Form CT W3 CT Gov Home 2020

What is the Form CT W3 CT gov Home

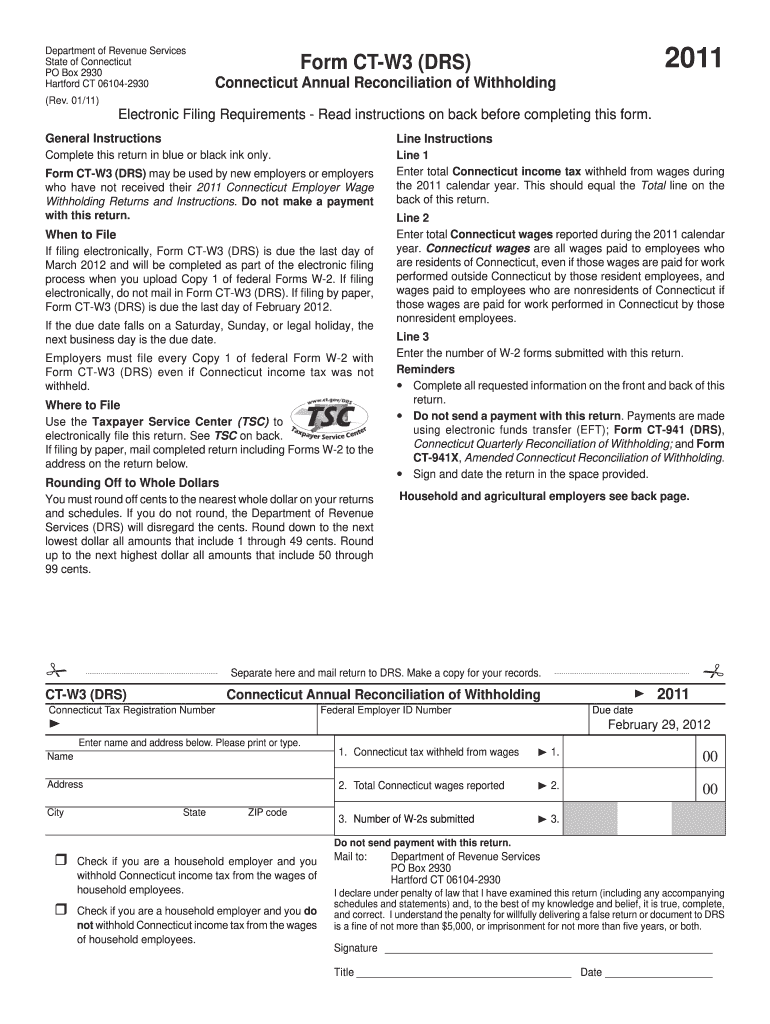

The Form CT W3 is a crucial document used by employers in Connecticut to report the total wages paid to employees and the total amount of Connecticut income tax withheld during a calendar year. This form is submitted to the Connecticut Department of Revenue Services and is essential for ensuring compliance with state tax regulations. It serves as a summary of the individual W-2 forms issued by employers to their employees, consolidating the information for state tax purposes.

How to use the Form CT W3 CT gov Home

To effectively use the Form CT W3, employers must first gather all necessary data from their employees' W-2 forms. This includes total wages, tips, and other compensation, as well as the total amount of Connecticut income tax withheld. Once this information is compiled, it can be entered into the appropriate fields on the form. Employers are required to file this form annually, typically by the end of January, to ensure timely reporting to the state.

Steps to complete the Form CT W3 CT gov Home

Completing the Form CT W3 involves several key steps:

- Collect all W-2 forms issued to employees for the tax year.

- Calculate the total wages, tips, and other compensation reported on these forms.

- Determine the total amount of Connecticut income tax withheld from employees.

- Fill out the Form CT W3 with the compiled totals.

- Review the form for accuracy before submission.

- Submit the completed form to the Connecticut Department of Revenue Services by the deadline.

Legal use of the Form CT W3 CT gov Home

The legal use of the Form CT W3 is governed by Connecticut state tax laws. Employers must ensure that the information reported is accurate and complete, as discrepancies can lead to penalties or audits. The form must be filed annually, and failure to do so can result in fines. It is important for employers to maintain records of submitted forms and any related documentation for future reference.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form CT W3. The form is typically due by January thirty-first of the year following the tax year being reported. Employers should also be aware of any changes to deadlines that may occur due to state regulations or updates from the Connecticut Department of Revenue Services. Keeping track of these dates is essential for maintaining compliance and avoiding penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form CT W3 can be submitted through various methods to accommodate different employer preferences. Employers can file the form online through the Connecticut Department of Revenue Services website, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate address provided by the state or submitted in person at designated locations. Each method has its own requirements and processing times, so employers should choose the one that best fits their needs.

Quick guide on how to complete form ct w3 ctgov home

Easily Prepare Form CT W3 CT gov Home on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers a perfect eco-friendly option to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Form CT W3 CT gov Home across any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

Steps to Edit and Electronically Sign Form CT W3 CT gov Home Effortlessly

- Find Form CT W3 CT gov Home and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of sending your form—through email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form CT W3 CT gov Home to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct w3 ctgov home

Create this form in 5 minutes!

How to create an eSignature for the form ct w3 ctgov home

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is Form CT W3 that I can submit through CT gov Home?

Form CT W3 is the reconciliation of employee wages and withholding filed by employers in Connecticut. By using CT gov Home, businesses can easily access and submit Form CT W3 online, ensuring compliance and accuracy in reporting. airSlate SignNow simplifies this process with its eSignature capabilities, making document submission straightforward.

-

How does airSlate SignNow integrate with Form CT W3 on CT gov Home?

airSlate SignNow offers seamless integration with CT gov Home, allowing users to access and eSign Form CT W3 directly. This integration streamlines the process, minimizing manual entry and enhancing efficiency. By choosing airSlate SignNow, businesses can ensure timely submissions and reduce the risk of errors.

-

What are the benefits of using airSlate SignNow for submitting Form CT W3?

Using airSlate SignNow to submit Form CT W3 provides numerous benefits, such as improved efficiency, reduced turnaround times, and increased accuracy. The platform's user-friendly interface makes it easy to prepare and eSign documents quickly. Additionally, you can track submissions and receive real-time notifications for enhanced document management.

-

Is there a cost associated with using airSlate SignNow for Form CT W3 submissions?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. These plans allow users to access powerful features to eSign Form CT W3 and other essential documents without breaking the bank. Investing in airSlate SignNow enhances your document workflow while being budget-friendly.

-

Can I use airSlate SignNow on mobile devices for Form CT W3?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to eSign Form CT W3 directly from their smartphones or tablets. This flexibility provides businesses with the capability to manage their document submissions on-the-go, ensuring convenience and efficiency in the filing process.

-

What features does airSlate SignNow offer for managing Form CT W3 documents?

airSlate SignNow provides a variety of features for managing your Form CT W3 documents, including template creation, secure storage, and automated reminders. These features streamline document workflows, making it easier to gather signatures and submit forms on CT gov Home. Additionally, the platform offers custom branding options to maintain your business's professional image.

-

How secure is the submission of Form CT W3 with airSlate SignNow?

Security is a top priority for airSlate SignNow when submitting critical documents like Form CT W3. The platform uses advanced encryption protocols to ensure that your data remains secure throughout the eSigning process. This commitment to security means you can confidently manage sensitive documents and comply with industry regulations.

Get more for Form CT W3 CT gov Home

- Irp schedule c form

- Spray diary template nz form

- Pr application form 4a sample

- Word format for hamad bin khalifa reccomendation letter

- Background screeners of america disclosure and release form

- Student registration form on line to success queen39s

- Completion of community involvement activities form

- Rt workplace investigation workshops registration form vancouver p 1

Find out other Form CT W3 CT gov Home

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document