Homestead Exemption Form Henderson County Texas 2019

What is the Homestead Exemption Form Henderson County Texas

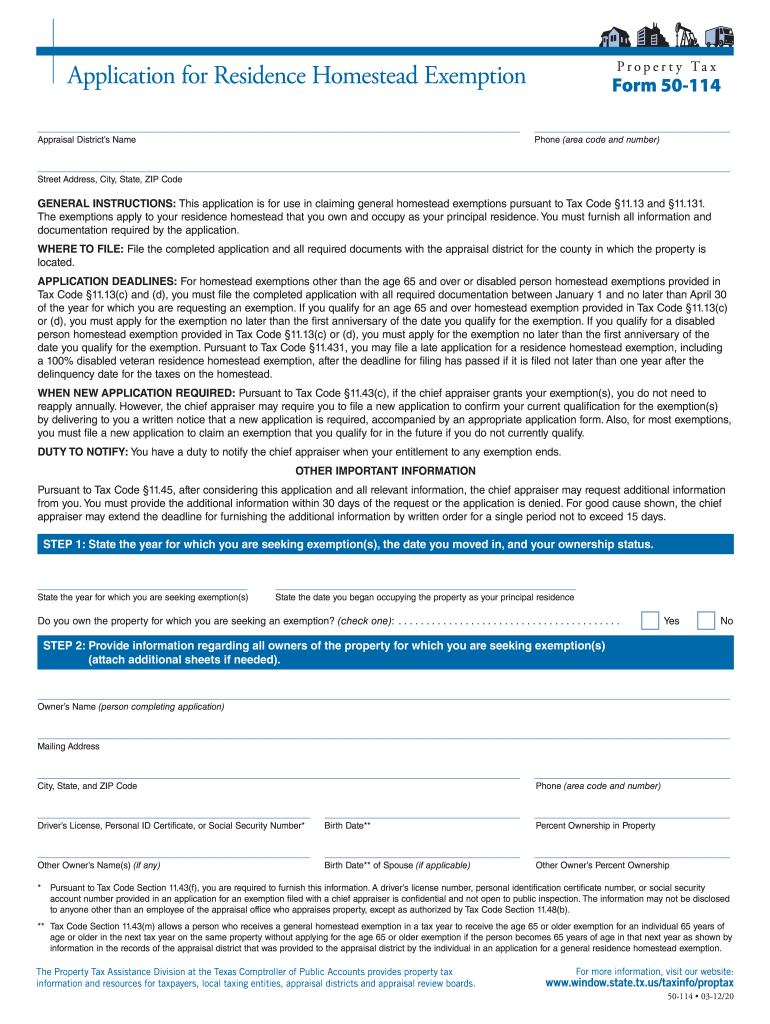

The Homestead Exemption Form for Henderson County, Texas, is a document that allows homeowners to claim a reduction in property taxes on their primary residence. This exemption is designed to provide financial relief to residents by lowering the taxable value of their home. By completing and submitting this form, eligible homeowners can benefit from significant savings on their annual property tax bills. The exemption is particularly important for those who may be facing economic challenges, as it helps to make homeownership more affordable.

How to obtain the Homestead Exemption Form Henderson County Texas

Homeowners can obtain the Homestead Exemption Form for Henderson County, Texas, through several methods. The form is typically available at the local appraisal district office, where residents can pick up a physical copy. Additionally, the form can often be downloaded from the official website of the Henderson County Appraisal District. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the submission process.

Steps to complete the Homestead Exemption Form Henderson County Texas

Completing the Homestead Exemption Form involves several key steps:

- Gather necessary information, including your property details, ownership status, and Social Security number.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide any supporting documentation, such as proof of residency or identity, if required.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate local appraisal district office by the specified deadline.

Eligibility Criteria

To qualify for the Homestead Exemption in Henderson County, homeowners must meet specific eligibility criteria. Generally, applicants must own and occupy the property as their primary residence. The property must not be used for commercial purposes, and the homeowner must not have claimed a homestead exemption on another property in Texas. Additionally, certain age and disability criteria may apply, allowing for further exemptions for senior citizens or individuals with disabilities.

Form Submission Methods

Homeowners have multiple options for submitting the Homestead Exemption Form in Henderson County. The form can be submitted in person at the local appraisal district office, allowing for immediate confirmation of receipt. Alternatively, homeowners may choose to mail the completed form to the office, ensuring it is sent well before the deadline to avoid any delays. Some jurisdictions may also offer online submission options, providing a convenient way to file electronically.

Legal use of the Homestead Exemption Form Henderson County Texas

The Homestead Exemption Form is legally binding and must be filled out truthfully. Misrepresentation or failure to meet eligibility requirements can result in penalties, including the loss of the exemption and potential fines. Homeowners should ensure they understand the legal implications of the form and maintain accurate records of their submission and any correspondence with the appraisal district.

Quick guide on how to complete homestead exemption form henderson county texas 2012

Prepare Homestead Exemption Form Henderson County Texas effortlessly on any device

Digital document management has grown in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Homestead Exemption Form Henderson County Texas on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Homestead Exemption Form Henderson County Texas with ease

- Locate Homestead Exemption Form Henderson County Texas and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all details and click on the Done button to save your edits.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious document searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Homestead Exemption Form Henderson County Texas and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homestead exemption form henderson county texas 2012

Create this form in 5 minutes!

How to create an eSignature for the homestead exemption form henderson county texas 2012

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Homestead Exemption Form Henderson County Texas?

The Homestead Exemption Form Henderson County Texas is a document that homeowners can file to reduce their property taxes. This exemption is designed to provide financial relief by lowering the appraised value of the home for tax purposes. By submitting this form, you can potentially save hundreds or even thousands of dollars on property taxes.

-

How do I obtain the Homestead Exemption Form Henderson County Texas?

You can obtain the Homestead Exemption Form Henderson County Texas from the Henderson County Appraisal District's website or local office. The form is typically available for download in PDF format to make it easy for you to print and fill out. Ensure that you have all necessary documentation ready when applying.

-

What is the deadline for filing the Homestead Exemption Form Henderson County Texas?

The deadline for filing the Homestead Exemption Form Henderson County Texas is generally April 30 of the tax year for which you are seeking the exemption. It’s important to submit your application on time to ensure that you receive the benefits for that tax year. Be sure to check for any updates or changes to deadlines.

-

Are there any costs associated with filing the Homestead Exemption Form Henderson County Texas?

Filing the Homestead Exemption Form Henderson County Texas is free of charge. There are no application fees to submit the form to the Henderson County Appraisal District. However, ensure that you have all required documents ready to avoid any delays in the processing of your exemption.

-

What benefits do I get with the Homestead Exemption Form Henderson County Texas?

By filing the Homestead Exemption Form Henderson County Texas, you can benefit from a reduction in your property taxes and potential eligibility for other exemptions. This can result in signNow savings over time, making homeownership more affordable. Additionally, it may offer protection against certain creditors.

-

Can I file the Homestead Exemption Form Henderson County Texas online?

Currently, the Homestead Exemption Form Henderson County Texas typically needs to be submitted via mail or in-person at the local appraisal district office. However, always check the Henderson County Appraisal District's official website, as they may introduce online filing options in the future to streamline the process.

-

Is there a specific eligibility requirement for the Homestead Exemption Form Henderson County Texas?

Yes, to be eligible for the Homestead Exemption Form Henderson County Texas, you must reside in the home you are claiming as your principal residence. Additionally, you must not hold an ownership interest in another property that you claim as your homestead. Other criteria may also apply, which you can find detailed on the appraisal district's website.

Get more for Homestead Exemption Form Henderson County Texas

Find out other Homestead Exemption Form Henderson County Texas

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission