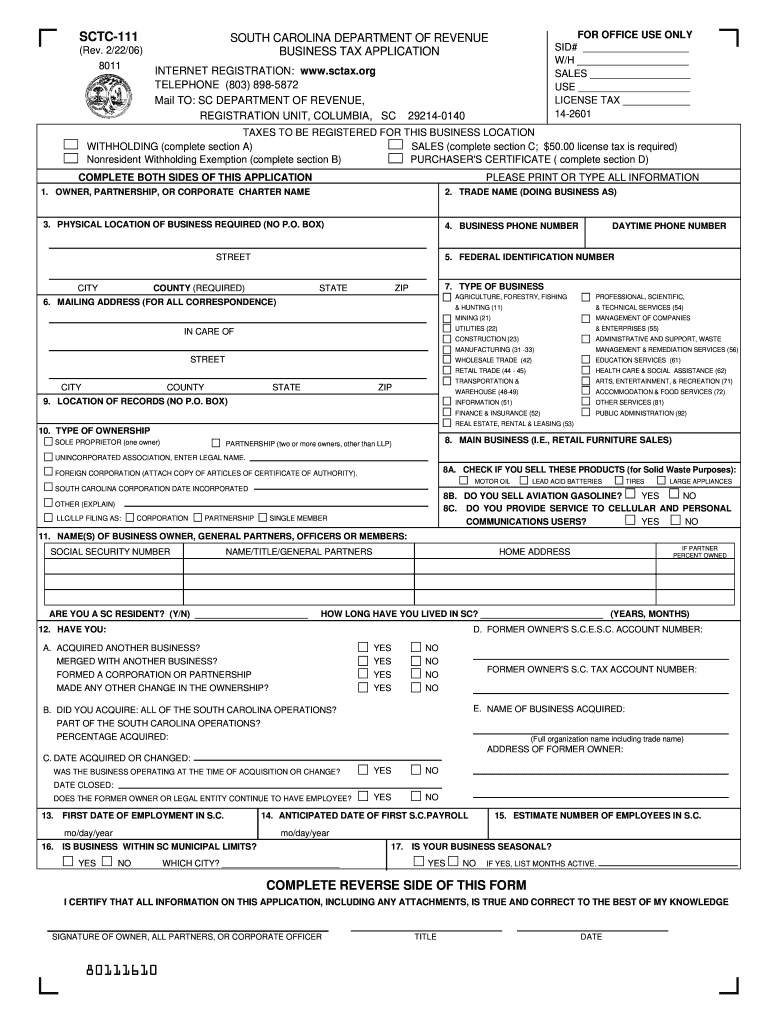

Sctc111 Form 2020

What is the Sctc111 Form

The Sctc111 Form is a specific document used in the United States for reporting certain tax-related information. This form is typically utilized by individuals or businesses to provide the necessary details required by the Internal Revenue Service (IRS). Understanding the purpose and function of the Sctc111 Form is essential for ensuring compliance with tax regulations and avoiding potential penalties.

How to use the Sctc111 Form

Using the Sctc111 Form involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website or other authorized sources. Next, gather all necessary information, such as personal identification details, income data, and any deductions you plan to claim. Carefully fill out the form, ensuring accuracy to prevent delays in processing. Finally, submit the completed form according to the guidelines provided by the IRS, either electronically or via mail.

Steps to complete the Sctc111 Form

Completing the Sctc111 Form requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Obtain the latest version of the Sctc111 Form.

- Read the instructions carefully to understand the requirements.

- Gather all relevant documents, including income statements and previous tax returns.

- Fill in your personal information, including your Social Security number and contact details.

- Report your income and any deductions or credits you wish to claim.

- Review the completed form for accuracy.

- Submit the form as directed, ensuring you meet any deadlines.

Legal use of the Sctc111 Form

The Sctc111 Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, it must be filled out accurately and submitted within the designated timeframes. The form should be signed and dated, confirming that the information provided is true and correct to the best of your knowledge. Compliance with the IRS guidelines is crucial to avoid legal issues and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Sctc111 Form are critical to ensure compliance with tax regulations. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 of each year for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. It is important to stay informed about these dates to avoid late fees or penalties.

Examples of using the Sctc111 Form

The Sctc111 Form can be used in various scenarios. For instance, self-employed individuals may use it to report income and expenses related to their business activities. Additionally, small businesses may utilize the form to claim deductions for operational costs. Understanding these examples can help users identify their specific needs and ensure they are using the form correctly for their tax reporting purposes.

Quick guide on how to complete sctc111 2006 form

Effortlessly Prepare Sctc111 Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers a suitable eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Sctc111 Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Sctc111 Form with Ease

- Locate Sctc111 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced files, the frustration of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sctc111 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sctc111 2006 form

Create this form in 5 minutes!

How to create an eSignature for the sctc111 2006 form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Sctc111 Form and how is it used?

The Sctc111 Form is a document crucial for specific business transactions, particularly in the context of tax reporting. With airSlate SignNow, users can easily create, send, and eSign this form, streamlining the submission process and ensuring compliance with regulatory requirements.

-

How much does it cost to use the Sctc111 Form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to customizable templates like the Sctc111 Form. Users can choose from various subscription tiers based on their needs, making it a cost-effective solution for businesses of all sizes.

-

Can I integrate the Sctc111 Form into my existing workflow?

Absolutely! airSlate SignNow allows for seamless integration of the Sctc111 Form into popular tools and software. This ensures that you can incorporate eSignatures into your current workflows without any disruption to your operations.

-

What features does airSlate SignNow offer for the Sctc111 Form?

With airSlate SignNow, users enjoy features such as easy document creation, automated workflows, and secure eSigning for the Sctc111 Form. These tools enhance efficiency and help maintain the integrity of your business documents.

-

How does airSlate SignNow ensure the security of the Sctc111 Form?

Security is a priority for airSlate SignNow, especially when handling documents like the Sctc111 Form. The platform employs advanced encryption and complies with industry standards to ensure your documents are protected throughout the signing process.

-

What are the benefits of using eSignatures for the Sctc111 Form?

Using eSignatures for the Sctc111 Form expedites the signing process, reduces paper waste, and enhances document tracking. airSlate SignNow’s solution simplifies this experience, providing users with a faster, more efficient method of handling important forms.

-

Is mobile access available for signing the Sctc111 Form?

Yes, airSlate SignNow offers mobile access, allowing users to sign the Sctc111 Form on-the-go. This flexibility supports busy professionals who need to manage their signing tasks from any location using their mobile device.

Get more for Sctc111 Form

Find out other Sctc111 Form

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter