for DEPARTMENT USE ONLY Form CT 8508 2021

Understanding the Connecticut W-3 Form

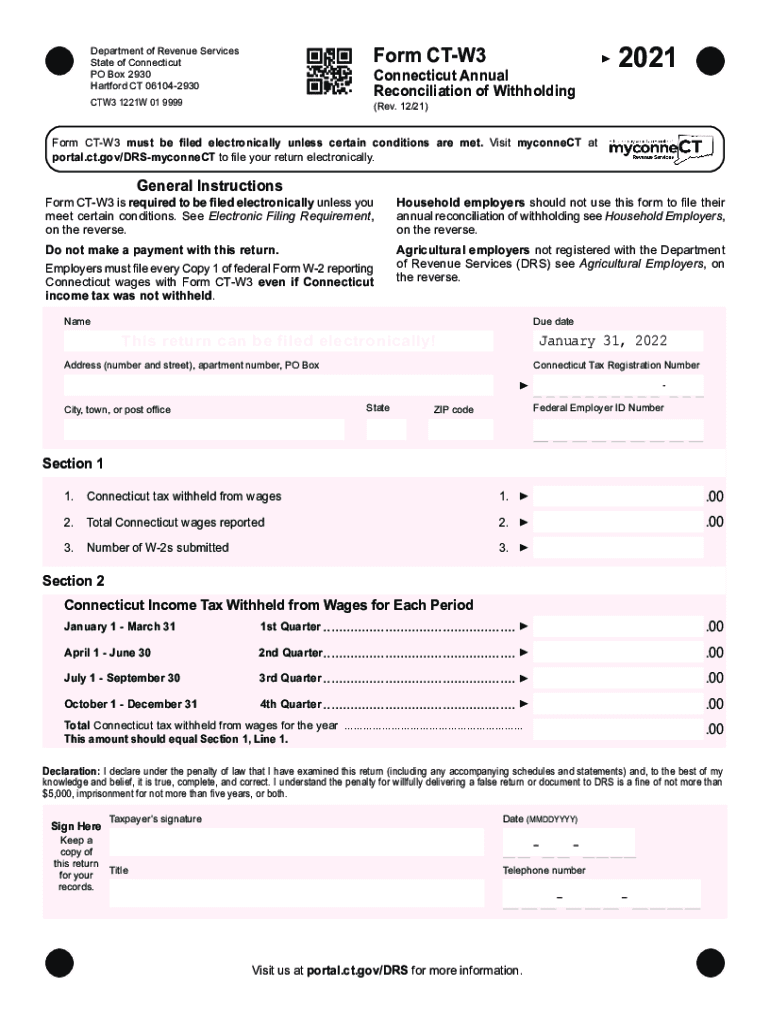

The Connecticut W-3 form, also known as the CT W-3, is a critical document for employers in Connecticut. It serves as a reconciliation of the state income tax withheld from employee wages throughout the year. This form is submitted to the Connecticut Department of Revenue Services (DRS) and provides a summary of all W-2 forms issued by an employer. It ensures that the correct amount of state income tax has been withheld and reported, which is essential for both compliance and accurate tax reporting.

Steps to Complete the Connecticut W-3 Form

Completing the Connecticut W-3 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather Employee Information: Collect all W-2 forms issued to employees for the tax year.

- Fill in Employer Details: Input your business name, address, and Employer Identification Number (EIN) at the top of the form.

- Report Total Wages: Calculate the total wages paid to employees and the total amount of state tax withheld.

- Verify Information: Double-check all entries for accuracy to avoid discrepancies.

- Sign and Date: Ensure the form is signed and dated by an authorized representative of the business.

Filing Deadlines for the Connecticut W-3 Form

The Connecticut W-3 form must be filed by the last day of February following the end of the tax year. For example, for the tax year ending December 31, the form is due by February 28 of the following year. It is crucial to adhere to this deadline to avoid penalties and ensure compliance with state tax regulations.

Submission Methods for the Connecticut W-3 Form

Employers have several options for submitting the Connecticut W-3 form:

- Online Submission: Employers can submit the form electronically through the Connecticut DRS website, which is often the fastest and most efficient method.

- Mail Submission: The form can also be printed and mailed to the Connecticut Department of Revenue Services. Ensure that it is sent to the correct address to avoid delays.

- In-Person Submission: Employers may choose to deliver the form in person at a local DRS office, which can be useful for obtaining immediate confirmation of receipt.

Legal Use of the Connecticut W-3 Form

The Connecticut W-3 form is legally required for employers who withhold state income tax from employee wages. It serves as a formal declaration of the total taxes withheld and is used by the state to ensure compliance with tax laws. Failure to file the W-3 form can result in penalties, including fines and interest on unpaid taxes.

Key Elements of the Connecticut W-3 Form

When completing the Connecticut W-3 form, several key elements must be included:

- Employer Information: Name, address, and EIN.

- Total Wages Paid: The total amount of wages paid to all employees during the tax year.

- Total Connecticut Tax Withheld: The total amount of state income tax withheld from employee wages.

- Signature: An authorized representative of the business must sign the form.

Quick guide on how to complete for department use only form ct 8508

Complete FOR DEPARTMENT USE ONLY Form CT 8508 effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers a great eco-friendly substitute to conventional printed and signed forms, allowing you to locate the right document and securely save it online. airSlate SignNow supplies you with all the tools you need to create, modify, and electronically sign your documents quickly and without complications. Manage FOR DEPARTMENT USE ONLY Form CT 8508 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

Effortlessly edit and electronically sign FOR DEPARTMENT USE ONLY Form CT 8508

- Locate FOR DEPARTMENT USE ONLY Form CT 8508 and click Obtain Form to initiate the process.

- Use the tools provided to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and hit the Finished button to save your modifications.

- Choose your preferred method of sending your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Alter and electronically sign FOR DEPARTMENT USE ONLY Form CT 8508 and enable remarkable communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for department use only form ct 8508

Create this form in 5 minutes!

How to create an eSignature for the for department use only form ct 8508

The way to create an e-signature for your PDF file in the online mode

The way to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What is ct w3 and how does it relate to airSlate SignNow?

CT W3 refers to the compliance and technical specifications necessary for seamless electronic signing processes. airSlate SignNow adheres to ct w3 standards to ensure that your documents are legally binding and meet all regulatory requirements.

-

How much does airSlate SignNow cost for ct w3 compliant solutions?

airSlate SignNow offers a range of pricing plans that are affordable and cater to all business sizes. Each plan ensures that your electronic signing capabilities comply with ct w3 requirements, providing you with a cost-effective solution.

-

What features does airSlate SignNow offer related to ct w3 compliance?

The features of airSlate SignNow include secure electronic signatures, document tracking, and audit trails, all designed to meet ct w3 compliance. These features ensure that your signed documents are valid and protected, allowing for a smooth signing process.

-

Can I integrate airSlate SignNow with other tools while ensuring ct w3 compliance?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms, such as CRM systems and project management software, without compromising ct w3 compliance. This allows you to enhance your workflow while ensuring all signatures remain valid.

-

What benefits does airSlate SignNow provide for businesses needing ct w3?

airSlate SignNow offers businesses several benefits related to ct w3 compliance, including improved efficiency, reduced turnaround times for document signing, and enhanced security for sensitive information. These advantages contribute to a smoother operational workflow.

-

Is airSlate SignNow suitable for small businesses needing ct w3 compliance?

Absolutely! airSlate SignNow provides a user-friendly interface and cost-effective solutions that are ideal for small businesses looking for ct w3 compliance. Our platform helps small businesses streamline their document signing processes effortlessly.

-

How does airSlate SignNow ensure secure storage of documents in alignment with ct w3?

airSlate SignNow employs advanced encryption methods and secure cloud storage solutions that align with ct w3 compliance standards. This ensures that all signed documents are stored safely and securely, preventing unauthorized access or data bsignNowes.

Get more for FOR DEPARTMENT USE ONLY Form CT 8508

- Notice to lessor exercising option to purchase delaware form

- Assignment of lease and rent from borrower to lender delaware form

- Assignment of lease from lessor with notice of assignment delaware form

- Letter from landlord to tenant as notice of abandoned personal property delaware form

- Guaranty or guarantee of payment of rent delaware form

- Letter from landlord to tenant as notice of default on commercial lease delaware form

- Residential or rental lease extension agreement delaware form

- Commercial rental lease application questionnaire delaware form

Find out other FOR DEPARTMENT USE ONLY Form CT 8508

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile