Form Ct 588 2019-2026

What is the Form Ct 588

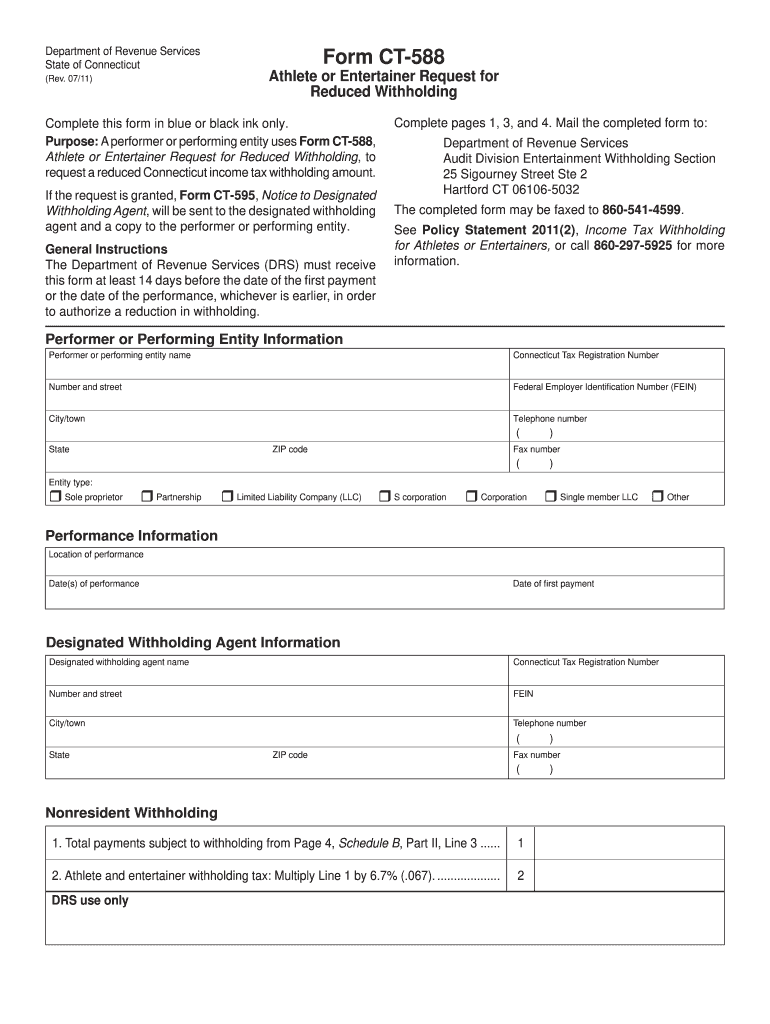

The Form Ct 588 is a tax-related document used primarily in the state of Connecticut. It serves as a certification for non-resident taxpayers who are claiming a tax exemption or reduction based on their income sourced from Connecticut. This form is essential for ensuring compliance with state tax laws and provides necessary information to the Connecticut Department of Revenue Services.

How to use the Form Ct 588

Using the Form Ct 588 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all relevant financial documents, including income statements and any applicable tax forms. Once the form is filled out, it should be reviewed for accuracy before submission. It is crucial to follow the specific instructions provided by the Connecticut Department of Revenue Services to avoid delays or issues with processing.

Steps to complete the Form Ct 588

Completing the Form Ct 588 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including W-2s or 1099s.

- Fill out the personal information section, including name, address, and Social Security number.

- Provide details about your income earned in Connecticut.

- Indicate the reason for claiming the exemption or reduction.

- Review the form for any errors or omissions.

- Submit the completed form to the Connecticut Department of Revenue Services by the specified deadline.

Legal use of the Form Ct 588

The Form Ct 588 is legally binding when filled out correctly and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful to avoid potential legal repercussions. The form must be signed and dated by the taxpayer, affirming the validity of the claims made within the document.

Key elements of the Form Ct 588

Key elements of the Form Ct 588 include:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Income Details: Breakdown of income earned in Connecticut.

- Exemption Reason: Justification for claiming a tax exemption or reduction.

- Signature: The taxpayer's signature, affirming the accuracy of the information provided.

Form Submission Methods

The Form Ct 588 can be submitted through various methods, including:

- Online: Via the Connecticut Department of Revenue Services website.

- Mail: Sending a physical copy to the appropriate address provided by the department.

- In-Person: Delivering the form directly to the local tax office.

Quick guide on how to complete form ct 588 2011

Manage Form Ct 588 with ease on any device

Web-based document handling has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents since you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Handle Form Ct 588 on any operating system with airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

How to modify and eSign Form Ct 588 effortlessly

- Obtain Form Ct 588 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Ct 588 and guarantee outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 588 2011

Create this form in 5 minutes!

How to create an eSignature for the form ct 588 2011

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form Ct 588?

Form Ct 588 is an essential tax form used in Connecticut for reporting and paying certain taxes. It is vital for businesses to understand the requirements of Form Ct 588 to ensure compliance with state regulations.

-

How can airSlate SignNow help with Form Ct 588?

AirSlate SignNow allows users to digitally sign and send Form Ct 588 quickly and securely. This feature streamlines the filing process, ensuring that the form is completed accurately and submitted on time.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers several pricing plans to suit different business needs. Users can choose from monthly or annual subscriptions, all of which include access to eSigning capabilities for forms like Form Ct 588.

-

Are there any integrations available for Form Ct 588 with airSlate SignNow?

Yes, airSlate SignNow provides integrations with various third-party applications, making it easier to manage and send Form Ct 588. These integrations help streamline workflows and reduce manual entry errors.

-

What features does airSlate SignNow offer for managing Form Ct 588?

AirSlate SignNow offers features like template creation, automated workflows, and audit trails specifically for managing Form Ct 588. These features enhance productivity and ensure that every eSigning session is secure and compliant.

-

Is it safe to use airSlate SignNow for eSigning Form Ct 588?

Absolutely! AirSlate SignNow employs advanced security protocols to safeguard sensitive information, ensuring that eSigning Form Ct 588 is secure and compliant with regulatory standards.

-

Can I track the status of my Form Ct 588 submissions with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their Form Ct 588 submissions in real time. This feature ensures that you can stay informed about when the form is sent, opened, and signed.

Get more for Form Ct 588

Find out other Form Ct 588

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple