Va 4 State Tax Form Fillable 2011

What is the Va 4 State Tax Form Fillable

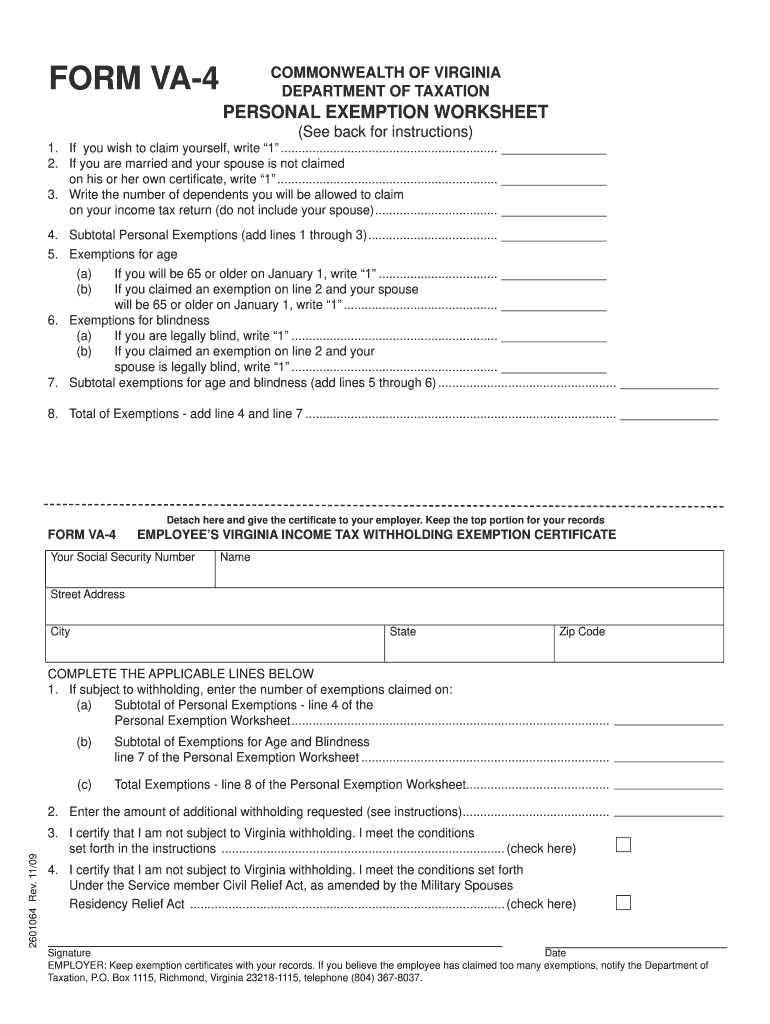

The Va 4 State Tax Form Fillable is a document used by employees in Virginia to determine the amount of state income tax withheld from their paychecks. This form allows individuals to provide their personal information, including their filing status and any applicable exemptions. By accurately completing the Va 4, taxpayers can ensure that the correct amount of tax is withheld, helping to avoid underpayment or overpayment throughout the tax year.

How to use the Va 4 State Tax Form Fillable

Using the Va 4 State Tax Form Fillable involves several straightforward steps. First, download the form from an official source or fill it out online. Next, provide your personal details, including your name, address, and Social Security number. Indicate your filing status and any exemptions you qualify for. After completing the form, review it for accuracy before submitting it to your employer. This process ensures that your state tax withholding aligns with your financial situation.

Steps to complete the Va 4 State Tax Form Fillable

Completing the Va 4 State Tax Form Fillable requires careful attention to detail. Follow these steps:

- Download or access the fillable form.

- Enter your personal information in the designated fields.

- Select your filing status: single, married, or head of household.

- Indicate any exemptions you are eligible for, such as dependents.

- Review all entries for accuracy and completeness.

- Sign and date the form.

- Submit the completed form to your employer.

Legal use of the Va 4 State Tax Form Fillable

The Va 4 State Tax Form Fillable is legally binding when completed accurately and submitted to your employer. It complies with state tax laws and regulations, ensuring that the withholding amounts are calculated based on the information you provide. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or in case of discrepancies.

State-specific rules for the Va 4 State Tax Form Fillable

Virginia has specific rules regarding the use of the Va 4 State Tax Form Fillable. These rules include guidelines on who must file the form, how often it should be updated, and the implications of claiming exemptions. For instance, employees should update their Va 4 whenever there is a change in their personal circumstances, such as marriage or the birth of a child, to ensure proper withholding.

Form Submission Methods

The Va 4 State Tax Form Fillable can be submitted in several ways. Employees typically provide the completed form directly to their employer's payroll department. Some employers may allow electronic submission through HR platforms. It is essential to confirm with your employer the preferred method of submission to ensure that your form is processed correctly.

Quick guide on how to complete va 4 state tax form fillable 2009

Complete Va 4 State Tax Form Fillable effortlessly on any device

Digital document management has gained signNow popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your files swiftly without delays. Manage Va 4 State Tax Form Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

The easiest way to modify and eSign Va 4 State Tax Form Fillable effortlessly

- Find Va 4 State Tax Form Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Alter and eSign Va 4 State Tax Form Fillable ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va 4 state tax form fillable 2009

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the VA 4 State Tax Form Fillable?

The VA 4 State Tax Form Fillable is an official document that allows Virginia residents to claim an exemption from state income tax withholding. It is designed to be easily filled out online, making tax management simpler and more efficient. By using the airSlate SignNow platform, you can quickly complete and submit your VA 4 State Tax Form Fillable.

-

How does airSlate SignNow help with filling out the VA 4 State Tax Form Fillable?

airSlate SignNow provides a user-friendly interface for filling out your VA 4 State Tax Form Fillable. With our smart fields and templates, you can ensure that all required information is accurately entered. The platform also allows for easy editing and signing, streamlining the entire process.

-

Is there a cost associated with using airSlate SignNow for the VA 4 State Tax Form Fillable?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for both individuals and businesses. While many features are accessible for free, premium offerings provide enhanced functionality, including advanced integrations and security features. Check our pricing page for details on our plans tailored for using the VA 4 State Tax Form Fillable.

-

Can I save my VA 4 State Tax Form Fillable in the cloud?

Absolutely! airSlate SignNow allows you to save your VA 4 State Tax Form Fillable securely in the cloud, ensuring your documents are safe and easily accessible. You can retrieve and modify your forms anytime, from anywhere, making it a convenient option for managing your tax documentation.

-

Are there any integrations available for airSlate SignNow when using the VA 4 State Tax Form Fillable?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow while filling out the VA 4 State Tax Form Fillable. You can connect to popular platforms like Google Drive, Dropbox, and many others, allowing you to streamline document management and storage.

-

How secure is the data when filling out the VA 4 State Tax Form Fillable on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you fill out the VA 4 State Tax Form Fillable, your data is protected with advanced encryption and secure servers. We comply with strict data protection regulations to ensure that your personal information remains confidential and safe.

-

Can I access the VA 4 State Tax Form Fillable on mobile devices?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to fill out the VA 4 State Tax Form Fillable easily on your smartphone or tablet. This flexibility means you can manage your tax documents on the go, ensuring convenience and accessibility wherever you are.

Get more for Va 4 State Tax Form Fillable

Find out other Va 4 State Tax Form Fillable

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple