Vermont Department of Taxes PO Box 547 2016

What is the Vermont Department Of Taxes PO Box 547

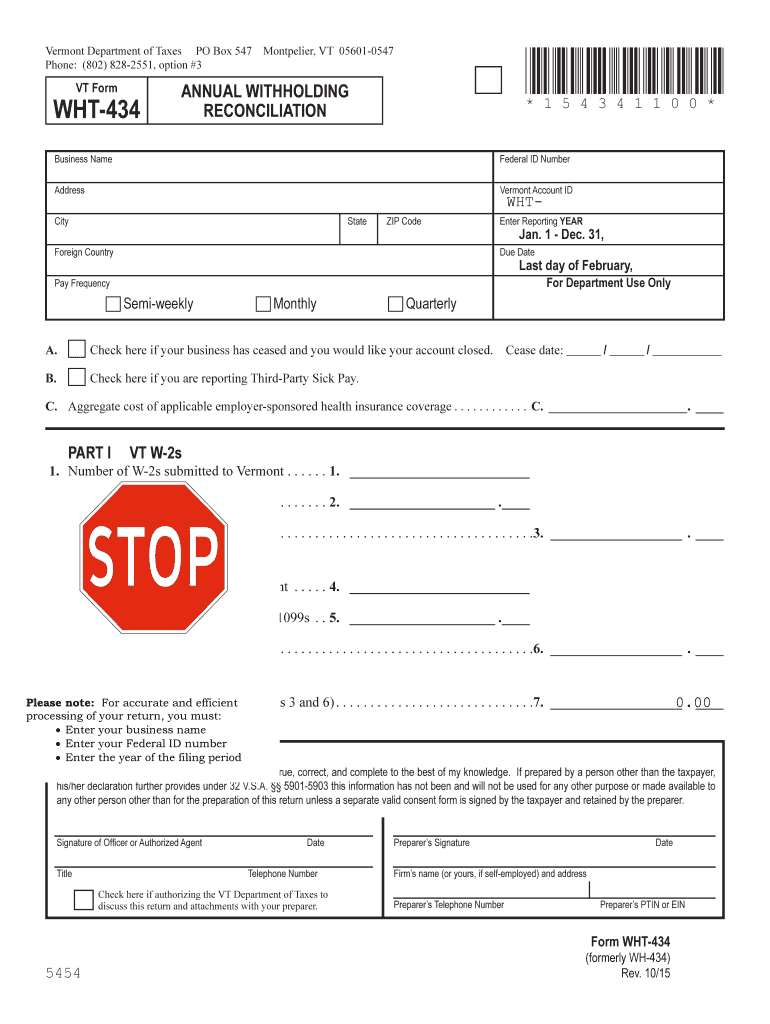

The Vermont Department of Taxes PO Box 547 is a designated mailing address for taxpayers to send various tax-related documents to the state of Vermont. This address is primarily used for filing state tax returns, making payments, and submitting other official correspondence related to taxation. Understanding the purpose of this PO Box is essential for ensuring that your tax documents reach the appropriate department in a timely manner.

How to use the Vermont Department Of Taxes PO Box 547

Using the Vermont Department of Taxes PO Box 547 involves several straightforward steps. First, ensure that you have completed the necessary tax forms accurately. Once your forms are filled out, place them in an envelope addressed to PO Box 547. It is advisable to include any required payment, such as a check or money order, if applicable. Finally, mail your envelope through a reliable postal service to ensure it arrives promptly at the designated address.

Steps to complete the Vermont Department Of Taxes PO Box 547

Completing the process for the Vermont Department of Taxes PO Box 547 involves the following steps:

- Gather all required tax documents and forms.

- Fill out the forms completely and accurately.

- Include any necessary payments, if required.

- Address the envelope to Vermont Department of Taxes PO Box 547.

- Mail the envelope using a reliable postal service.

Legal use of the Vermont Department Of Taxes PO Box 547

The Vermont Department of Taxes PO Box 547 serves as an official channel for submitting tax documents, making it a legally recognized method for fulfilling tax obligations. When documents are sent to this address, they are considered submitted to the state, provided they are mailed within the specified deadlines. Adhering to the legal requirements surrounding the submission of tax documents is crucial for compliance and avoiding penalties.

Required Documents

When submitting documents to the Vermont Department of Taxes PO Box 547, it is essential to include the correct paperwork. Commonly required documents include:

- State income tax returns, such as the Form IN-111.

- Payment vouchers, if applicable.

- Any additional forms required for specific tax situations, such as credits or deductions.

Ensuring that all necessary documents are included will help prevent delays in processing your tax submission.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their forms to the Vermont Department of Taxes. The primary methods include:

- Mail: Send your completed forms to PO Box 547.

- Online: Utilize the Vermont Department of Taxes online portal for electronic submissions.

- In-Person: Visit a local tax office to submit forms directly.

Choosing the method that best suits your needs can streamline the filing process and ensure timely submission.

Quick guide on how to complete vermont department of taxes po box 547

Prepare Vermont Department Of Taxes PO Box 547 effortlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Vermont Department Of Taxes PO Box 547 across any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Vermont Department Of Taxes PO Box 547 without hassle

- Obtain Vermont Department Of Taxes PO Box 547 and click Access Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow specially offers for that function.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Finish button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and eSign Vermont Department Of Taxes PO Box 547 and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont department of taxes po box 547

Create this form in 5 minutes!

How to create an eSignature for the vermont department of taxes po box 547

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Vermont Department Of Taxes PO Box 547 used for?

The Vermont Department Of Taxes PO Box 547 is primarily used for submitting tax returns and correspondence related to taxes in the state of Vermont. Ensuring that your documents signNow the correct destination is crucial for compliance. Using services like airSlate SignNow can streamline this process with electronic signatures and document tracking.

-

How can airSlate SignNow help with submissions to the Vermont Department Of Taxes PO Box 547?

With airSlate SignNow, you can easily prepare, send, and eSign documents required by the Vermont Department Of Taxes PO Box 547. The platform offers user-friendly features to ensure your submissions are accurate and timely. This reduces the risk of delays or errors in your tax submissions.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers several features like customizable templates, real-time collaboration, and secure storage, which are quite valuable when dealing with documents for the Vermont Department Of Taxes PO Box 547. These tools make it easier to manage various forms and keep everything organized. The seamless integration with other applications also enhances overall efficiency.

-

Is airSlate SignNow cost-effective for businesses dealing with the Vermont Department Of Taxes?

Yes, airSlate SignNow is designed to be cost-effective while providing essential features for businesses needing to communicate with the Vermont Department Of Taxes PO Box 547. It minimizes the costs associated with paper and mailing, making it budget-friendly. Plus, the time saved on documentation can lead to increased productivity.

-

Can I integrate airSlate SignNow with other software to manage my taxes?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms like CRMs and accounting tools to help manage your submissions to the Vermont Department Of Taxes PO Box 547. This integration enhances workflow efficiency, allowing for smoother data transfer and better document management.

-

What benefits does eSigning provide for documents sent to Vermont Department Of Taxes PO Box 547?

eSigning with airSlate SignNow ensures that your documents sent to the Vermont Department Of Taxes PO Box 547 are not only legally binding but also processed more rapidly. The instant signing capability reduces turnaround time signNowly, enabling swift submission of important tax documents. This leads to better compliance and peace of mind.

-

Are there security measures in place for documents related to Vermont Department Of Taxes PO Box 547?

Yes, airSlate SignNow employs top-notch security protocols to protect your documents related to the Vermont Department Of Taxes PO Box 547. Features such as encryption and multi-factor authentication ensure that your sensitive information remains confidential and secure. This is paramount for maintaining compliance and safeguarding your tax data.

Get more for Vermont Department Of Taxes PO Box 547

Find out other Vermont Department Of Taxes PO Box 547

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now