How to Fill Out a State Tax Withholding Form Colorado 2020

What is the state tax withholding form in Colorado?

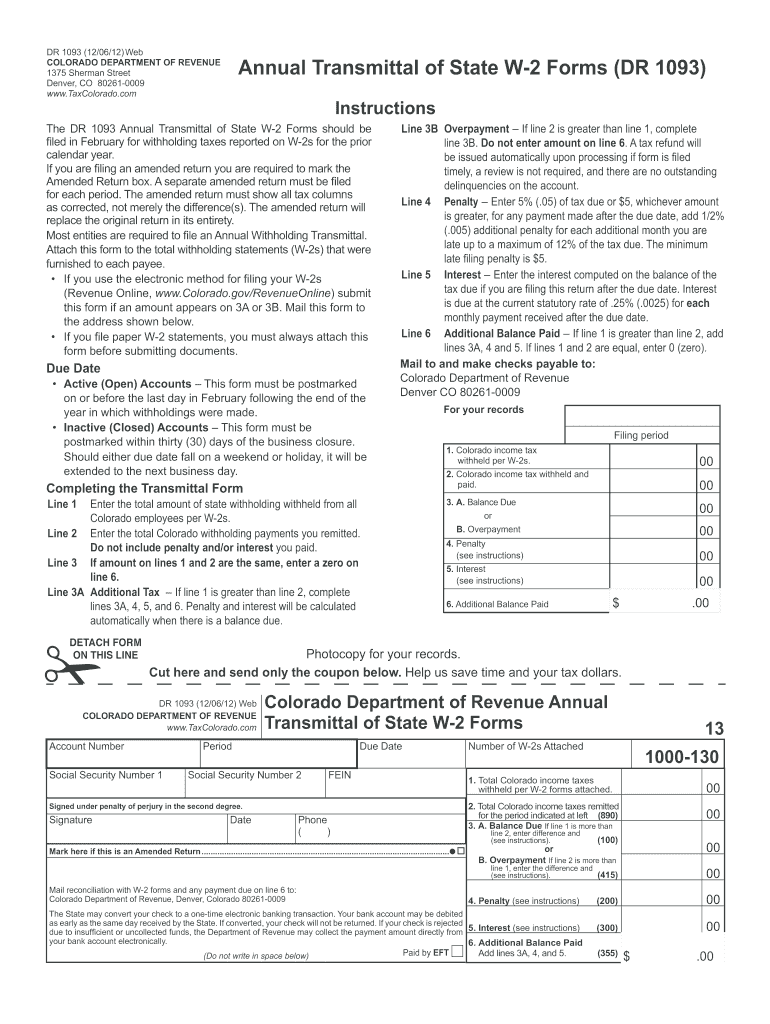

The state tax withholding form in Colorado, commonly referred to as the Colorado Form W-4, is a document that employees use to indicate their tax withholding preferences. This form allows employers to determine the correct amount of state income tax to withhold from an employee's paycheck. By accurately completing this form, employees can ensure that they are not over- or under-withheld during the tax year, which can help prevent unexpected tax liabilities or refunds when filing their state tax returns.

Steps to complete the state tax withholding form in Colorado

Completing the Colorado state tax withholding form involves several straightforward steps:

- Obtain the form: You can download the Colorado Form W-4 from the Colorado Department of Revenue website or request a copy from your employer.

- Fill in personal information: Enter your name, address, Social Security number, and filing status. Your filing status can be single, married, or head of household.

- Claim allowances: Determine the number of allowances you wish to claim. The more allowances you claim, the less tax will be withheld from your paycheck.

- Additional withholding: If you want additional amounts withheld from your paycheck, specify that amount in the designated section.

- Sign and date the form: Ensure that you sign and date the form to validate it before submitting it to your employer.

Legal use of the state tax withholding form in Colorado

The Colorado state tax withholding form is legally binding once it is completed and signed. It is crucial that the information provided is accurate and truthful, as submitting false information can lead to penalties. Employers are required to keep this form on file and use it to calculate the appropriate amount of state income tax withholding for each employee. The form must be updated whenever there are changes in your personal circumstances, such as marital status or the number of dependents.

Key elements of the state tax withholding form in Colorado

Several key elements are essential to understand when filling out the Colorado Form W-4:

- Personal Information: This includes your name, address, and Social Security number.

- Filing Status: Your filing status affects your tax rate and the number of allowances you can claim.

- Allowances: The number of allowances claimed can significantly impact your withholding amount.

- Additional Withholding: This section allows you to specify any extra amount you wish to have withheld from your paycheck.

Form submission methods for Colorado state tax withholding

Once you have completed the Colorado state tax withholding form, you can submit it to your employer through various methods:

- In-Person: Hand the completed form directly to your employer's HR or payroll department.

- Mail: If your employer allows it, you may be able to mail the form to the appropriate department.

- Digital Submission: Some employers may permit electronic submission of the form through secure online portals.

Quick guide on how to complete how to fill out a state tax withholding form colorado 2012

Complete How To Fill Out A State Tax Withholding Form Colorado effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents rapidly without any holdups. Manage How To Fill Out A State Tax Withholding Form Colorado on any device with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign How To Fill Out A State Tax Withholding Form Colorado with ease

- Find How To Fill Out A State Tax Withholding Form Colorado and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Modify and eSign How To Fill Out A State Tax Withholding Form Colorado and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill out a state tax withholding form colorado 2012

Create this form in 5 minutes!

How to create an eSignature for the how to fill out a state tax withholding form colorado 2012

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is the purpose of filling out a state tax withholding form in Colorado?

The state tax withholding form in Colorado is crucial for ensuring that the correct amount of state income tax is withheld from your paycheck. Accurately filling out this form helps prevent underpayment or overpayment of taxes, which can impact your financial situation. Understanding how to fill out a state tax withholding form Colorado can save you from surprises during tax season.

-

How can I easily fill out a state tax withholding form Colorado using airSlate SignNow?

Using airSlate SignNow, you can streamline the process of filling out a state tax withholding form Colorado. Our platform provides a user-friendly interface that simplifies document preparation and eSignatures, making your experience efficient and hassle-free. With our service, you can complete the form in minutes from any device.

-

What benefits does airSlate SignNow offer for filling out tax forms?

airSlate SignNow offers several benefits when filling out tax forms including the state tax withholding form Colorado. Users can enjoy secure eSigning, easy document sharing, and compliance with legal standards all in one platform. Additionally, our cost-effective solution makes it affordable for businesses of all sizes to manage their tax documents.

-

Are there any integrations available that can help with filling out the Colorado state tax withholding form?

Yes, airSlate SignNow integrates with various applications that can aid in filling out the Colorado state tax withholding form. These integrations allow for seamless data transfer between software systems, improving accuracy and saving time. By utilizing these tools, businesses can enhance their document processes.

-

What is the pricing structure for using airSlate SignNow for tax documents?

airSlate SignNow offers several pricing plans that cater to different business needs, ensuring that anyone looking to fill out a state tax withholding form in Colorado can find a suitable option. Pricing varies based on features and user count, making it cost-effective for individuals and large teams alike. You can choose a plan that best meets your requirements without overspending.

-

Can I save my filled-out state tax withholding form in Colorado for future use?

Absolutely! airSlate SignNow allows you to save your completed state tax withholding form Colorado securely within your account. This features provides easy access for future editing or reference, helping you manage your tax documents efficiently. You can retrieve your saved forms whenever you need them.

-

Is it safe to use airSlate SignNow for filling out sensitive tax forms?

Yes, using airSlate SignNow for filling out your state tax withholding form Colorado is secure. We implement advanced encryption and strict data protection measures to ensure your information remains confidential. You can confidently complete and eSign your tax documents knowing that your data is well-protected.

Get more for How To Fill Out A State Tax Withholding Form Colorado

- Water tank inspection checklist pdf 42323403 form

- Penn hills occupancy permit form

- Aig annuity forms

- Materials management plan template form

- Nh swim raft rules form

- Seafarer application form 466904620

- Application for renewal of part time appointment form

- Instructionsnotice of application form f31 use t

Find out other How To Fill Out A State Tax Withholding Form Colorado

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation