Form 302 Tn Inheritance Tax 2015

What is the Form 302 Tn Inheritance Tax

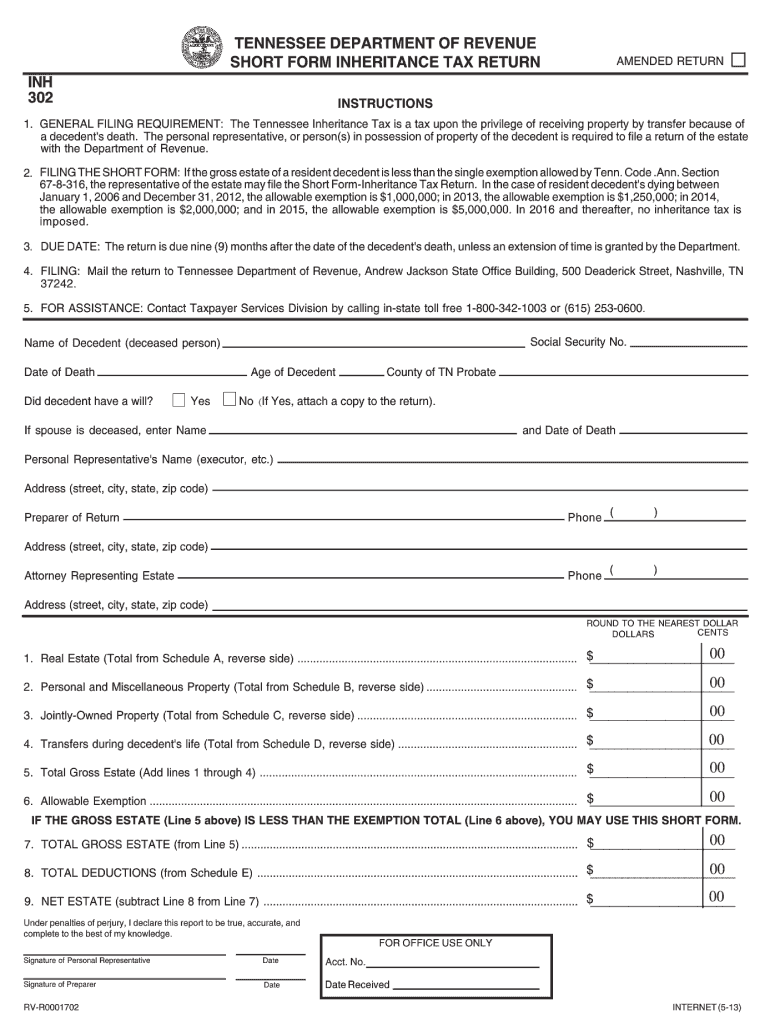

The Form 302 Tn Inheritance Tax is a legal document used in the state of Tennessee to report and calculate the inheritance tax owed on the transfer of property from a deceased individual to their heirs. This form is essential for ensuring compliance with state tax laws regarding inherited assets. It is typically required when the estate exceeds a certain value threshold, and it must be filed within a specific timeframe after the individual's death.

How to use the Form 302 Tn Inheritance Tax

To use the Form 302 Tn Inheritance Tax effectively, individuals must gather all necessary information regarding the deceased's assets and liabilities. This includes details about real estate, bank accounts, investments, and any debts owed by the estate. Once this information is compiled, the form can be filled out accurately, ensuring that all required sections are completed. It is advisable to consult with a tax professional or attorney to ensure compliance with state regulations and to understand any potential tax implications.

Steps to complete the Form 302 Tn Inheritance Tax

Completing the Form 302 Tn Inheritance Tax involves several key steps:

- Gather all relevant documents related to the deceased's estate.

- Fill out the personal information section, including the decedent's name, date of death, and Social Security number.

- List all assets and their estimated values, ensuring to include any applicable deductions.

- Calculate the total inheritance tax owed based on the state's tax rates.

- Sign and date the form, ensuring that it is submitted to the appropriate state agency.

Legal use of the Form 302 Tn Inheritance Tax

The legal use of the Form 302 Tn Inheritance Tax is crucial for fulfilling state obligations regarding inheritance tax. The form must be completed accurately and submitted within the designated timeframe to avoid penalties. Additionally, it is important to ensure that all information provided is truthful and complete, as any discrepancies may lead to legal consequences, including audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Form 302 Tn Inheritance Tax are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's death. If the form is not submitted by this deadline, interest and penalties may accrue on the unpaid tax amount. It is advisable to keep track of important dates and consider filing earlier to ensure all information is accurate and complete.

Required Documents

When completing the Form 302 Tn Inheritance Tax, several documents are required to substantiate the information provided. These may include:

- The decedent's death certificate.

- A copy of the will, if applicable.

- Documents detailing the value of assets, such as appraisals or bank statements.

- Records of any debts or liabilities of the estate.

Form Submission Methods (Online / Mail / In-Person)

The Form 302 Tn Inheritance Tax can be submitted through various methods. Individuals may choose to file the form online, if available, or submit it via mail to the appropriate state agency. In some cases, in-person submission may be an option, allowing for immediate confirmation of receipt. It is important to check the specific submission guidelines provided by the state to ensure compliance with all requirements.

Quick guide on how to complete form 302 tn inheritance tax 2013

Complete Form 302 Tn Inheritance Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 302 Tn Inheritance Tax on any device with airSlate SignNow mobile applications for Android or iOS and streamline any document-related process today.

The simplest way to edit and electronically sign Form 302 Tn Inheritance Tax without hassle

- Obtain Form 302 Tn Inheritance Tax and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Select key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 302 Tn Inheritance Tax to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 302 tn inheritance tax 2013

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is Form 302 TN Inheritance Tax?

Form 302 TN Inheritance Tax is a document required by the state of Tennessee for reporting the taxable estate of a deceased person. This form ensures compliance with state laws regarding inheritance tax and provides important financial information to the authorities.

-

How can airSlate SignNow help with Form 302 TN Inheritance Tax?

airSlate SignNow simplifies the process of filling out and electronically signing Form 302 TN Inheritance Tax. Our platform allows you to upload the form, fill it out digitally, and send it for signatures, making it easy to manage and submit the required documents.

-

Is there a fee for using airSlate SignNow for Form 302 TN Inheritance Tax?

Yes, airSlate SignNow offers flexible pricing plans that vary based on usage. With our cost-effective solution, you can choose a plan that suits your needs and manage the signing process for Form 302 TN Inheritance Tax without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for Form 302 TN Inheritance Tax?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications and tools, allowing you to streamline your workflow when dealing with Form 302 TN Inheritance Tax. This integration enhances efficiency and reduces the time spent on document management.

-

What features does airSlate SignNow offer for managing Form 302 TN Inheritance Tax?

Key features include customizable templates for Form 302 TN Inheritance Tax, automated reminders for signatures, and real-time tracking of document status. These features ensure that you can manage your inheritance tax forms efficiently and effectively.

-

Is airSlate SignNow user-friendly for submitting Form 302 TN Inheritance Tax?

Yes, airSlate SignNow is designed with user experience in mind. The intuitive interface allows users, regardless of technical skill, to easily navigate the platform and submit Form 302 TN Inheritance Tax without hassle.

-

How does airSlate SignNow ensure the security of Form 302 TN Inheritance Tax documents?

We prioritize security at airSlate SignNow. Our platform uses encryption and secure access controls to protect your Form 302 TN Inheritance Tax documents, ensuring that sensitive information remains confidential and secure.

Get more for Form 302 Tn Inheritance Tax

Find out other Form 302 Tn Inheritance Tax

- Can I Sign Presentation

- eSign PDF Easy

- eSign PDF Safe

- eSign Word Online

- How To eSign PDF

- How Do I eSign PDF

- Help Me With eSign PDF

- Can I eSign PDF

- eSign Word Computer

- How To eSign Word

- Can I eSign Word

- eSign Document Online

- eSign Document Computer

- eSign Word Free

- eSign Document Mobile

- eSign Document Free

- eSign Document Secure

- eSign Document Simple

- eSign Document Easy

- How To eSign Document