Declaraciones Juradas De Exencin Fiscal De La Residencia 2023-2026

Understanding the Texas Residence Homestead Exemption

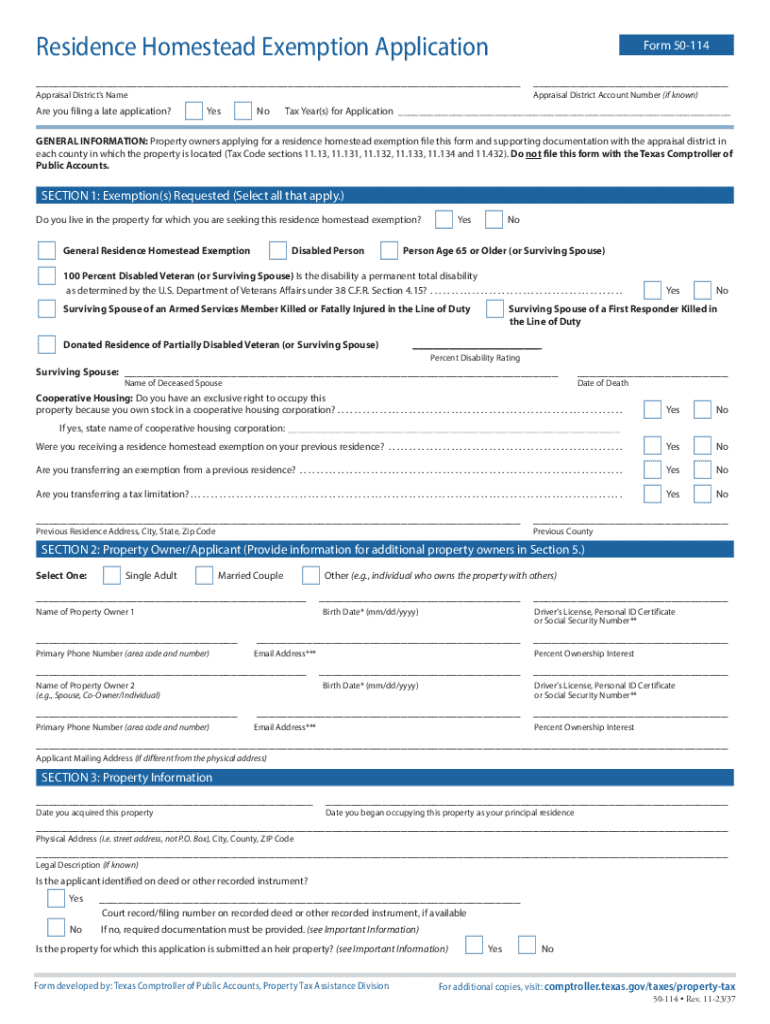

The Texas residence homestead exemption is a legal provision that allows homeowners to reduce their property taxes. This exemption is applicable to individuals who own and occupy their homes as their principal residence. By filing the appropriate form, homeowners can benefit from a reduction in the appraised value of their property, which directly lowers their tax burden. The exemption is particularly beneficial for those on a fixed income, such as retirees, as it can provide significant savings over time.

Eligibility Criteria for the Homestead Exemption

To qualify for the Texas residence homestead exemption, applicants must meet specific criteria. The primary requirements include:

- The applicant must own the property.

- The property must be the applicant's principal residence.

- The applicant must not claim a homestead exemption on any other property.

- Age or disability status may provide additional exemptions.

It is essential for applicants to review these criteria carefully to ensure they meet all requirements before submitting their application.

Steps to Complete the Homestead Exemption Application

Filling out the Texas form for the homestead exemption involves several straightforward steps:

- Obtain the Form 50-114, which is the official application for the residence homestead exemption.

- Provide all required information, including your name, address, and details about the property.

- Indicate any eligibility for additional exemptions, such as age or disability.

- Sign and date the application.

- Submit the completed form to your local appraisal district office.

Completing these steps accurately is crucial to ensure that your application is processed without delay.

Form Submission Methods

The Texas form for the homestead exemption can be submitted through various methods. Homeowners have the option to:

- Submit the application online through the local appraisal district's website.

- Mail the completed form to the appropriate appraisal district office.

- Deliver the form in person at the local appraisal district office.

Choosing the method that best suits your needs can streamline the application process and help ensure timely processing.

Required Documents for Application

When applying for the Texas residence homestead exemption, certain documents are necessary to support your application. These may include:

- A copy of your Texas driver's license or state-issued ID.

- Proof of property ownership, such as a deed.

- Any documentation supporting claims for additional exemptions (e.g., disability documentation).

Having these documents ready can facilitate a smoother application process and help avoid any potential delays.

Filing Deadlines for the Homestead Exemption

It is important to be aware of the filing deadlines for the Texas residence homestead exemption. Generally, applications must be submitted by:

- April 30 of the tax year for which the exemption is sought.

- Late applications may be accepted under certain circumstances, but it is advisable to file on time.

Staying informed about these deadlines ensures that homeowners do not miss out on valuable tax savings.

Handy tips for filling out Declaraciones Juradas De Exencin Fiscal De La Residencia online

Quick steps to complete and e-sign Declaraciones Juradas De Exencin Fiscal De La Residencia online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a GDPR and HIPAA compliant platform for optimum straightforwardness. Use signNow to electronically sign and send out Declaraciones Juradas De Exencin Fiscal De La Residencia for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct declaraciones juradas de exencin fiscal de la residencia

Create this form in 5 minutes!

How to create an eSignature for the declaraciones juradas de exencin fiscal de la residencia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas form homestead exemption online?

The Texas form homestead exemption online is a digital process that allows homeowners in Texas to apply for a homestead exemption through an online platform. This exemption can reduce property taxes for eligible homeowners, making it a valuable financial benefit. By using airSlate SignNow, you can easily complete and submit the necessary forms online.

-

How do I apply for the Texas form homestead exemption online?

To apply for the Texas form homestead exemption online, you can use airSlate SignNow to fill out the required forms digitally. Simply create an account, access the homestead exemption form, and follow the prompts to complete your application. This streamlined process saves time and ensures accuracy in your submission.

-

What are the benefits of using airSlate SignNow for the Texas form homestead exemption online?

Using airSlate SignNow for the Texas form homestead exemption online offers several benefits, including ease of use, cost-effectiveness, and secure document handling. The platform allows you to eSign documents quickly and track your application status in real-time. This convenience helps you manage your homestead exemption application efficiently.

-

Is there a fee to file the Texas form homestead exemption online?

Filing the Texas form homestead exemption online through airSlate SignNow is generally free, as the exemption itself does not incur a filing fee. However, there may be costs associated with using the platform for additional features or services. It's best to review the pricing details on the airSlate SignNow website for any applicable charges.

-

Can I integrate airSlate SignNow with other software for the Texas form homestead exemption online?

Yes, airSlate SignNow offers integrations with various software applications, making it easier to manage your documents related to the Texas form homestead exemption online. You can connect with popular tools like Google Drive, Dropbox, and more to streamline your workflow. This integration enhances your overall experience and efficiency.

-

What documents do I need to submit for the Texas form homestead exemption online?

When applying for the Texas form homestead exemption online, you typically need to provide proof of residency, such as a driver's license or utility bill, along with the completed exemption application form. airSlate SignNow allows you to upload these documents securely, ensuring that your application is complete and accurate.

-

How long does it take to process the Texas form homestead exemption online application?

The processing time for the Texas form homestead exemption online application can vary by county, but it generally takes a few weeks. Using airSlate SignNow helps you track your application status, so you can stay informed throughout the process. This transparency allows you to plan accordingly and follow up if necessary.

Get more for Declaraciones Juradas De Exencin Fiscal De La Residencia

Find out other Declaraciones Juradas De Exencin Fiscal De La Residencia

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease