Tax Vermont GovsitestaxDo Not Return This Form to the Vermont Department of Taxes 2020-2026

What is Vermont Form 434?

The Vermont Form 434, also known as the Vermont WHT 434, is a tax form used for annual reconciliation of withholding tax. This form is essential for employers in Vermont to report the total amount of state income tax withheld from employee wages throughout the year. It ensures that the correct amount of tax has been collected and remitted to the state, allowing for accurate tax reporting and compliance with Vermont tax laws.

Steps to Complete Vermont Form 434

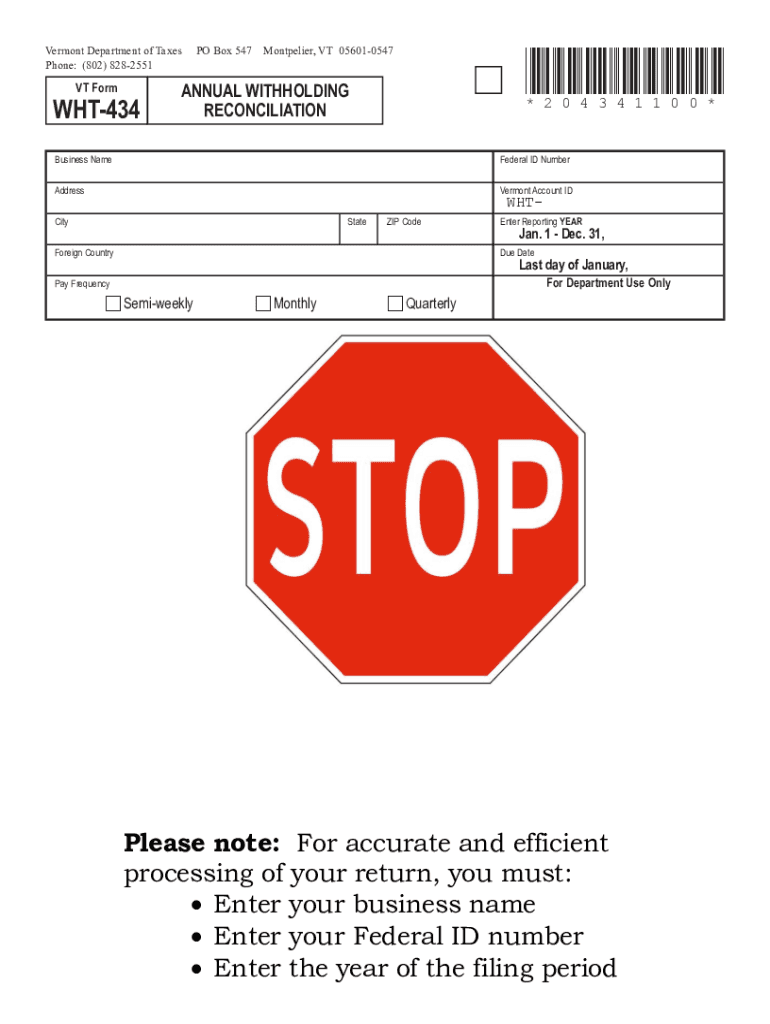

Completing the Vermont Form 434 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including total wages paid, total Vermont income tax withheld, and any adjustments for the year.

- Fill out the form with the required details, ensuring all figures are accurate and reflect your payroll records.

- Review the completed form for any errors or omissions, as inaccuracies can lead to penalties.

- Submit the form electronically or by mail, following the guidelines provided by the Vermont Department of Taxes.

Legal Use of Vermont Form 434

The Vermont Form 434 is legally binding when completed accurately and submitted on time. It complies with state regulations regarding withholding tax reporting. Employers must ensure that they meet the filing deadlines to avoid penalties. The form serves as a declaration of the withholding amounts and acts as a reconciliation tool to verify that the correct taxes have been withheld and remitted.

Filing Deadlines for Vermont Form 434

It is crucial for employers to be aware of the filing deadlines for Vermont Form 434. Typically, the form must be submitted by the end of January following the tax year. This deadline ensures that the Vermont Department of Taxes has the necessary information to process tax returns and maintain accurate records. Missing the deadline may result in fines or penalties for the employer.

Required Documents for Vermont Form 434

To complete the Vermont Form 434, employers should have the following documents ready:

- Payroll records for the year, including total wages and taxes withheld.

- Any previous forms submitted related to withholding tax.

- Supporting documentation for any adjustments or corrections made during the year.

Form Submission Methods for Vermont Form 434

Employers have multiple options for submitting the Vermont Form 434. The form can be filed electronically through the Vermont Department of Taxes website, which is often the preferred method for its efficiency and speed. Alternatively, employers can mail the completed form to the designated address provided by the department. In-person submissions may also be possible at local tax offices, depending on current regulations.

Quick guide on how to complete taxvermontgovsitestaxdo not return this form to the vermont department of taxes

Accomplish Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes seamlessly

- Find Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxvermontgovsitestaxdo not return this form to the vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the taxvermontgovsitestaxdo not return this form to the vermont department of taxes

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF document on Android OS

People also ask

-

What is the Vermont Form 434?

The Vermont Form 434 is a document used for reporting business income and expenses for tax purposes in Vermont. It is essential for businesses operating in the state to file this form accurately to ensure compliance with tax regulations. airSlate SignNow provides an efficient way to eSign and manage your Vermont Form 434 securely.

-

How can airSlate SignNow help with the Vermont Form 434?

airSlate SignNow streamlines the process of preparing and eSigning the Vermont Form 434. Our user-friendly interface allows you to fill out, send, and manage forms quickly. Additionally, our document tracking capabilities ensure you never miss a deadline on your Vermont Form 434 submissions.

-

Is there a cost associated with using airSlate SignNow for Vermont Form 434?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs when handling documents like the Vermont Form 434. Our competitive pricing ensures that you receive excellent value while enjoying powerful features for eSigning and document management. Check our website for specific pricing details and packages.

-

What features does airSlate SignNow offer for managing Vermont Form 434?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and easy collaboration tools for your Vermont Form 434. You can also utilize in-person signing and automated reminders to keep your documents on track. These features simplify the management of your tax-related documents.

-

Can I integrate airSlate SignNow with other tools for easier management of Vermont Form 434?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Microsoft Office, helping you manage your Vermont Form 434 more effectively. These integrations allow for a smoother workflow and easy access to your documents across platforms.

-

How does airSlate SignNow ensure the security of my Vermont Form 434?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure cloud storage to protect your sensitive information, including your Vermont Form 434. Additionally, our robust authentication protocols ensure that only authorized users can access your documents.

-

What are the benefits of using airSlate SignNow for eSigning Vermont Form 434?

Using airSlate SignNow for your Vermont Form 434 offers numerous benefits, including faster turnaround times and enhanced convenience. With eSigning, you can complete transactions without the need for physical paperwork, saving time and resources. Our platform also allows for seamless collaboration with other stakeholders.

Get more for Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes

- Landlord tenant lease co signer agreement arkansas form

- Application for sublease arkansas form

- Inventory and condition of leased premises for pre lease and post lease arkansas form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out arkansas form

- Property manager agreement arkansas form

- Agreement for delayed or partial rent payments arkansas form

- Tenants maintenance repair request form arkansas

- Guaranty attachment to lease for guarantor or cosigner arkansas form

Find out other Tax vermont govsitestaxDo Not Return This Form To The Vermont Department Of Taxes

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later