Quarterly Withholding Form W1q 9701 easily on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Delaware Quarterly Withholding Form W1q 9701 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest method to edit and eSign Delaware Quarterly Withholding Form W1q 9701 effortlessly

- Obtain Delaware Quarterly Withholding Form W1q 9701 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then press the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing additional document versions. airSlate SignNow addresses all your document management needs in a few clicks from any device you select. Edit and eSign Delaware Quarterly Withholding Form W1q 9701 and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 delaware quarterly withholding form w1q 9701

Create this form in 5 minutes!

How to create an eSignature for the 2016 delaware quarterly withholding form w1q 9701

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Delaware Quarterly Withholding Form W1q 9701?

The Delaware Quarterly Withholding Form W1q 9701 is a document that employers use to report the amounts withheld from employees' wages for state income tax purposes. It is essential to submit this form quarterly to ensure compliance with Delaware tax regulations. Using airSlate SignNow simplifies the process of preparing and submitting this form.

-

How can airSlate SignNow help with the Delaware Quarterly Withholding Form W1q 9701?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing the Delaware Quarterly Withholding Form W1q 9701. You can quickly fill out and submit the form online, reducing the likelihood of errors and ensuring timely submissions. This streamlines your workflow and enhances your organization's efficiency.

-

Is there a cost associated with using airSlate SignNow for the Delaware Quarterly Withholding Form W1q 9701?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans are available to meet various organizational needs, allowing you to select an option that best fits your budget while efficiently managing your documents, including the Delaware Quarterly Withholding Form W1q 9701.

-

What features does airSlate SignNow offer for handling the Delaware Quarterly Withholding Form W1q 9701?

airSlate SignNow offers features such as document templates, electronic signatures, real-time notifications, and secure storage. These features enhance the preparation and submission process of the Delaware Quarterly Withholding Form W1q 9701, making it easier to track deadlines and maintain compliance. Additionally, you can collaborate with your team effortlessly.

-

How does airSlate SignNow ensure the security of the Delaware Quarterly Withholding Form W1q 9701?

airSlate SignNow employs advanced encryption and compliance measures to ensure the security of your documents, including the Delaware Quarterly Withholding Form W1q 9701. Your sensitive information is protected throughout the signing process, giving you peace of mind when handling payroll-related documents. Regular security updates and audits further ensure that your data remains safe.

-

Can I integrate airSlate SignNow with other software for managing the Delaware Quarterly Withholding Form W1q 9701?

Yes, airSlate SignNow offers integrations with numerous business applications, enhancing your ability to manage the Delaware Quarterly Withholding Form W1q 9701 alongside other payroll and HR solutions. Seamless integration capabilities allow you to streamline your workflow and improve overall productivity within your organization.

-

What benefits can I expect from using airSlate SignNow for the Delaware Quarterly Withholding Form W1q 9701?

Using airSlate SignNow for the Delaware Quarterly Withholding Form W1q 9701 simplifies the entire documentation process, reducing time spent on administrative tasks. Benefits include quick access to templates, efficient collaboration among team members, and improved compliance with state tax laws. This leads to greater accuracy and a reduction in the risk of penalties associated with late or incorrect submissions.

Get more for Delaware Quarterly Withholding Form W1q 9701

- Residential lease lf310 04 r310 04 form

- Hsfpp module 2 answer key form

- Vic fhog form

- Service agreement contract amity in home care services form

- Sra allotment letter online form

- Alg ii weiterbewilligungsantrag antrag auf weiterbewilligung der leistungen zur sicherung des lebensunterhalts nach dem zweiten form

- Pda form

- Esic accident register form 11 pdf

Find out other Delaware Quarterly Withholding Form W1q 9701

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement