Cr0100 Form 2020

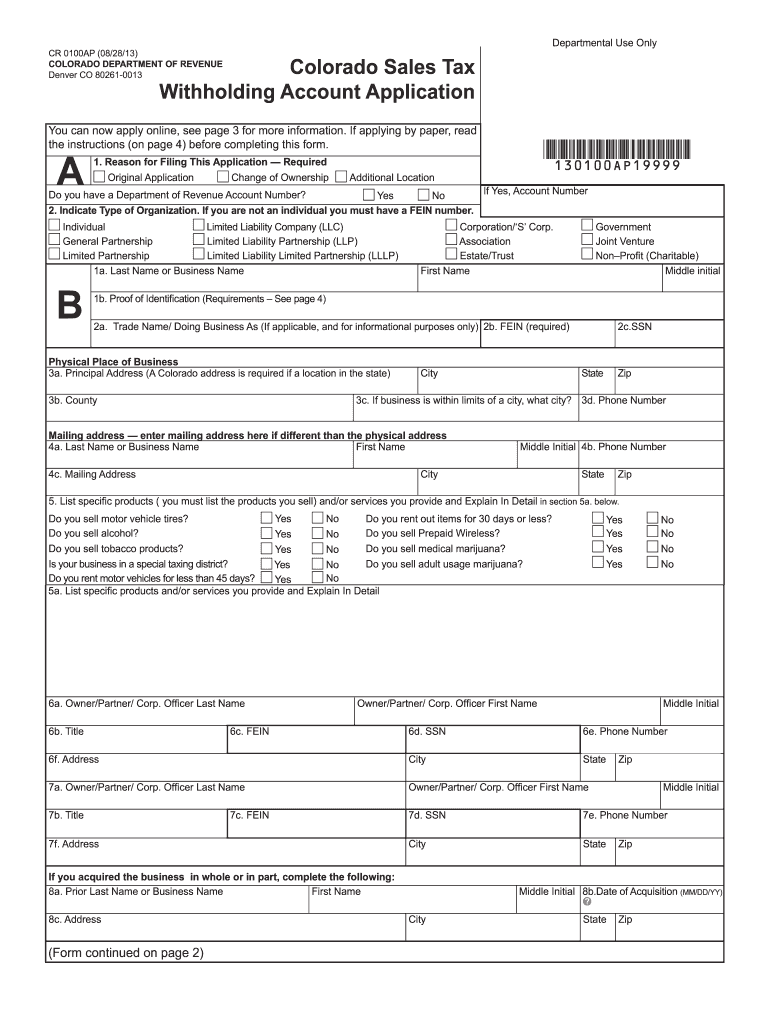

What is the Cr0100 Form

The Cr0100 Form is a tax-related document used primarily for reporting business income and expenses. It is essential for various business entities, including corporations and partnerships, to ensure compliance with federal tax regulations. This form helps the Internal Revenue Service (IRS) assess the financial performance of a business over a specific period. Understanding the purpose and requirements of the Cr0100 Form is crucial for any business owner looking to maintain accurate financial records and fulfill their tax obligations.

How to use the Cr0100 Form

Using the Cr0100 Form involves several key steps. First, gather all necessary financial information, including income statements, expense reports, and any relevant supporting documentation. Next, carefully fill out the form, ensuring that all entries are accurate and complete. It is important to follow the IRS guidelines for reporting income and deductions. After completing the form, review it for any errors before submitting it to the IRS. Proper use of the Cr0100 Form can help streamline the tax filing process and reduce the likelihood of audits.

Steps to complete the Cr0100 Form

Completing the Cr0100 Form requires attention to detail and adherence to specific guidelines. Here are the steps to follow:

- Gather financial records, including income and expense documentation.

- Enter business information, such as the business name, address, and tax identification number.

- Report total income earned during the tax year.

- List all deductible expenses, ensuring to categorize them correctly.

- Calculate the net income or loss by subtracting total expenses from total income.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Cr0100 Form

The legal use of the Cr0100 Form is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted on time. Failing to comply with these regulations can lead to penalties and interest charges. Additionally, businesses must retain copies of the form and any supporting documents for a specified period, as they may be required during audits or reviews by the IRS. Understanding the legal implications of the Cr0100 Form is essential for maintaining compliance and protecting your business interests.

Key elements of the Cr0100 Form

Several key elements are crucial for the proper completion of the Cr0100 Form. These include:

- Business Information: Accurate details about the business entity.

- Total Income: A comprehensive report of all income sources.

- Deductible Expenses: A breakdown of all eligible expenses that can reduce taxable income.

- Net Income Calculation: The final figure that reflects the business's financial performance.

Each of these elements plays a significant role in ensuring the form is completed correctly and complies with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Cr0100 Form are critical to avoid penalties. Generally, the form must be submitted by the 15th day of the fourth month following the end of the business's tax year. For businesses operating on a calendar year, this typically means the deadline is April 15. It is important to note that extensions may be available, but they must be filed correctly to avoid complications. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Quick guide on how to complete cr0100 2013 form

Effortlessly Complete Cr0100 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Cr0100 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Alter and Electronically Sign Cr0100 Form Without Hassle

- Obtain Cr0100 Form and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details using the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Edit and electronically sign Cr0100 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr0100 2013 form

Create this form in 5 minutes!

How to create an eSignature for the cr0100 2013 form

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Cr0100 Form?

The Cr0100 Form is a critical document used for various business transactions. This form helps streamline processes by providing necessary information in a standardized format. Understanding its purpose is essential for efficient document management.

-

How can airSlate SignNow assist with the Cr0100 Form?

airSlate SignNow allows users to easily upload, fill out, and eSign the Cr0100 Form online. Our platform simplifies the signing process, ensuring that you can complete transactions swiftly and securely. This feature enhances your workflow efficiency and keeps your business organized.

-

What are the pricing options for using airSlate SignNow for the Cr0100 Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes when using the Cr0100 Form. Whether you're a small business or a large enterprise, you can find a plan that suits your budget and needs. Sign up today to see how our competitive pricing can save you time and money.

-

Are there any integrations available for the Cr0100 Form within airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance the management of the Cr0100 Form. You can connect with tools like Google Drive, Dropbox, and others for easy access and storage. This connectivity ensures you can streamline your document workflows efficiently.

-

What benefits can I expect when using airSlate SignNow for the Cr0100 Form?

By using airSlate SignNow for the Cr0100 Form, you can enjoy benefits such as improved turnaround time and enhanced security for your signed documents. Our platform also offers customizable templates, making it easier for you to manage your paperwork. Overall, it simplifies document management for better productivity.

-

Is airSlate SignNow secure for handling the Cr0100 Form?

Absolutely! airSlate SignNow prioritizes security and ensures that your Cr0100 Form and other documents are protected with advanced encryption protocols. We comply with industry standards to safeguard your sensitive information, giving you peace of mind as you handle all your eSigning needs.

-

Can I easily send the Cr0100 Form to multiple recipients with airSlate SignNow?

Yes, airSlate SignNow makes it easy to send the Cr0100 Form to multiple recipients in just a few clicks. This feature allows for simultaneous signing, which accelerates the document approval process. You can manage your team’s workflows more effectively with such capabilities.

Get more for Cr0100 Form

- Alien addition maze fourth grade addition practice worksheet fourth grade addition practicewith a fun math maze form

- Torrid return address form

- Outcome rating scale ors vermont legislature form

- Formulaire de demande de prime reward request form

- Aoc 005 a fillable form

- Jesuit oath pdf form

- C104a p65 use form r85 to tell your bank or building society that you qualify for tax interest on your account

- Application for scheme retirement benefitsto be c form

Find out other Cr0100 Form

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document