Sales and Use Tax Department of Taxation New York State 2019-2026

Understanding the rev 1715 Form

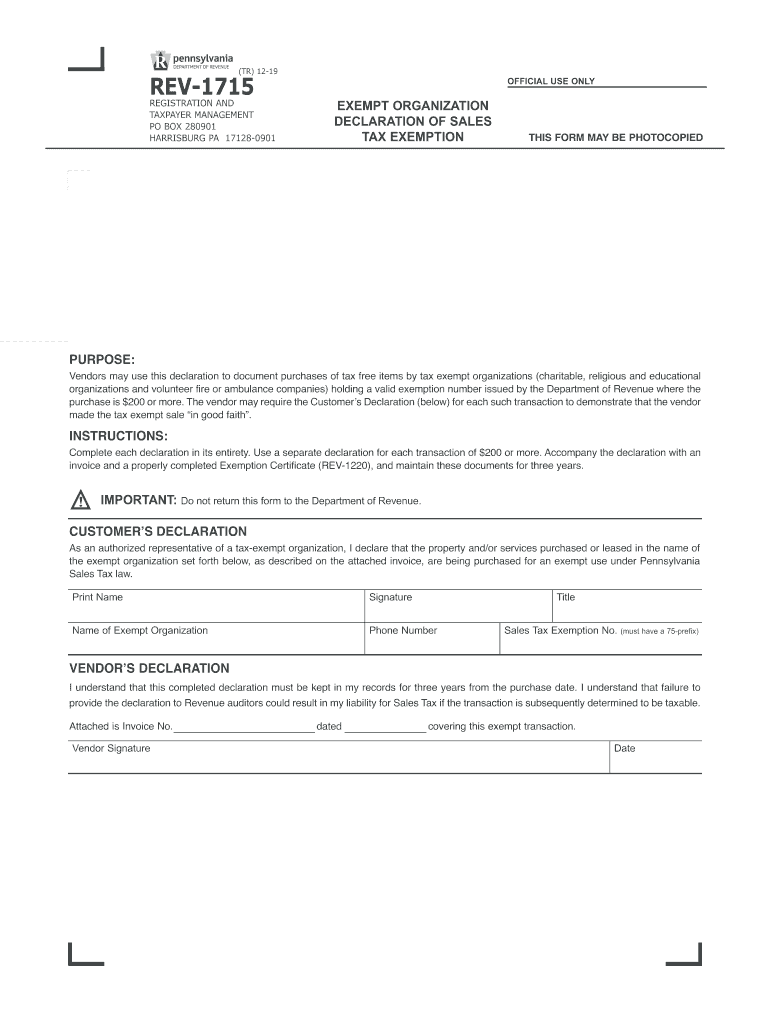

The rev 1715 form, also known as the Pennsylvania rev 1715 tax form, is a crucial document used for reporting sales and use tax in the state of Pennsylvania. This form is essential for businesses and individuals who need to comply with state tax regulations. It serves as a declaration of taxable sales and purchases, ensuring that the appropriate amount of tax is collected and remitted to the state. Understanding its purpose is vital for maintaining compliance and avoiding penalties.

Steps to Complete the rev 1715 Form

Filling out the rev 1715 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, such as sales records and receipts. Next, accurately report your total sales and any exempt sales. Be sure to calculate the total tax due based on the applicable rates. Once completed, review the form for any errors before submission. Properly completing this form helps avoid complications with the Pennsylvania Department of Revenue.

Required Documents for Filing the rev 1715 Form

To successfully file the rev 1715 form, specific documents are required. These include:

- Sales records that detail all taxable and exempt transactions.

- Receipts or invoices that support the reported sales figures.

- Any previous tax returns that may provide context or additional information.

Having these documents on hand not only streamlines the filing process but also ensures that your submissions are accurate and complete.

Filing Deadlines for the rev 1715 Form

Timely filing of the rev 1715 form is essential to avoid penalties. The deadlines for submission can vary based on the reporting period. Typically, the form is due on a quarterly basis, with specific dates set by the Pennsylvania Department of Revenue. It is advisable to mark these deadlines on your calendar to ensure compliance and avoid late fees.

Legal Use of the rev 1715 Form

The rev 1715 form is legally binding when filled out correctly and submitted according to state regulations. Compliance with the guidelines set forth by the Pennsylvania Department of Revenue ensures that the form is recognized as a valid declaration of tax obligations. Utilizing electronic signature solutions, like signNow, can enhance the legal standing of your submission by providing a secure and compliant method for signing and submitting documents.

Penalties for Non-Compliance with the rev 1715 Form

Failure to file the rev 1715 form on time or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the Pennsylvania Department of Revenue. Understanding the consequences of non-compliance emphasizes the importance of accurate and timely submissions to maintain good standing with state tax authorities.

Quick guide on how to complete sales and use tax department of taxation new york state

Easily Prepare Sales And Use Tax Department Of Taxation New York State on Any Device

Digital document management has surged in popularity among businesses and individuals. It offers a superb eco-friendly option to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hassles. Manage Sales And Use Tax Department Of Taxation New York State across all platforms using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Modify and eSign Sales And Use Tax Department Of Taxation New York State Effortlessly

- Find Sales And Use Tax Department Of Taxation New York State and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Formulate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiring form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Sales And Use Tax Department Of Taxation New York State while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sales and use tax department of taxation new york state

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax department of taxation new york state

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is rev 1715 in relation to airSlate SignNow?

Rev 1715 refers to a specific feature set available in airSlate SignNow that streamlines the eSigning process. This functionality enhances document management and allows for quicker turnaround times on contracts and agreements, making it a vital tool for businesses.

-

How much does airSlate SignNow cost for rev 1715 users?

The pricing for airSlate SignNow utilizing rev 1715 varies based on the subscription plan chosen. Generally, users can expect competitive rates that provide excellent value for the features included, such as advanced signing capabilities and integrations.

-

What features does rev 1715 offer for document signing?

Rev 1715 encompasses features like customizable templates, automated workflows, and advanced security options for document signing. These features are designed to enhance user experience and improve efficiency in document processing.

-

Can rev 1715 integrate with other software solutions?

Yes, rev 1715 allows for seamless integrations with various software platforms such as CRM systems, cloud storage, and productivity tools. This compatibility ensures that businesses can maintain their workflows without disruption.

-

What are the benefits of using airSlate SignNow with rev 1715?

Using airSlate SignNow with rev 1715 offers numerous benefits, such as faster document turnaround times and reduced manual errors. Additionally, businesses experience a higher level of efficiency and improved compliance with electronic signatures.

-

Is rev 1715 suitable for small businesses?

Absolutely! Rev 1715 in airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective pricing and user-friendly interface make it accessible for small businesses looking to enhance their eSigning capabilities.

-

How secure is airSlate SignNow's rev 1715 feature?

The rev 1715 feature in airSlate SignNow includes robust security measures such as encryption and multi-factor authentication. These security protocols ensure that all signed documents and user data remain confidential and protected against unauthorized access.

Get more for Sales And Use Tax Department Of Taxation New York State

- City of tshwane guidelines for the design and construction of water and sanitation systems form

- Lion vs elephant digestion lab answer key form

- Tax residence certificate malta form

- Fax 176a form

- Local safeguarding contacts recording form cppe

- Mcgraw hill medical assisting workbook answer key form

- Www azed govadultedserviceshse transcript requesthse transcript requestarizona department of education form

- Arizona high school equivalency ged test pathway access code form

Find out other Sales And Use Tax Department Of Taxation New York State

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free