Ma St 10 Form 2009

What is the Ma St 10 Form

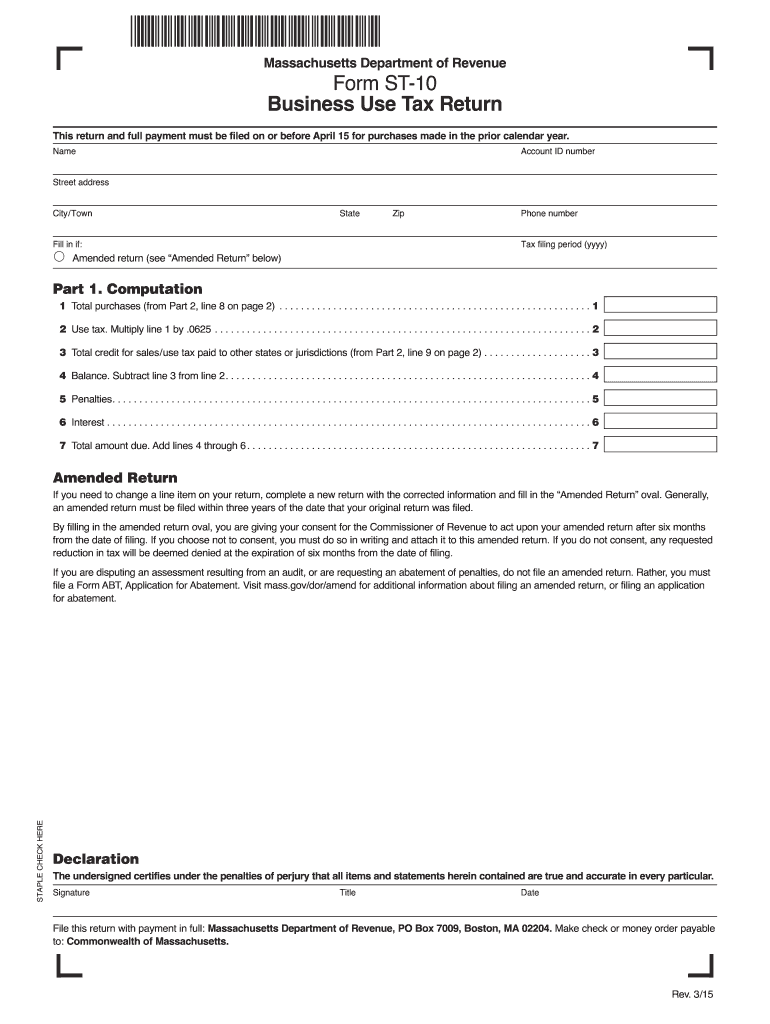

The Ma St 10 Form is a state-specific document used in Massachusetts for various tax-related purposes. It is primarily utilized for the purpose of claiming certain deductions or credits on state tax returns. Understanding the specific function of this form is essential for ensuring compliance with state tax regulations and for optimizing tax benefits. This form is typically required for individuals and businesses operating within Massachusetts.

How to use the Ma St 10 Form

Using the Ma St 10 Form involves several key steps to ensure accurate completion. First, gather all necessary information, including personal identification details and any relevant financial documentation. Next, carefully follow the instructions provided with the form to fill it out correctly. Ensure that all sections are completed and that the information is accurate to avoid delays or issues with processing. Once completed, the form can be submitted according to the specified submission methods.

Steps to complete the Ma St 10 Form

Completing the Ma St 10 Form requires a systematic approach:

- Obtain the latest version of the Ma St 10 Form from the appropriate state resources.

- Read the instructions thoroughly to understand each section and requirement.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial details, such as income and deductions.

- Review the form for accuracy and completeness before submission.

Legal use of the Ma St 10 Form

The legal use of the Ma St 10 Form is governed by Massachusetts state tax laws. It is important to ensure that the form is filled out truthfully and accurately, as any discrepancies can lead to penalties or legal consequences. The form serves as a formal declaration of your tax situation and must be submitted in accordance with state regulations to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Ma St 10 Form are critical to ensure compliance with state tax laws. Typically, the form must be submitted by the due date of your state tax return. It is advisable to check the Massachusetts Department of Revenue website for specific deadlines each tax year, as these can vary. Missing the deadline may result in penalties or interest on any owed taxes.

Required Documents

When completing the Ma St 10 Form, you will need to gather several supporting documents to ensure accuracy and compliance. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and help avoid errors.

Quick guide on how to complete ma st 10 form

Effortlessly Prepare Ma St 10 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdup. Handle Ma St 10 Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to Update and eSign Ma St 10 Form with Ease

- Locate Ma St 10 Form and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ma St 10 Form to maintain effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ma st 10 form

Create this form in 5 minutes!

How to create an eSignature for the ma st 10 form

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Ma St 10 Form and when should I use it?

The Ma St 10 Form is a tax document used in Massachusetts for income tax withholding. You should use it when you need to inform your employer or the Massachusetts Department of Revenue about your personal exemptions or any special withholding requirements.

-

How can airSlate SignNow help me with the Ma St 10 Form?

With airSlate SignNow, you can easily upload, fill out, and eSign the Ma St 10 Form online. Our platform ensures that your forms are securely stored and easily accessible, streamlining the process of completing your tax documentation.

-

Is there a cost associated with using airSlate SignNow for the Ma St 10 Form?

AirSlate SignNow offers a variety of pricing plans to suit different needs and budgets. You can choose from monthly or annual subscriptions, with options that allow unlimited access to features for handling the Ma St 10 Form and other documents.

-

What features does airSlate SignNow offer for completing the Ma St 10 Form?

AirSlate SignNow provides features like template creation, secure eSigning, document sharing, and tracking. These tools simplify the process of completing the Ma St 10 Form and facilitate quick, organized submissions.

-

Can I integrate airSlate SignNow with other software for the Ma St 10 Form?

Yes, airSlate SignNow offers integrations with various business applications such as CRM systems, cloud storage services, and more. This allows you to streamline your workflow when managing the Ma St 10 Form alongside other documents.

-

What benefits can I expect from using airSlate SignNow for the Ma St 10 Form?

By using airSlate SignNow for the Ma St 10 Form, you can expect improved efficiency, reduced paper clutter, and enhanced security. Our platform allows for quick eSigning and easy access from any device, ensuring you can submit your forms without delays.

-

Is it easy to share the completed Ma St 10 Form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily share your completed Ma St 10 Form via email or through secure links. This functionality makes it convenient to send your tax forms to employers or state agencies seamlessly.

Get more for Ma St 10 Form

- Jbphh application for an agent privilege letter form

- Combined community action application form

- Sc2 form ofsted

- Tc 62m 100115209 form

- How to fill out copart power of attorney form

- Abc form 218

- Family court case information affidavit

- Mundijongps wa edu auwp contentuniform order sheetuniform order sheet mundijongps wa edu au

Find out other Ma St 10 Form

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement