AFFIDAVIT of INDIVIDUAL TAX EXEMPTION Graham County, AZ 2020-2026

Understanding the affidavit for tax exemption

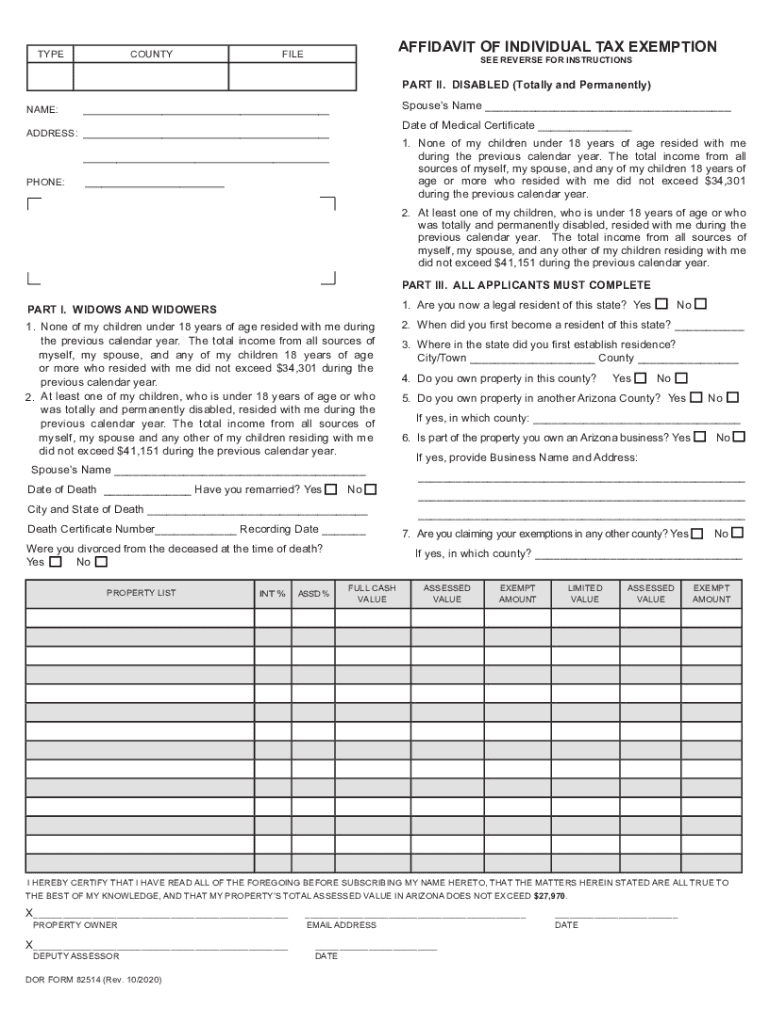

The affidavit for tax exemption, specifically the Arizona form 82514, serves as a legal document that allows eligible individuals to claim an exemption from certain taxes. This form is particularly relevant for residents in Graham County, Arizona, who may qualify based on specific criteria, such as disability status or age. The affidavit must be completed accurately to ensure compliance with local tax regulations.

Steps to complete the affidavit for tax exemption

Completing the affidavit for tax exemption involves several key steps:

- Gather necessary documentation, such as proof of eligibility (e.g., disability documentation or age verification).

- Obtain the Arizona form 82514, which can be accessed through official state resources.

- Fill out the form with accurate personal information, including your name, address, and the specific exemption being claimed.

- Sign and date the affidavit to validate your claim.

- Submit the completed form to the appropriate local tax authority.

Legal use of the affidavit for tax exemption

The affidavit for tax exemption is legally binding when executed correctly. It is essential that the form is signed in the presence of a notary public if required by local laws. This ensures that the affidavit is recognized by tax authorities and can be used to support your claim for tax exemption. Failure to comply with legal requirements may result in penalties or denial of the exemption.

Eligibility criteria for the affidavit for tax exemption

To qualify for the affidavit for tax exemption, individuals must meet specific eligibility criteria set forth by the state. Common requirements include:

- Being a resident of Arizona.

- Meeting age requirements, typically being sixty-five years or older.

- Having a qualifying disability as defined by state law.

- Providing necessary documentation to support the exemption claim.

Required documents for the affidavit for tax exemption

When submitting the affidavit for tax exemption, it is important to include supporting documents. These may include:

- Proof of age, such as a birth certificate or government-issued ID.

- Documentation of disability, which may include medical records or letters from healthcare providers.

- Previous tax returns or tax statements, if applicable.

Form submission methods for the affidavit for tax exemption

The completed affidavit for tax exemption can typically be submitted through various methods, including:

- Online submission through the state’s tax portal.

- Mailing the form to the local tax authority.

- In-person submission at designated government offices.

Quick guide on how to complete affidavit of individual tax exemption graham county az

Prepare AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing users to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The easiest way to alter and eSign AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ with ease

- Find AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ and click Get Form to begin.

- Utilize the resources we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this task.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct affidavit of individual tax exemption graham county az

Create this form in 5 minutes!

How to create an eSignature for the affidavit of individual tax exemption graham county az

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is an affidavit for tax exemption?

An affidavit for tax exemption is a legal document that taxpayers use to declare their eligibility for tax exemptions. This document typically includes personal details, relevant tax information, and the reasons for claiming the exemption. Using a solution like airSlate SignNow simplifies the process of creating and signing these affidavits securely online.

-

How does airSlate SignNow help with affidavits for tax exemption?

airSlate SignNow offers a user-friendly platform for creating, sending, and signing affidavits for tax exemption. With customizable templates and electronic signatures, users can expedite the filing process and ensure compliance with legal requirements. This ensures that your affidavit is both professional and properly executed.

-

Is there a cost associated with using airSlate SignNow for affidavits for tax exemption?

Yes, airSlate SignNow operates on a subscription model, offering various pricing plans to accommodate different business needs. Each plan includes features designed to streamline the creation and management of documents, including affidavits for tax exemption. Users can choose a plan that fits their budget while still benefiting from high-quality document solutions.

-

Can I integrate airSlate SignNow with other software for managing affidavits for tax exemption?

Absolutely! airSlate SignNow supports multiple integrations with popular software applications like Google Drive, Salesforce, and more. This compatibility allows users to manage their documents efficiently, including affidavits for tax exemption, without switching platforms or disrupting existing workflows.

-

What are the benefits of using airSlate SignNow for affidavits for tax exemption?

Using airSlate SignNow for affidavits for tax exemption provides numerous benefits, including faster processing times and enhanced security for sensitive information. The platform allows users to sign documents remotely, eliminating the need for physical meetings. Additionally, the ease of use ensures that anyone can create and manage these affidavits seamlessly.

-

Is it legal to submit an electronic affidavit for tax exemption?

Yes, electronic affidavits for tax exemption are legally recognized in many jurisdictions, provided they comply with local laws regarding electronic signatures. airSlate SignNow ensures that its electronic signature process meets these legal standards, allowing you to submit your affidavit with confidence. Always check your local regulations for specific requirements.

-

What features does airSlate SignNow offer for creating affidavits for tax exemption?

airSlate SignNow provides an array of features for creating affidavits for tax exemption, including customizable templates, intuitive drag-and-drop tools, and secure eSigning options. Users can also track document status and receive notifications when their affidavits are signed. This comprehensive suite of tools makes managing tax-related documents efficient and straightforward.

Get more for AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ

Find out other AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION Graham County, AZ

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile