St 10 2015-2026

What is the St 10?

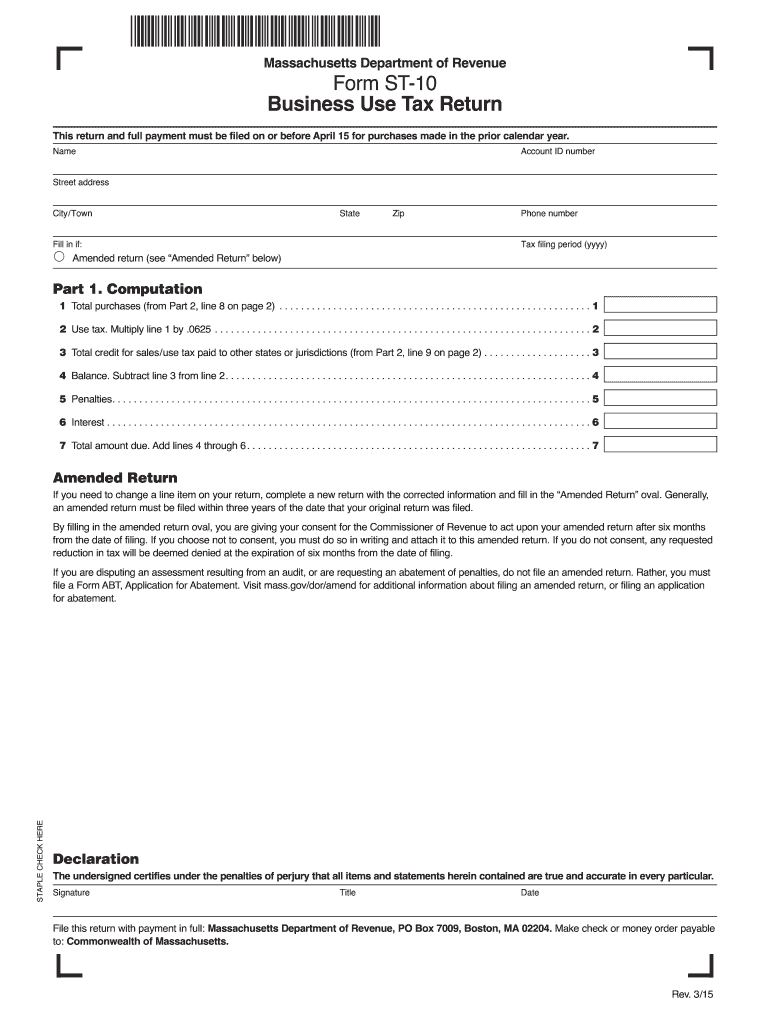

The St 10 form is a Massachusetts business use tax form that allows businesses to report and pay the use tax on tangible personal property purchased for use in the state. This form is essential for businesses that acquire items for use rather than for resale, ensuring compliance with Massachusetts tax regulations. The St 10 is crucial for maintaining accurate tax records and fulfilling state obligations.

How to use the St 10

Using the St 10 form involves several steps to ensure accurate reporting of use tax. Businesses must first gather information about their purchases, including the total cost of the items and the applicable use tax rate. The form requires details such as the business name, address, and tax identification number. Once completed, the form can be submitted to the Massachusetts Department of Revenue, either online or via mail, depending on the preference of the taxpayer.

Steps to complete the St 10

Completing the St 10 form requires careful attention to detail. Here are the steps involved:

- Gather necessary information about purchases, including receipts and invoices.

- Calculate the total cost of items subject to use tax.

- Determine the applicable use tax rate based on the current Massachusetts tax laws.

- Fill out the St 10 form with accurate details, including business information and tax calculations.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Massachusetts Department of Revenue by the specified deadline.

Legal use of the St 10

The legal use of the St 10 form is essential for businesses to comply with Massachusetts tax laws. Proper completion and timely submission of the form ensure that businesses fulfill their obligations regarding use tax. Failure to accurately report and pay use tax can lead to penalties and interest charges. Therefore, understanding the legal implications of the St 10 is crucial for maintaining compliance and avoiding potential legal issues.

Required Documents

When completing the St 10 form, certain documents are required to support the information provided. These may include:

- Receipts or invoices for all purchases subject to use tax.

- Documentation of any exemptions claimed, if applicable.

- Previous tax returns, if relevant, to ensure consistency in reporting.

Having these documents on hand will facilitate the accurate completion of the form and help substantiate the reported figures in case of an audit.

Form Submission Methods

The St 10 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the Massachusetts Department of Revenue's website, which may offer a quicker processing time.

- Mailing a physical copy of the completed form to the appropriate address provided by the state.

- In-person submission at designated state offices, if preferred.

Choosing the right submission method can depend on the business's resources and urgency in processing the tax payment.

Quick guide on how to complete st 10

Effortlessly Prepare St 10 on Any Device

Digital document management has gained signNow traction among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools to create, modify, and electronically sign your documents swiftly without delays. Manage St 10 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to Modify and eSign St 10 with Ease

- Locate St 10 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Put to rest the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign St 10 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 10

Create this form in 5 minutes!

How to create an eSignature for the st 10

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a form st return?

A form st return is a document used to report sales tax collected in the state of New York. It is vital for businesses to submit this form accurately and on time to avoid penalties. airSlate SignNow simplifies the signing and submission of form st returns with its user-friendly electronic signature solutions.

-

How much does airSlate SignNow cost for sending form st returns?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. You can choose from monthly or annual subscriptions, which provide unlimited access to features that help streamline the sending of form st returns. Check our pricing page for detailed information and to find the plan that best suits your needs.

-

What features does airSlate SignNow provide for form st return processing?

airSlate SignNow includes features such as customizable templates, in-app signing, and document tracking that simplify the process of handling form st returns. With our platform, you can easily create, send, and manage your documents while ensuring compliance with state regulations. Our intuitive interface makes it accessible for users of all skill levels.

-

Can I integrate airSlate SignNow with other software for managing form st returns?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing your workflow for managing form st returns. You can connect with tools like CRMs, cloud storage services, and accounting software to ensure that your document handling is efficient and organized. This integration capability adds substantial value for businesses looking to optimize their processes.

-

What are the benefits of using airSlate SignNow for form st returns?

Using airSlate SignNow for your form st returns brings efficiency, speed, and security to your document processes. The electronic signature feature ensures that your forms are signed quickly, reducing processing time and enabling faster submission. Additionally, our platform enhances compliance and minimizes the risk of errors associated with manual signing.

-

Is it easy to use airSlate SignNow for beginners handling form st returns?

Absolutely! airSlate SignNow is designed for users of all experience levels, making it easy for beginners to navigate. The platform provides tutorials and customer support to guide you in using features tailored for form st returns. Within minutes, you can start sending and signing documents confidently.

-

How secure is airSlate SignNow when managing form st returns?

Security is a top priority for airSlate SignNow. Our platform implements advanced encryption and security protocols to protect your sensitive information, especially when handling form st returns. Compliance with industry standards ensures that your documents remain safe and secure throughout their lifecycle.

Get more for St 10

- Football tournament letter in bengali pdf form

- Parent permission participation sex ed form

- In forma pauperis 5504502

- Net tangible benefit form requirements by state

- Cystic fibrosis karting sponsership forms for racing

- Cis301 form

- Application for approval to use spiritswhen to us form

- Hemorrhoids va disability form

Find out other St 10

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement