Form 199 Instructions 2010

What is the Form 199 Instructions

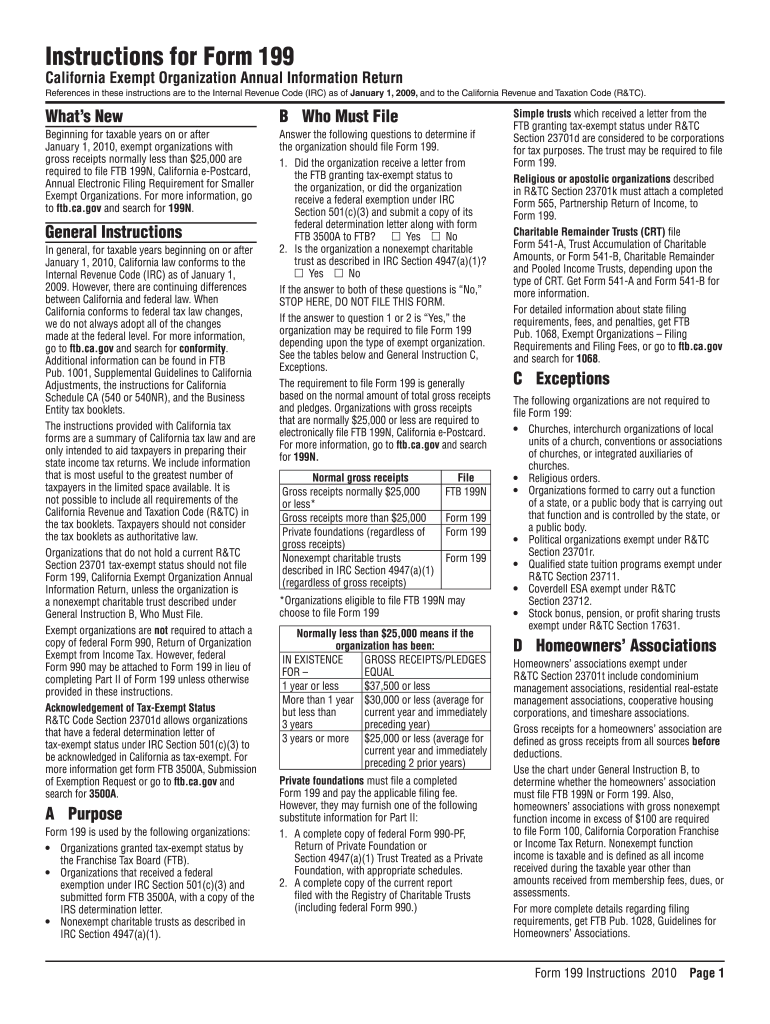

The Form 199 Instructions provide guidance on completing the Form 199, which is used for reporting specific information related to partnerships and limited liability companies (LLCs) in the United States. This form is essential for ensuring compliance with federal tax regulations and helps entities accurately report their income, deductions, and credits. Understanding the instructions is crucial for proper filing and avoiding potential penalties.

Steps to complete the Form 199 Instructions

Completing the Form 199 requires careful attention to detail. Here are the key steps:

- Gather necessary information, including the entity’s name, address, and Employer Identification Number (EIN).

- Review the specific sections of the Form 199 that apply to your entity type, whether it is a partnership or an LLC.

- Fill out the required fields, ensuring accuracy in reporting income, deductions, and credits.

- Double-check all entries for completeness and correctness before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the Form 199 Instructions

The legal use of the Form 199 Instructions is paramount for entities to ensure compliance with the Internal Revenue Service (IRS) regulations. The instructions outline the legal obligations for reporting and provide clarity on how to meet these requirements. Proper adherence to these guidelines helps prevent issues related to audits and penalties, ensuring that the entity remains in good standing with tax authorities.

Filing Deadlines / Important Dates

Timely filing of the Form 199 is critical. The IRS typically sets specific deadlines for submission, which can vary based on the entity type and fiscal year. Entities should be aware of the following important dates:

- The standard deadline for filing Form 199 is usually the fifteenth day of the third month after the end of the entity’s tax year.

- Extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the Form 199, certain documents are necessary to ensure accurate reporting. These documents may include:

- Financial statements that detail income and expenses.

- Records of all deductions and credits claimed.

- Previous year’s tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 199 can be submitted through various methods, allowing for flexibility based on the entity's preferences. The available submission methods include:

- Online submission through the IRS e-file system, which is often the fastest option.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete form 199 instructions 2010

Easily Prepare Form 199 Instructions on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 199 Instructions on any device using airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to Edit and eSign Form 199 Instructions Effortlessly

- Locate Form 199 Instructions and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 199 Instructions and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 199 instructions 2010

Create this form in 5 minutes!

How to create an eSignature for the form 199 instructions 2010

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What are the key features of airSlate SignNow related to Form 199 Instructions?

airSlate SignNow offers a range of features designed to simplify the eSigning process for Form 199 Instructions. These include customizable templates, straightforward document sharing, and a user-friendly interface that ensures quick completion. With integrations to popular apps, you can streamline your workflow efficiently.

-

How can I benefit from using airSlate SignNow for Form 199 Instructions?

Using airSlate SignNow for Form 199 Instructions allows businesses to enhance their efficiency and reduce turnaround times. The solution provides secure eSigning, which is legally binding and eliminates the need for physical signatures. This not only saves time but also reduces costs associated with paper documents.

-

Is there a cost associated with using airSlate SignNow for Form 199 Instructions?

airSlate SignNow offers competitive pricing plans that cater to various business needs when it comes to Form 199 Instructions. There are different tiers to choose from, allowing you to select a package that best fits your budget and requirements. Additionally, a free trial is available for new users to experience its features before committing.

-

Can I integrate airSlate SignNow with other software for Form 199 Instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to incorporate into your existing workflow for Form 199 Instructions. Common integrations include CRM systems, document management software, and cloud storage solutions, which enhance your overall productivity.

-

What types of documents can I eSign besides Form 199 Instructions?

In addition to Form 199 Instructions, airSlate SignNow supports a wide array of document types ranging from contracts, agreements, to tax forms. This versatile platform provides the flexibility businesses need to manage multiple documents securely and efficiently. Whether you are handling HR documents or client contracts, airSlate SignNow has you covered.

-

How secure is the airSlate SignNow platform for eSigning Form 199 Instructions?

The security of your documents, including Form 199 Instructions, is a top priority for airSlate SignNow. The platform employs advanced encryption techniques and complies with industry standards to protect your data. Additionally, each signed document is stored securely, ensuring peace of mind for users.

-

How easy is it to set up airSlate SignNow for Form 199 Instructions?

Setting up airSlate SignNow for Form 199 Instructions is quick and user-friendly. After signing up, users can create templates, upload documents, and invite signers in just a few clicks. The intuitive design means that even those with little technical expertise can get started effortlessly.

Get more for Form 199 Instructions

- Virginia irp application form

- Irp3 a form

- Sample mou for nonprofit partnership example form

- New caney isd physical form

- Optimum bill pdf form

- Bsf329 4 application to transact marine operations with form

- Fillable online if you need to print out a copy of the requisition form

- Covid 19 consent formvoice in the valley

Find out other Form 199 Instructions

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe