Massachusetts Department of Revenue Form M 8736 Fiduciary or 2020

What is the Massachusetts Department of Revenue Form M-8736 Fiduciary?

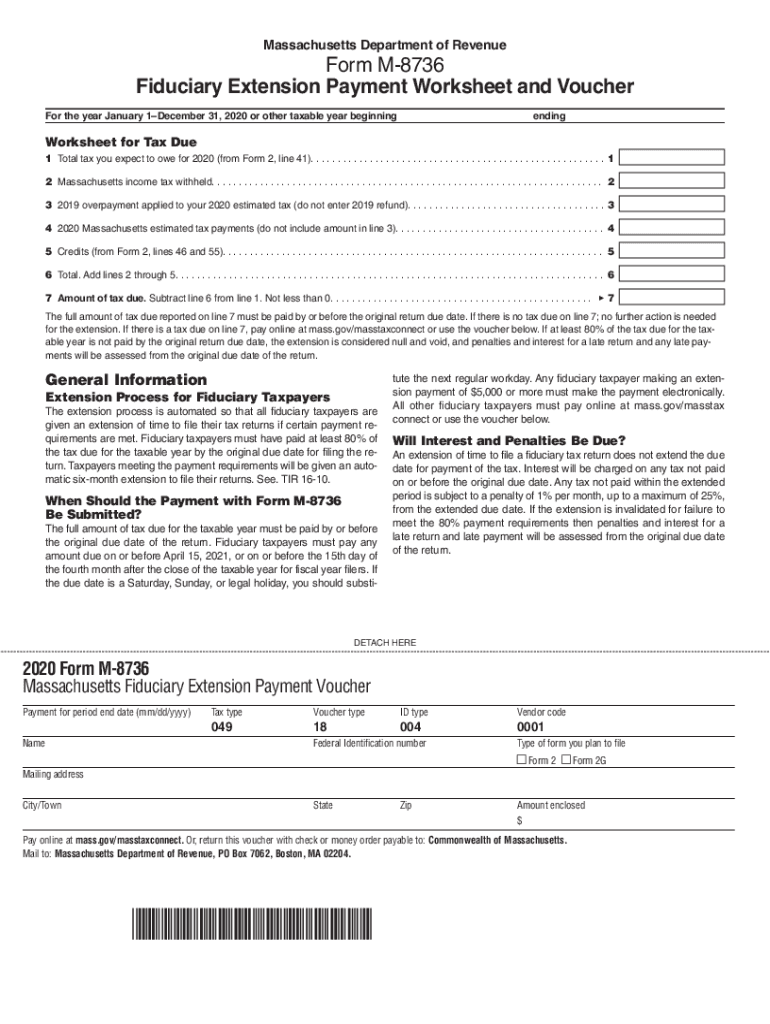

The Massachusetts Department of Revenue Form M-8736 is used for fiduciary income tax purposes. This form is essential for estates and trusts that generate income in Massachusetts. It allows fiduciaries to report income, deductions, and credits associated with the estate or trust. Understanding the purpose of this form is crucial for ensuring compliance with state tax laws.

Steps to Complete the Massachusetts Department of Revenue Form M-8736 Fiduciary

Completing Form M-8736 involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Fill in the identifying information, including the name, address, and federal identification number of the estate or trust.

- Report all income received by the estate or trust during the tax year.

- Deduct any allowable expenses that were incurred in the production of income.

- Calculate the tax liability based on the net income reported.

- Sign and date the form before submission.

Legal Use of the Massachusetts Department of Revenue Form M-8736 Fiduciary

The legal use of Form M-8736 is significant as it ensures that fiduciaries comply with Massachusetts tax obligations. Properly completing and submitting this form is essential for avoiding penalties and ensuring that the estate or trust meets its tax responsibilities. The form must be filed annually, reflecting the income and expenses accurately to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for Form M-8736 are critical to avoid late fees and penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this means the form is due by April 15. It is advisable to keep track of these dates to ensure timely submission.

Required Documents

To complete Form M-8736, certain documents are required:

- Financial statements for the estate or trust.

- Records of income received, including interest, dividends, and rental income.

- Documentation of any deductions claimed, such as administrative expenses.

- Previous tax returns for reference, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Form M-8736 can be submitted through various methods:

- Online submission via the Massachusetts Department of Revenue website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Quick guide on how to complete massachusetts department of revenue form m 8736 fiduciary or

Complete Massachusetts Department Of Revenue Form M 8736 Fiduciary Or effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your files swiftly without delays. Manage Massachusetts Department Of Revenue Form M 8736 Fiduciary Or on any device with airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign Massachusetts Department Of Revenue Form M 8736 Fiduciary Or without stress

- Find Massachusetts Department Of Revenue Form M 8736 Fiduciary Or and then click Get Form to initiate the process.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Massachusetts Department Of Revenue Form M 8736 Fiduciary Or while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form m 8736 fiduciary or

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 8736 fiduciary or

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is masstaxconnect login and how do I access it?

The masstaxconnect login is the gateway for users to access their account on the airSlate SignNow platform. You can log in by visiting the official website and entering your credentials in the login section. If you're a new user, you'll need to create an account to start using the service.

-

What features are available after masstaxconnect login?

Once you complete the masstaxconnect login, you'll have access to a variety of features such as document eSigning, secure file storage, and collaboration tools. These features help streamline document workflows and improve productivity. Additionally, users benefit from customizable templates and audit trails for compliance.

-

Is there a cost associated with masstaxconnect login?

Yes, while the masstaxconnect login provides access to basic features, a subscription plan may be required for advanced functionalities. airSlate SignNow offers different pricing tiers based on user needs, with options for individual users and teams. This ensures that you can find a plan that suits your budget.

-

Can I integrate other tools with my masstaxconnect login?

Absolutely! After your masstaxconnect login, you can integrate airSlate SignNow with a variety of third-party applications. Popular integrations include tools for CRM, project management, and document storage, which enhance your business's workflow efficiency. These integrations allow for a seamless experience across platforms.

-

What benefits does airSlate SignNow offer through masstaxconnect login?

Using the masstaxconnect login, you gain immediate access to tools that enhance document handling efficiency. Key benefits include reduced turnaround times for signatures, improved security for sensitive documents, and cost savings by minimizing paper usage. These advantages can signNowly impact your business’s overall productivity.

-

How do I reset my masstaxconnect login credentials?

If you forget your masstaxconnect login credentials, you can easily reset them by following the instructions on the login page. Simply click on the 'Forgot Password?' link, enter your registered email, and follow the steps sent to your inbox. This allows you to regain access quickly and securely.

-

Is customer support available after masstaxconnect login?

Yes, airSlate SignNow offers robust customer support for users who log in through masstaxconnect. You can access live chat, email support, and a comprehensive knowledge base to help you navigate any issues. Their dedicated support team is available to assist with any technical difficulties you might face.

Get more for Massachusetts Department Of Revenue Form M 8736 Fiduciary Or

Find out other Massachusetts Department Of Revenue Form M 8736 Fiduciary Or

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form