Instructions for the Colorado Business Registration Form CR 2020-2026

Instructions for the Colorado Tax Application

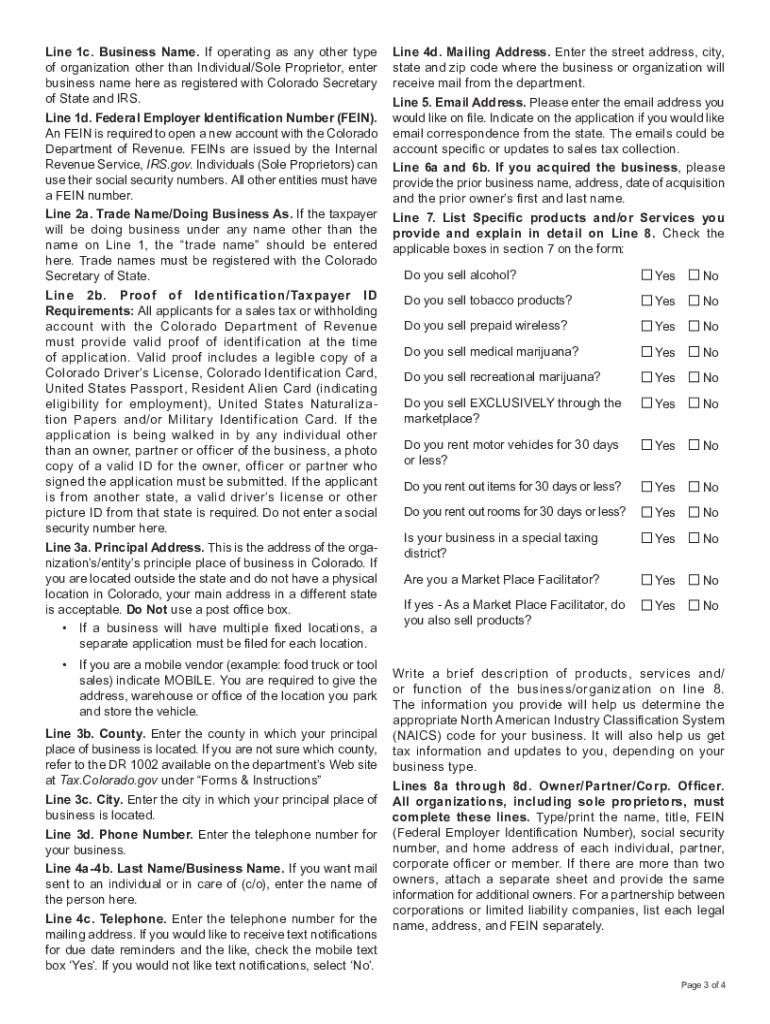

The Colorado tax application, often referred to as the CR-0100AP, is essential for businesses seeking to register for a Colorado sales tax account. Understanding the instructions is crucial for ensuring that all required information is accurately provided. Key elements include the business name, address, type of business entity, and the nature of sales conducted. Each section must be completed thoroughly to prevent delays in application processing.

Steps to Complete the Colorado Tax Application

Completing the Colorado tax application involves several steps:

- Gather necessary information about your business, including the legal structure and ownership details.

- Fill out the CR-0100AP form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the application either online or by mail, depending on your preference.

Following these steps will help streamline the registration process and ensure compliance with state regulations.

Required Documents for the Colorado Tax Application

When applying for a Colorado sales tax account, certain documents are required to support your application. These may include:

- A valid form of identification, such as a driver's license or state ID.

- Business formation documents, if applicable, such as Articles of Incorporation or a partnership agreement.

- Proof of business location, like a lease agreement or utility bill.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods for the Colorado Tax Application

The Colorado tax application can be submitted through various methods, making it accessible for all business owners:

- Online Submission: The application can be filled out and submitted electronically through the Colorado Department of Revenue website.

- Mail Submission: Completed forms can also be printed and mailed to the appropriate address provided in the instructions.

- In-Person Submission: For those who prefer direct interaction, applications can be submitted at local Colorado Department of Revenue offices.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Eligibility Criteria for the Colorado Tax Application

To successfully apply for a Colorado sales tax account, certain eligibility criteria must be met. These include:

- The applicant must be conducting business activities within Colorado.

- Businesses must have a physical presence or nexus in the state.

- The applicant must provide accurate and complete information on the application form.

Ensuring that you meet these criteria will help in avoiding complications during the application process.

Quick guide on how to complete instructions for the colorado business registration form cr

Complete Instructions For The Colorado Business Registration Form CR seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Instructions For The Colorado Business Registration Form CR on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Instructions For The Colorado Business Registration Form CR effortlessly

- Find Instructions For The Colorado Business Registration Form CR and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Modify and eSign Instructions For The Colorado Business Registration Form CR and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for the colorado business registration form cr

Create this form in 5 minutes!

How to create an eSignature for the instructions for the colorado business registration form cr

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the colorado tax application feature in airSlate SignNow?

The colorado tax application feature in airSlate SignNow allows users to securely manage and electronically sign tax-related documents. This feature streamlines the submission process for various tax forms and enhances compliance by ensuring all necessary signatures are obtained efficiently.

-

How can I use airSlate SignNow for my colorado tax application needs?

You can utilize airSlate SignNow for your colorado tax application by creating templates for frequently used forms. With its intuitive interface, you can easily send documents for eSignatures and track their status, ensuring your tax submissions are timely and accurate.

-

What are the pricing options for airSlate SignNow's colorado tax application services?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Each plan includes features to facilitate your colorado tax application process, with options for additional functionalities aimed at larger organizations.

-

Is airSlate SignNow compliant with Colorado tax regulations?

Yes, airSlate SignNow is designed to be compliant with relevant Colorado tax regulations. By utilizing industry-standard security measures and legal compliance practices, the platform ensures that your colorado tax application processes are reliable and secure.

-

What benefits does airSlate SignNow provide for colorado tax applications?

One of the key benefits of using airSlate SignNow for colorado tax applications is the signNow reduction in paperwork and time spent on filing. The platform's automation capabilities ensure that you can eSign and store documents electronically, making tax management more efficient.

-

Can I integrate airSlate SignNow with other software for my colorado tax application workflow?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, enhancing your colorado tax application workflow. You can connect it with accounting and CRM systems, improving data flow and process efficiency.

-

How does airSlate SignNow ensure the security of my colorado tax application data?

airSlate SignNow employs top-tier security protocols, including encryption and secure cloud storage, to protect your data. This commitment to security ensures that your sensitive information related to colorado tax applications remains safe from unauthorized access.

Get more for Instructions For The Colorado Business Registration Form CR

- Small estate administration package for estates under 40000 district of columbia form

- Dc eviction form

- Dc family court form

- District of columbia adoption form

- Final decree adoption 497301732 form

- Final decree adoption 497301733 form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497301734 form

- District of columbia annual form

Find out other Instructions For The Colorado Business Registration Form CR

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document