*DONOTSEND* COLORADO DEPARTMENT of REVENUE Tax Colorado 2020-2026

Understanding the Colorado Form DR 1093

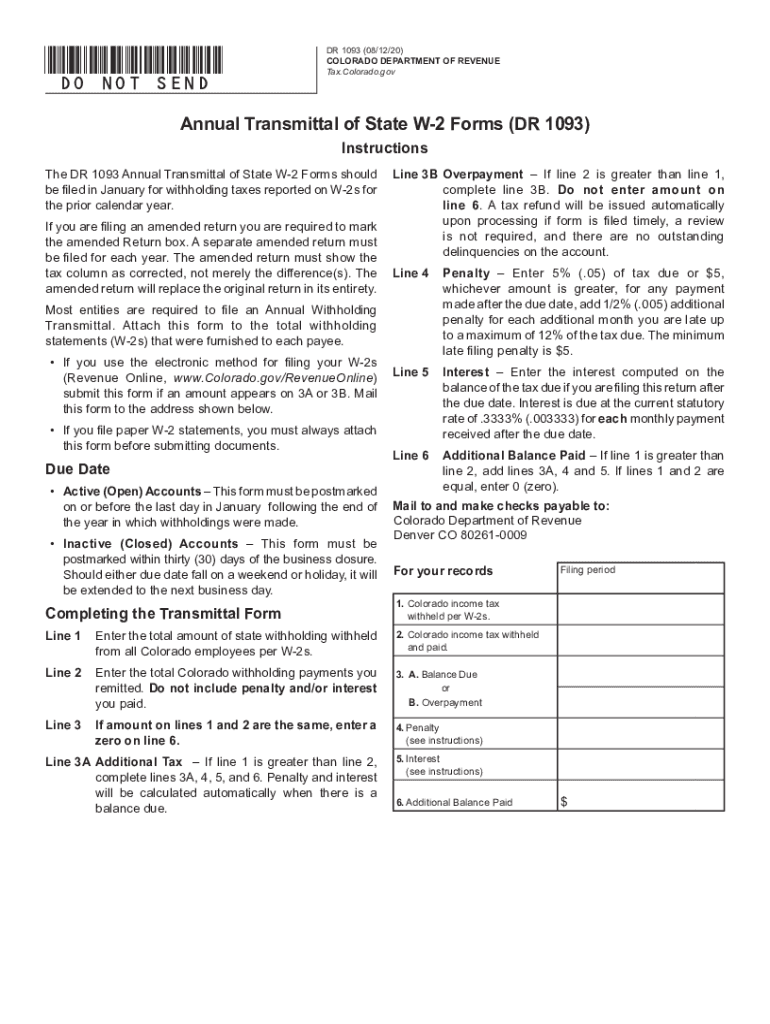

The Colorado Form DR 1093 is a crucial document used for reporting state withholding tax for employees. This form is essential for employers to accurately report the amount of state income tax withheld from employee wages. It is necessary for compliance with Colorado tax laws and helps ensure that the correct amount of tax is remitted to the state. The form must be completed accurately to avoid penalties and ensure that employees' tax records are correct.

Steps to Complete the Colorado Form DR 1093

Completing the Colorado Form DR 1093 involves several key steps:

- Gather necessary information, including employee details and withholding amounts.

- Fill out the form with accurate data, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the Colorado Department of Revenue by the specified deadline.

Following these steps carefully can help prevent issues with tax compliance and ensure timely processing.

Filing Deadlines for the Colorado Form DR 1093

It is important to be aware of the filing deadlines associated with the Colorado Form DR 1093. Typically, this form must be submitted annually, and the due date is usually aligned with the end of the tax year. Employers should mark their calendars to ensure they meet these deadlines to avoid penalties for late submission.

Legal Use of the Colorado Form DR 1093

The Colorado Form DR 1093 is legally binding when completed and submitted according to state regulations. It is essential for employers to understand the legal implications of this form, as inaccuracies can lead to legal issues and financial penalties. Ensuring compliance with state tax laws is crucial for maintaining good standing with the Colorado Department of Revenue.

Form Submission Methods for Colorado Form DR 1093

Employers have several options for submitting the Colorado Form DR 1093:

- Online Submission: Many employers prefer to submit forms electronically through the Colorado Department of Revenue's online portal.

- Mail: Forms can also be printed and mailed to the appropriate address provided by the Colorado Department of Revenue.

- In-Person: Some employers may choose to deliver the form in person at a local Department of Revenue office.

Choosing the right submission method can streamline the filing process and ensure timely delivery.

Key Elements of the Colorado Form DR 1093

When filling out the Colorado Form DR 1093, it is important to include key elements such as:

- Employer identification information, including name and address.

- Employee details, including Social Security numbers and withholding amounts.

- Signature of the person responsible for the accuracy of the information provided.

Ensuring these elements are included can help facilitate processing and compliance with state regulations.

Quick guide on how to complete donotsend colorado department of revenue taxcolorado

Manage *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado effortlessly on any device

Online document handling has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado without hassle

- Find *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado and then click Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Modify and eSign *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct donotsend colorado department of revenue taxcolorado

Create this form in 5 minutes!

How to create an eSignature for the donotsend colorado department of revenue taxcolorado

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is DR 1093 Colorado in relation to airSlate SignNow?

DR 1093 Colorado refers to a specific regulation that may require streamlined document management. With airSlate SignNow, users can efficiently eSign and send documents in compliance with such state regulations, ensuring smoother operations.

-

How does airSlate SignNow support compliance with DR 1093 Colorado?

airSlate SignNow offers features specifically designed to meet state regulations like DR 1093 Colorado. The platform provides secure, legally binding eSignatures and automated workflows that facilitate compliance with legal standards.

-

What are the pricing options for airSlate SignNow related to DR 1093 Colorado?

airSlate SignNow provides competitive pricing tiers that suit different business needs, whether you're aiming to comply with DR 1093 Colorado or simply streamline your document workflows. Pricing plans are designed to be budget-friendly, ensuring that all businesses can enhance their document management.

-

What features does airSlate SignNow offer to comply with DR 1093 Colorado?

airSlate SignNow includes several key features such as document templates, customizable workflows, and advanced security measures. These features are particularly useful for businesses needing to comply with DR 1093 Colorado regulations, providing both efficiency and security.

-

Can airSlate SignNow integrate with other tools for DR 1093 Colorado documentation?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow in relation to DR 1093 Colorado. Integration with tools like CRM systems and cloud storage allows users to manage documents effectively.

-

What are the benefits of using airSlate SignNow for DR 1093 Colorado?

By using airSlate SignNow for DR 1093 Colorado, businesses can improve operational efficiency through automated document processes. This results in faster turnaround times and reduced administrative burdens, allowing your team to focus on core business functions.

-

Is airSlate SignNow user-friendly for handling DR 1093 Colorado documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to navigate for all users, regardless of technical skill. This simplicity is especially beneficial for firms needing to comply with the requirements of DR 1093 Colorado.

Get more for *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado

- Torontosom form

- Texas womens health application pdf form

- Catholic profession of faith printable form

- Philmont participant information worksheet

- Worked examples to eurocode 2 volume 2 form

- Form approved o m b 2060 0095 united states environmental protection agency declaration form importation of motor vehicles and

- Hawaii form n 301

- Gad 7 scale general anxiety disorder 7 item form

Find out other *DONOTSEND* COLORADO DEPARTMENT OF REVENUE Tax Colorado

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF