Scdor 111 Form 2012

What is the Scdor 111 Form

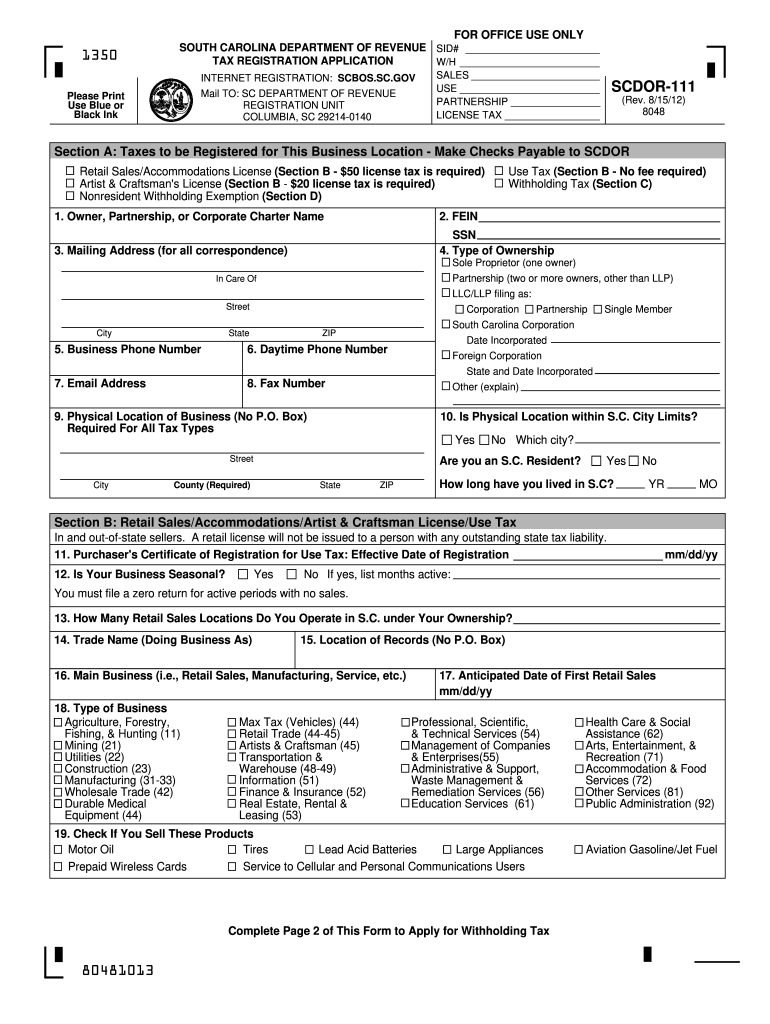

The Scdor 111 Form is a crucial document used in the state of South Carolina for tax purposes. Specifically, it is utilized for the purpose of reporting and paying certain taxes owed to the South Carolina Department of Revenue. This form is essential for individuals and businesses alike, ensuring compliance with state tax regulations. Understanding its purpose helps taxpayers fulfill their obligations accurately and on time.

How to use the Scdor 111 Form

Using the Scdor 111 Form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information that pertain to your tax situation. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form either online or via mail, depending on your preference and the guidelines provided by the South Carolina Department of Revenue.

Steps to complete the Scdor 111 Form

Completing the Scdor 111 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial records, including income statements and previous tax returns.

- Obtain the latest version of the Scdor 111 Form from the South Carolina Department of Revenue website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any deductions or credits applicable to your situation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Scdor 111 Form

The Scdor 111 Form is legally binding when completed correctly and submitted to the appropriate authorities. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The form must be filed by the established deadlines to avoid additional fees or interest on unpaid taxes. Compliance with state regulations is crucial for maintaining good standing with the South Carolina Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Scdor 111 Form, providing flexibility based on individual preferences:

- Online Submission: Many taxpayers prefer to submit the form electronically through the South Carolina Department of Revenue's online portal, which offers a streamlined process.

- Mail: You can print the completed form and send it via postal mail to the designated address provided by the department.

- In-Person: For those who prefer face-to-face interaction, visiting a local Department of Revenue office is an option for submitting the form directly.

Filing Deadlines / Important Dates

Filing deadlines for the Scdor 111 Form vary based on the type of taxpayer and the specific tax obligations. Generally, individual taxpayers must submit their forms by April fifteenth of each year. Businesses may have different deadlines depending on their fiscal year and tax classification. It is crucial to stay informed about these dates to avoid penalties and ensure timely compliance with tax regulations.

Quick guide on how to complete scdor 111 2012 form

Manage Scdor 111 Form easily on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without any delays. Handle Scdor 111 Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to modify and eSign Scdor 111 Form with ease

- Locate Scdor 111 Form and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Scdor 111 Form and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct scdor 111 2012 form

Create this form in 5 minutes!

How to create an eSignature for the scdor 111 2012 form

How to generate an eSignature for your Scdor 111 2012 Form in the online mode

How to create an eSignature for the Scdor 111 2012 Form in Google Chrome

How to create an eSignature for putting it on the Scdor 111 2012 Form in Gmail

How to make an eSignature for the Scdor 111 2012 Form from your mobile device

How to generate an electronic signature for the Scdor 111 2012 Form on iOS devices

How to make an eSignature for the Scdor 111 2012 Form on Android OS

People also ask

-

What is the Scdor 111 Form and why is it important?

The Scdor 111 Form is a crucial document used for tax purposes in South Carolina. It helps businesses and individuals report their income accurately to the state. Ensuring that your Scdor 111 Form is filled out correctly can prevent issues with the South Carolina Department of Revenue.

-

How does airSlate SignNow simplify the Scdor 111 Form process?

airSlate SignNow streamlines the process of completing and eSigning the Scdor 111 Form. With its user-friendly interface, you can easily fill out the form, add necessary signatures, and send it digitally. This saves time and reduces the hassle of dealing with paper documents.

-

Can I integrate airSlate SignNow with other platforms for managing the Scdor 111 Form?

Yes, airSlate SignNow offers various integrations with popular platforms like Google Drive, Dropbox, and more. This means you can easily access and manage your Scdor 111 Form alongside your other documents, enhancing your workflow efficiency.

-

What features does airSlate SignNow offer for handling the Scdor 111 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features make it easier to manage your Scdor 111 Form, ensuring that it is completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for managing the Scdor 111 Form?

Absolutely! airSlate SignNow offers a range of pricing plans that are designed to be budget-friendly for businesses of all sizes. By using airSlate SignNow for your Scdor 111 Form needs, you save on printing and mailing costs while benefiting from an efficient digital solution.

-

What security measures does airSlate SignNow have for the Scdor 111 Form?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and secure access protocols to protect your Scdor 111 Form and any sensitive information contained within it. You can trust that your data is safe and compliant with regulations.

-

Can I access the Scdor 111 Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices. This allows you to access, complete, and eSign your Scdor 111 Form on the go, making it convenient and flexible for busy professionals.

Get more for Scdor 111 Form

Find out other Scdor 111 Form

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document