NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate 2021-2026

Understanding the NJ Employees Withholding Allowance Certificate

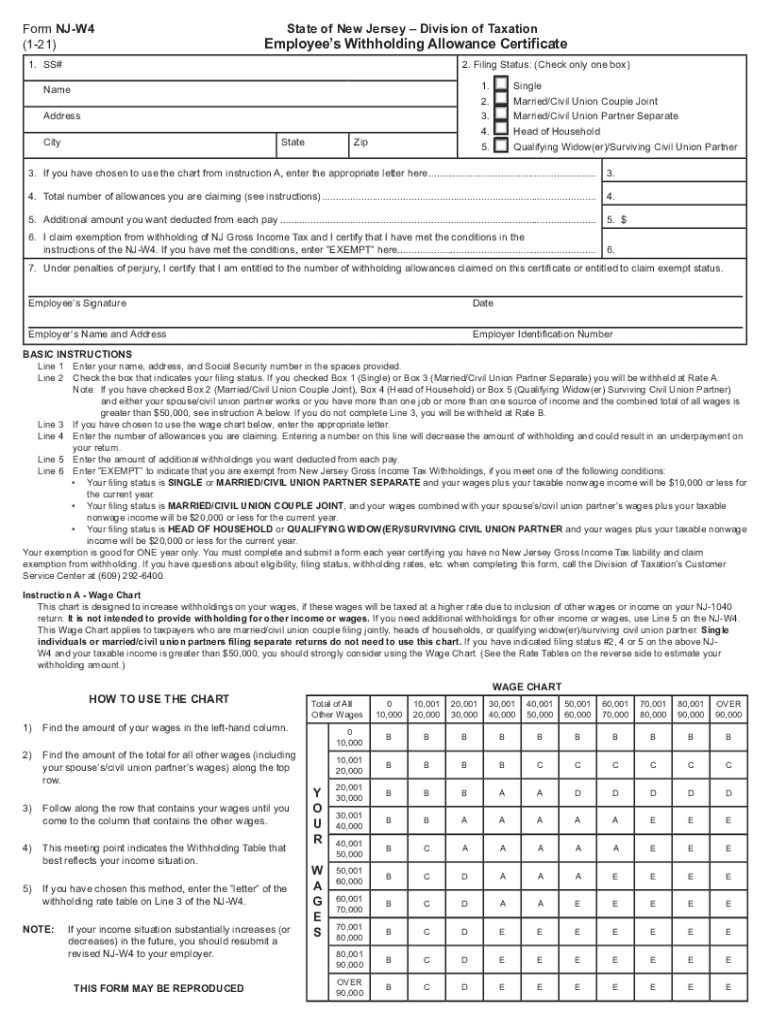

The NJ Employees Withholding Allowance Certificate, commonly referred to as the NJ W-4, is a crucial document for employees in New Jersey. This certificate allows employees to indicate the number of withholding allowances they are claiming, which directly affects the amount of state income tax withheld from their paychecks. By accurately completing this form, employees can ensure that they are not over- or under-withheld, helping to manage their tax obligations effectively.

Steps to Complete the NJ Employees Withholding Allowance Certificate

Completing the NJ Employees Withholding Allowance Certificate involves several straightforward steps:

- Obtain the NJ W-4 form from your employer or download it from the New Jersey Division of Taxation website.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine the number of allowances you are eligible to claim based on your personal situation, such as dependents and filing status.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal Use of the NJ Employees Withholding Allowance Certificate

The NJ Employees Withholding Allowance Certificate is legally binding once it is signed by the employee. It is essential for both employees and employers to understand that this form must be filled out accurately to comply with New Jersey tax laws. Employers are responsible for withholding the correct amount of state income tax based on the information provided in this certificate. Failure to comply with the withholding requirements can lead to penalties for both parties.

State-Specific Rules for the NJ Employees Withholding Allowance Certificate

New Jersey has specific regulations governing the use of the Employees Withholding Allowance Certificate. For instance, the state allows employees to claim multiple allowances, which can reduce the amount withheld for state income tax. However, employees must ensure that their claims are legitimate and reflect their current financial situation. Additionally, any changes in personal circumstances, such as marriage or the birth of a child, should prompt a review and potential update of the withholding allowances claimed.

Examples of Using the NJ Employees Withholding Allowance Certificate

Consider a scenario where an employee has two children and is married. They may choose to claim three allowances on their NJ W-4 to reduce the amount withheld from their paycheck. Conversely, a single employee without dependents may only claim one allowance. These examples illustrate how personal circumstances can influence the number of allowances claimed, ultimately affecting take-home pay and tax liabilities.

Filing Deadlines and Important Dates

While the NJ Employees Withholding Allowance Certificate does not have a specific filing deadline, it is important for employees to submit the form to their employer as soon as they start a new job or experience a significant life change. Employers are required to implement the withholding changes based on the submitted form in a timely manner, typically within one pay period. Staying aware of these deadlines ensures compliance with state tax regulations.

Quick guide on how to complete nj employees withholding allowance certificate nj employees withholding allowance certificate

Prepare NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and electronically sign NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate with ease

- Obtain NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj employees withholding allowance certificate nj employees withholding allowance certificate

Create this form in 5 minutes!

How to create an eSignature for the nj employees withholding allowance certificate nj employees withholding allowance certificate

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is an NJ W4 form?

The NJ W4 form is a New Jersey Employee's Withholding Allowance Certificate. It is used by employees to determine the amount of state income tax to withhold from their paychecks. Understanding the NJ W4 is essential for accurate tax management in New Jersey.

-

How can airSlate SignNow help me manage my NJ W4 forms?

airSlate SignNow streamlines the process of completing and signing your NJ W4 forms electronically. With an easy-to-use interface, you can fill out, sign, and send your NJ W4 documents quickly, ensuring compliance and efficiency. Its automation features also help reduce errors in your tax information.

-

Is there a cost associated with using airSlate SignNow for NJ W4 forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our economical solutions facilitate unlimited document signing, including NJ W4 forms, making it a cost-effective choice for businesses and individuals alike. Check our pricing page for specific plan details.

-

Can I integrate airSlate SignNow with other applications for NJ W4 management?

Absolutely! airSlate SignNow integrates with a wide range of applications, allowing seamless management of your NJ W4 documents. Whether you're using HR software or financial applications, our platform can connect to enhance your workflow and document handling efficiency.

-

What are the benefits of using airSlate SignNow for NJ W4 forms?

Using airSlate SignNow for your NJ W4 forms provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform ensures your documents are stored safely while allowing easy access for signing and sharing, making tax season less stressful.

-

How secure is airSlate SignNow when handling NJ W4 forms?

Security is a top priority at airSlate SignNow. When managing your NJ W4 forms, we employ advanced encryption and secure cloud storage to protect your sensitive information. You can trust that your data is handled with the utmost care to maintain your privacy.

-

Is it easy to share completed NJ W4 forms using airSlate SignNow?

Yes, sharing completed NJ W4 forms through airSlate SignNow is simple and efficient. Once your form is signed, you can instantly share it via email or link, ensuring that recipients receive the necessary documentation without delay. This simplification speeds up the overall process.

Get more for NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate

Find out other NJ Employees Withholding Allowance Certificate NJ Employees Withholding Allowance Certificate

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request