Connecticut State Tax InformationSupport 2020

What is the Connecticut State Tax Information Support?

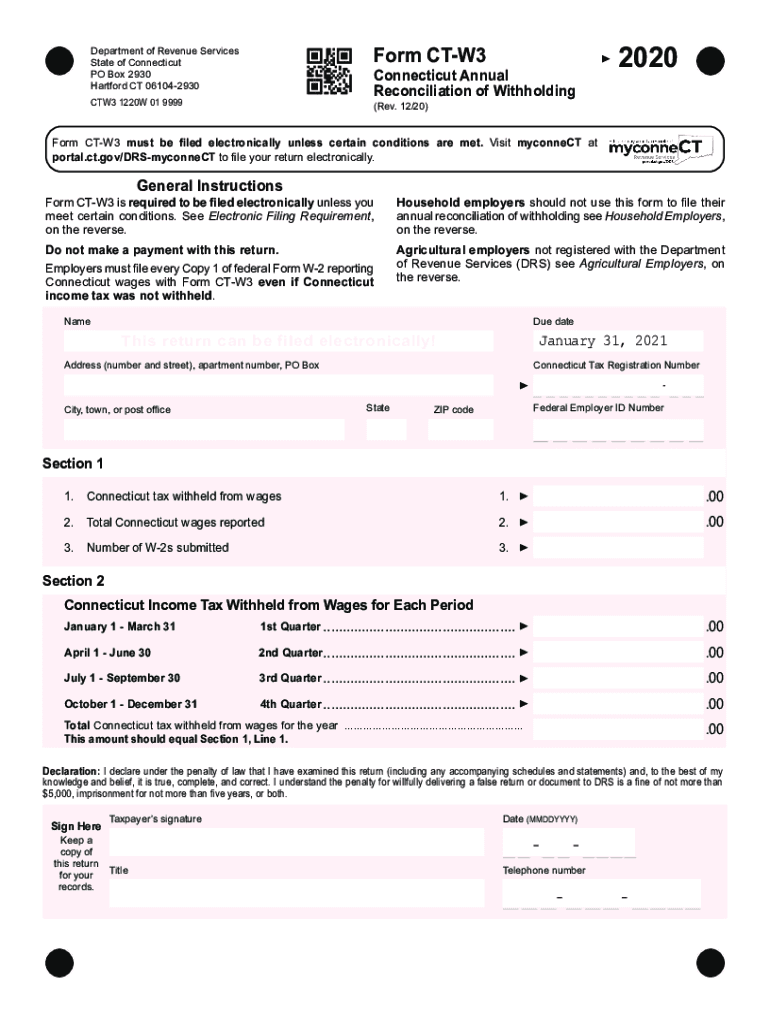

The Connecticut State Tax Information Support is a resource designed to assist taxpayers in understanding their obligations and rights regarding state taxes. This support system provides essential information about various forms, including the state of CT W-3, which is a crucial document for reporting withholding tax information. It helps taxpayers navigate the complexities of state tax regulations and ensures they are compliant with the law.

Steps to Complete the Connecticut State Tax Information Support

Completing the Connecticut State Tax Information Support involves several key steps. First, gather all necessary documents, including your income statements and any previous tax returns. Next, access the appropriate forms, such as the CT W-3, either online or through a physical copy. Carefully fill out the forms, ensuring all information is accurate and complete. Finally, submit the forms through the designated method, whether online, by mail, or in person, while keeping a copy for your records.

Legal Use of the Connecticut State Tax Information Support

The legal use of the Connecticut State Tax Information Support is essential for ensuring compliance with state tax laws. This resource provides guidance on how to properly fill out forms, such as the CT W-3, and outlines the legal implications of submitting incorrect or incomplete information. Taxpayers are encouraged to utilize this support to avoid penalties and ensure their tax filings are valid and recognized by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut State Tax Information Support, including the CT W-3, are critical for compliance. Typically, the state requires that forms be submitted by specific dates, often aligned with federal tax deadlines. It is important for taxpayers to be aware of these dates to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Required Documents

To effectively utilize the Connecticut State Tax Information Support, certain documents are required. These include income statements, previous tax returns, and any relevant forms such as the CT W-3. Having these documents organized and readily available will facilitate the completion of tax forms and ensure that all necessary information is provided for accurate reporting.

Penalties for Non-Compliance

Non-compliance with the Connecticut State Tax Information Support can result in significant penalties. Taxpayers who fail to submit required forms, such as the CT W-3, or who provide inaccurate information may face fines, interest on unpaid taxes, and other legal repercussions. Understanding these penalties underscores the importance of adhering to state tax regulations and utilizing available resources for assistance.

Examples of Using the Connecticut State Tax Information Support

Examples of utilizing the Connecticut State Tax Information Support include scenarios where individuals need to report their withholding tax accurately. For instance, an employee who receives a W-2 form from their employer can refer to the CT W-3 to ensure that their withholding information is correctly reported to the state. Additionally, small business owners can use this support to understand their tax obligations when filing for their employees.

Quick guide on how to complete connecticut state tax informationsupport

Effortlessly Prepare Connecticut State Tax InformationSupport on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the needed forms and securely keep them online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Connecticut State Tax InformationSupport on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

The Easiest Method to Modify and Electronically Sign Connecticut State Tax InformationSupport with Ease

- Obtain Connecticut State Tax InformationSupport and click on Get Form to begin.

- Use the tools available to complete your document.

- Select important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to store your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Connecticut State Tax InformationSupport and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut state tax informationsupport

Create this form in 5 minutes!

How to create an eSignature for the connecticut state tax informationsupport

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the state of ct w3 form used for?

The state of ct w3 form is a crucial document that summarizes your business's wage and tax information. It assists businesses in reporting employee earnings to the Connecticut Department of Revenue Services. Using airSlate SignNow to eSign and send this form can simplify the entire process signNowly.

-

How can airSlate SignNow help with the state of ct w3 process?

airSlate SignNow streamlines the completion and submission of the state of ct w3 form through its intuitive platform. With our eSignature solution, you can easily sign and send your completed forms online, saving you time and ensuring compliance with state regulations. This makes your workflow much more efficient.

-

Is there a cost associated with using airSlate SignNow for the state of ct w3?

Yes, airSlate SignNow offers different pricing plans suitable for various business sizes that include features for managing documents like the state of ct w3. Our plans are cost-effective, ensuring you have access to powerful eSigning tools without breaking your budget. Contact us for a detailed overview of the pricing options available.

-

What features does airSlate SignNow offer for handling state of ct w3 documents?

airSlate SignNow includes features like template creation, bulk sending, and real-time tracking for your state of ct w3 documents. These tools help you manage your documents efficiently and ensure that every form is promptly signed. This ultimately leads to better organization and reduced processing times.

-

Can I integrate airSlate SignNow with other software for my state of ct w3 needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting software and CRMs, to enhance your state of ct w3 management. This integration allows you to automatically populate forms and maintain consistency across your documentation processes.

-

What are the benefits of using airSlate SignNow for the state of ct w3?

Utilizing airSlate SignNow for the state of ct w3 form offers multiple benefits, including improved efficiency and enhanced document security. You can complete the signing process from anywhere, making it an ideal solution for remote and distributed teams. This helps save time and reduces paper-related clutter.

-

Is it secure to use airSlate SignNow for state of ct w3 forms?

Yes, airSlate SignNow employs advanced security protocols to protect your data, including for sensitive documents like the state of ct w3. Our platform ensures compliance with legal standards, so you can trust that your documents are safe and securely handled throughout the signing process.

Get more for Connecticut State Tax InformationSupport

- Nwcg general message form

- Forms sc egov usda

- Cdph interfacility infection control transfer form

- Difiazgovcontentform soonbdrr surprise outform soonbdrr surprise out of network billing dispute

- Form please read all information carefully fff enterprises

- Badging flychicago form

- Fillable online outline of coverage correction florida form

- Distribution of form appeals to courtsmichigangov

Find out other Connecticut State Tax InformationSupport

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast