Kendall County Homestead Exemption Form 2019

What is the Kendall County Homestead Exemption Form

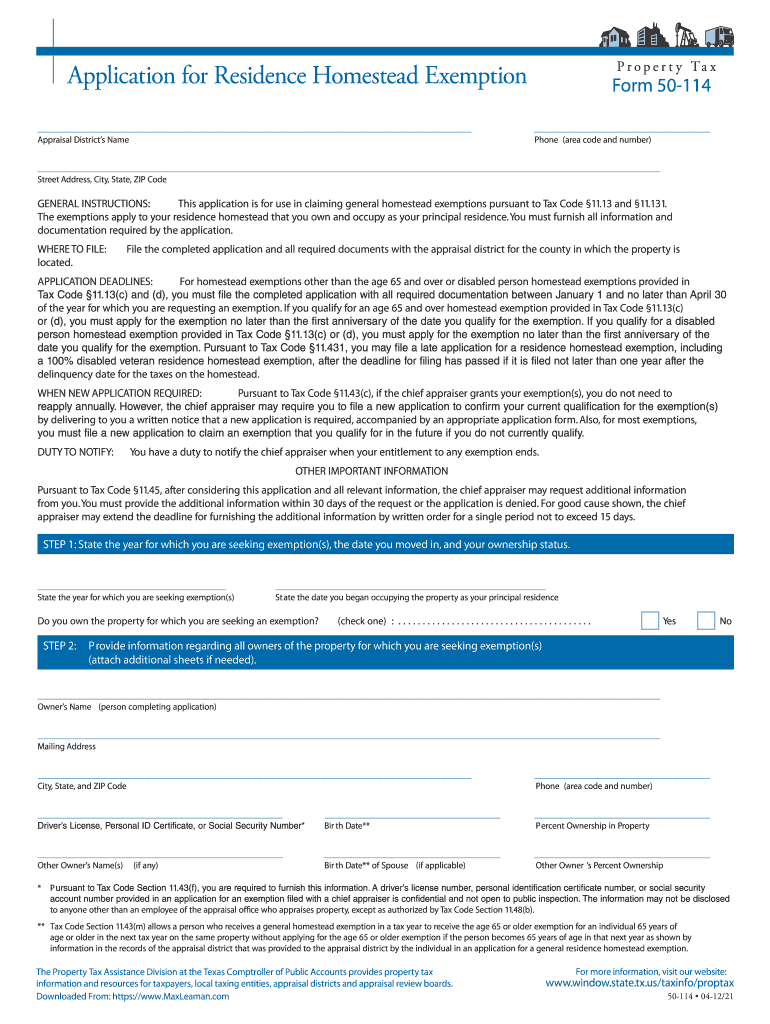

The Kendall County Homestead Exemption Form is a crucial document for property owners seeking to reduce their property tax burden in Kendall County, Texas. This exemption allows eligible homeowners to claim a reduction in the appraised value of their primary residence, which can lead to significant savings on property taxes. The form is designed to ensure that property owners meet specific criteria set by the local tax authority, making it essential for those looking to benefit from this tax relief program.

Eligibility Criteria for the Kendall County Homestead Exemption

To qualify for the Kendall County Homestead Exemption, applicants must meet several criteria. Homeowners must occupy the property as their principal residence and must not claim a homestead exemption on any other property. Additionally, applicants must provide proof of ownership and may need to meet age or disability requirements for certain exemptions, such as the senior tax exemption. Understanding these eligibility criteria is vital for ensuring that your application is successful.

Steps to Complete the Kendall County Homestead Exemption Form

Completing the Kendall County Homestead Exemption Form involves several straightforward steps. First, gather necessary documentation, including proof of residency and ownership. Next, accurately fill out the form, ensuring all information is correct and complete. After completing the form, submit it to the Kendall County Appraisal District by the designated deadline. It is advisable to keep a copy of the submitted form for your records. Following these steps helps ensure that your application is processed smoothly.

Form Submission Methods for the Kendall County Homestead Exemption

Homeowners have multiple options for submitting the Kendall County Homestead Exemption Form. The form can be submitted online through the Kendall County Appraisal District's website, mailed directly to their office, or delivered in person. Each method has its advantages, with online submission often being the quickest and most convenient option. Understanding these submission methods can help streamline the application process and ensure timely processing of your exemption request.

Required Documents for the Kendall County Homestead Exemption

When applying for the Kendall County Homestead Exemption, specific documents are required to support your application. These typically include proof of identity, such as a driver's license or state ID, and documentation proving ownership of the property, like a deed or tax statement. Additional documents may be necessary for specific exemptions, such as those for seniors or disabled individuals. Ensuring you have all required documents ready will facilitate a smoother application process.

Legal Use of the Kendall County Homestead Exemption Form

The Kendall County Homestead Exemption Form must be used in accordance with local and state laws governing property tax exemptions. This includes adhering to deadlines for submission and ensuring that all information provided is accurate and truthful. Misuse of the form or providing false information can lead to penalties, including denial of the exemption or legal repercussions. Understanding the legal framework surrounding this form is essential for homeowners seeking to benefit from tax relief.

Quick guide on how to complete kendall county homestead exemption form

Complete Kendall County Homestead Exemption Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Kendall County Homestead Exemption Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and electronically sign Kendall County Homestead Exemption Form without effort

- Locate Kendall County Homestead Exemption Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure confidential information with the tools airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Kendall County Homestead Exemption Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kendall county homestead exemption form

Create this form in 5 minutes!

How to create an eSignature for the kendall county homestead exemption form

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the kendall county homestead exemption?

The Kendall County homestead exemption is a tax relief program designed to reduce the property taxes on a homeowner's primary residence. By applying for this exemption, eligible homeowners can benefit from a reduction in their assessed property value, leading to potential savings on their annual tax bill. It's important to understand the eligibility requirements and application process to fully take advantage of this exemption.

-

How do I apply for the kendall county homestead exemption?

To apply for the Kendall County homestead exemption, homeowners must submit an application form to the Kendall County Appraisal District. The application typically requires proof of residency and ownership of the property. Make sure to check the filing deadlines to ensure you don’t miss out on the benefits offered by the kendall county homestead exemption.

-

What are the eligibility requirements for the kendall county homestead exemption?

Eligibility for the Kendall County homestead exemption generally includes being the property owner of a primary residence and living in that residence as of January 1st. Additionally, the homeowner should not be claiming a homestead exemption on any other property. It’s vital to review the specific requirements to ensure compliance and maximize your benefits.

-

What benefits does the kendall county homestead exemption provide?

The Kendall County homestead exemption can provide signNow financial benefits by lowering the taxable value of your home, which leads to lower property taxes. This exemption is particularly advantageous for families or individuals on a fixed income, as it helps maintain affordable housing costs. Overall, it promotes stability and financial relief for local homeowners.

-

Is there a deadline to apply for the kendall county homestead exemption?

Yes, there is a deadline to apply for the Kendall County homestead exemption, typically falling on April 30th of each year. Homeowners must ensure their application is submitted before this date to qualify for the current tax year. Keeping track of this deadline is crucial to reap the benefits of the exemption.

-

Can I retain the kendall county homestead exemption if I sell my home?

If you sell your home, you will lose your Kendall County homestead exemption as it is tied to your primary residence. However, as a new homeowner, you can apply for this exemption on your new primary residence. It's advisable to familiarize yourself with the application process for the new property to continue receiving tax relief.

-

What happens if I don’t apply for the kendall county homestead exemption?

Failing to apply for the Kendall County homestead exemption means you will miss out on potential savings on your property taxes. Without this exemption, your home will be assessed at its full value, which could lead to higher tax bills. It’s a missed opportunity for financial relief that many homeowners can benefit from.

Get more for Kendall County Homestead Exemption Form

- Cards against humanity instructions form

- Pc1 form 62484309

- Mathster graph paper generator form

- Challan receipt format

- Maybank2e bulk payment template form

- Procare sign in and out sheet form

- Ch 250s proof of service of response by mail spanish form

- Jv 692 notification to sheriff of juvenile delinquency felony adjudication welfare ampamp institutions code section 827 2 form

Find out other Kendall County Homestead Exemption Form

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template