FTB 3536 Estimated Fee for LLCs FTB 3536 Estimated Fee for LLCs 2021

What is the FTB 3536 Estimated Fee for LLCs?

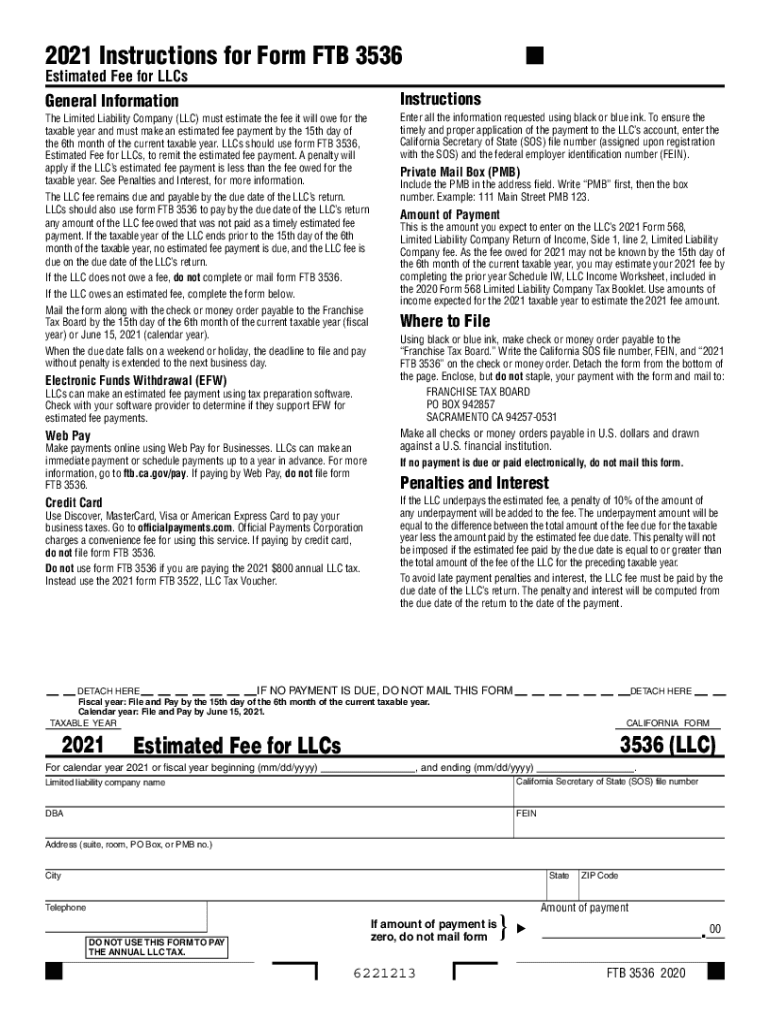

The FTB 3536 form is used by Limited Liability Companies (LLCs) in California to report and pay the estimated fee based on their total income. This fee is applicable for LLCs that are doing business in California and is calculated based on the income thresholds established by the state. Understanding this fee is crucial for compliance and financial planning for LLCs operating in California.

Steps to Complete the FTB 3536 Estimated Fee for LLCs

Completing the FTB 3536 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Determine your LLC's total income for the year, as this will dictate the fee amount.

- Fill out the FTB 3536 form accurately, ensuring all income figures are reported correctly.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to the California Franchise Tax Board by the designated deadline.

Legal Use of the FTB 3536 Estimated Fee for LLCs

The FTB 3536 form is legally required for LLCs operating in California to fulfill their tax obligations. Failing to file this form can result in penalties and interest on unpaid fees. It is essential for LLCs to understand the legal implications of this form to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

LLCs must be aware of specific deadlines for filing the FTB 3536 to avoid penalties. Typically, the estimated fee must be filed by the 15th day of the fourth month after the close of the LLC's taxable year. Keeping track of these dates is vital for maintaining compliance and avoiding late fees.

Required Documents

To complete the FTB 3536 form, LLCs need to have several documents on hand:

- Income statements that detail the total income for the year.

- Previous year’s tax returns for reference.

- Any additional documentation that supports income claims, such as profit and loss statements.

Penalties for Non-Compliance

Failure to file the FTB 3536 form or pay the estimated fee can lead to significant penalties. These may include late fees, interest on unpaid amounts, and potential legal action from the state. It is important for LLCs to prioritize timely filing and payment to avoid these consequences.

Quick guide on how to complete 2021 ftb 3536 estimated fee for llcs 2021 ftb 3536 estimated fee for llcs

Effortlessly Prepare FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the necessary forms and securely archive them online. airSlate SignNow equips you with everything required to create, modify, and electronically sign your documents swiftly and without interruption. Handle FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs using any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The easiest method to alter and eSign FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs seamlessly

- Obtain FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to keep your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worries of lost or mismanaged files, cumbersome form searching, or mistakes that necessitate generating new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 ftb 3536 estimated fee for llcs 2021 ftb 3536 estimated fee for llcs

Create this form in 5 minutes!

How to create an eSignature for the 2021 ftb 3536 estimated fee for llcs 2021 ftb 3536 estimated fee for llcs

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is ca 3536 in relation to airSlate SignNow?

The ca 3536 is a unique code that represents a specific feature set or pricing plan within the airSlate SignNow platform. It helps users identify the right package tailored to their business needs. Utilizing ca 3536 ensures you get access to essential eSignature tools at a competitive price.

-

How much does the ca 3536 plan cost?

The ca 3536 pricing plan is designed to be affordable, with various subscription options available. Customers can choose monthly or yearly billing to suit their budgetary needs. This pricing structure allows businesses of all sizes to take advantage of airSlate SignNow's robust features.

-

What features are included in the ca 3536 package?

The ca 3536 package includes a range of features such as unlimited eSignatures, template creation, and document tracking. Additionally, users of the ca 3536 plan can utilize advanced analytics and integrations with popular business applications. This comprehensive feature set makes managing documents simple and efficient.

-

What are the benefits of using airSlate SignNow with the ca 3536 code?

Choosing the ca 3536 plan unlocks numerous benefits for businesses, including increased productivity and streamlined workflows. Users can quickly send and sign documents from anywhere, enhancing efficiency. Additionally, the ca 3536 plan provides excellent customer support to assist with any queries.

-

Does airSlate SignNow support integrations under the ca 3536 plan?

Yes, the ca 3536 plan includes support for various integrations with popular platforms such as Google Drive, Dropbox, and Salesforce. These integrations help businesses connect their workflow seamlessly while using airSlate SignNow. This functionality ensures that you can work with your preferred tools without interruption.

-

Can I try the ca 3536 plan before committing?

Absolutely! airSlate SignNow offers a trial period for the ca 3536 plan, allowing potential customers to explore its features without any commitment. This trial helps you assess how the ca 3536 package can improve your document management processes. Sign up today to experience the benefits firsthand!

-

Is airSlate SignNow compliant with regulations under the ca 3536 plan?

Yes, the ca 3536 plan ensures compliance with all major eSignature laws and regulations, such as ESIGN and UETA. This compliance guarantees that your digitally signed documents hold legal validity. Adopting airSlate SignNow with ca 3536 gives you peace of mind regarding document security and authenticity.

Get more for FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs

Find out other FTB 3536 Estimated Fee For LLCs FTB 3536 Estimated Fee For LLCs

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy