CR 0100AP 061020 2020

What is the CR 0100AP?

The CR 0100AP is a Colorado application for withholding tax registration. This form is essential for businesses that need to register for a Colorado withholding account. It is used to report and remit state income tax withheld from employee wages and other payments. Completing this form correctly ensures compliance with Colorado tax laws and facilitates proper tax withholding for employees.

How to Use the CR 0100AP

Using the CR 0100AP involves several straightforward steps. First, ensure you have all necessary information, such as your business details and employee information. You can complete the form online or print it out for manual entry. After filling out the required fields, review the form for accuracy. Once confirmed, submit the form to the Colorado Department of Revenue to initiate your withholding account.

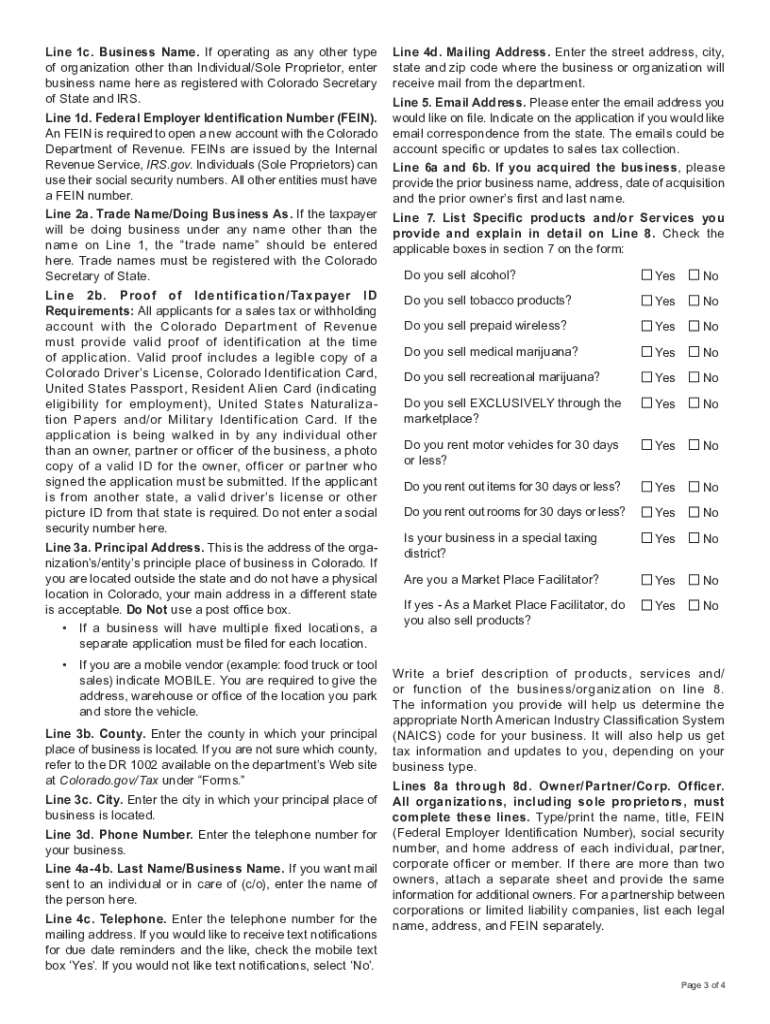

Steps to Complete the CR 0100AP

To complete the CR 0100AP, follow these steps:

- Gather necessary business information, including your Employer Identification Number (EIN).

- Access the CR 0100AP form through the Colorado Department of Revenue website.

- Fill in the required sections, including business name, address, and contact information.

- Provide details about your employees and the type of payments you will be making.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the appropriate state office.

Legal Use of the CR 0100AP

The CR 0100AP is legally binding once submitted and processed by the Colorado Department of Revenue. It complies with state regulations regarding tax withholding. Proper use of this form ensures that businesses meet their tax obligations and avoid penalties. It is crucial to maintain accurate records of submissions and any correspondence related to the form.

Key Elements of the CR 0100AP

Key elements of the CR 0100AP include:

- Business Information: Name, address, and EIN.

- Type of Business: Indicate the nature of your business entity.

- Employee Information: Details about employees for whom tax will be withheld.

- Signature: Authorized signature of the business owner or representative.

Required Documents

When completing the CR 0100AP, you may need to provide supporting documents. These can include:

- Your Employer Identification Number (EIN) confirmation.

- Business registration documents.

- Any previous tax filings related to withholding.

Quick guide on how to complete cr 0100ap 061020

Complete CR 0100AP 061020 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your documents quickly and without delays. Handle CR 0100AP 061020 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign CR 0100AP 061020 without effort

- Find CR 0100AP 061020 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools airSlate SignNow specifically offers for such tasks.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal significance as a traditional handwriting signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or save it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Alter and eSign CR 0100AP 061020 while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr 0100ap 061020

Create this form in 5 minutes!

How to create an eSignature for the cr 0100ap 061020

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is cr0100ap and how does it relate to airSlate SignNow?

The cr0100ap is a unique identifier for specific features within airSlate SignNow that enhance document signing processes. By understanding cr0100ap, users can better leverage the platform's capabilities to maximize their eSignature workflows.

-

How does airSlate SignNow pricing work, specifically for cr0100ap features?

AirSlate SignNow offers flexible pricing plans that include access to advanced cr0100ap features. These plans are designed to suit businesses of all sizes, ensuring that you can use key functionalities without overspending.

-

What are the key features of airSlate SignNow related to cr0100ap?

AirSlate SignNow encompasses a range of features leveraging the cr0100ap functionality, such as customizable templates and automated workflows. These features streamline document management and are integral for increasing operational efficiency.

-

What benefits can businesses expect from using cr0100ap with airSlate SignNow?

By utilizing airSlate SignNow’s cr0100ap features, businesses can experience reduced turnaround times for document approvals. This translates into greater efficiency and improved customer satisfaction, which are vital for maintaining a competitive edge.

-

Can cr0100ap features be integrated with other software?

Absolutely! AirSlate SignNow's cr0100ap functionality supports integrations with various applications, enhancing your document management ecosystem. These integrations allow for seamless workflows and data exchange, ensuring a cohesive user experience.

-

Is airSlate SignNow compliant with eSignature regulations when using cr0100ap?

Yes, airSlate SignNow, including its cr0100ap features, complies with essential eSignature regulations such as ESIGN and UETA. This compliance guarantees that your electronic signatures are legally binding and secure.

-

How can I get support for using cr0100ap features in airSlate SignNow?

AirSlate SignNow provides comprehensive support for all users, including those interested in cr0100ap features. You can access tutorials, knowledge bases, and customer support channels to resolve any queries or issues promptly.

Get more for CR 0100AP 061020

- Waiver and release from liability for adult for scout function form

- Waiver and release from liability for adult for lodge membership form

- Waiver liability land 497427244 form

- Waiver and release from liability for adult for intramural sports form

- Release minor child 497427246 form

- Waiver and release from liability for adult for aerobic sports form

- Waiver release liability 497427248 form

- Waiver liability track form

Find out other CR 0100AP 061020

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter