Massachusetts Department of Revenue Form M 8736 Fi 2024-2026

What is the Massachusetts Department Of Revenue Form M-8736?

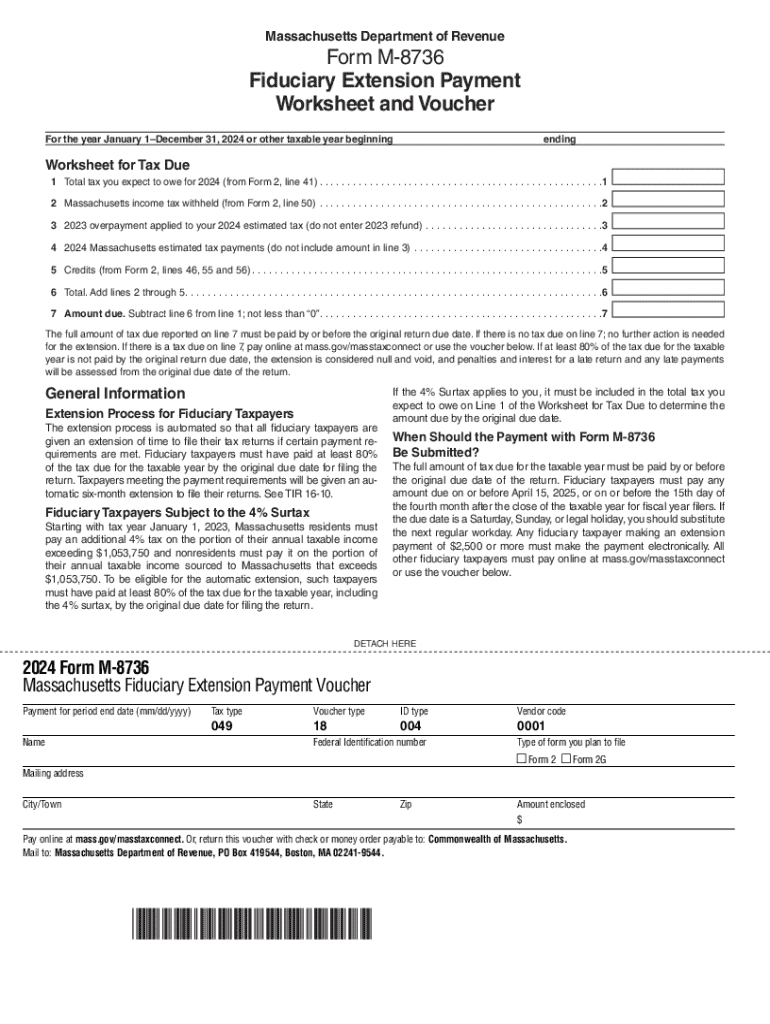

The Massachusetts Department of Revenue Form M-8736 is a fiduciary extension payment form used by estates and trusts to request an extension of time for filing their income tax returns. This form is essential for fiduciaries who need additional time to prepare their tax documents while ensuring that any tax liabilities are addressed promptly. By submitting Form M-8736, fiduciaries can avoid penalties associated with late filing.

How to use the Massachusetts Department Of Revenue Form M-8736

To use the Massachusetts Form M-8736 effectively, fiduciaries must complete the form accurately, providing necessary information such as the name of the estate or trust, the taxpayer identification number, and the amount of tax payment being submitted. It is crucial to ensure that the payment is made by the due date to prevent penalties. After filling out the form, it can be submitted either electronically or via mail, depending on the preferences of the fiduciary.

Steps to complete the Massachusetts Department Of Revenue Form M-8736

Completing Form M-8736 involves several key steps:

- Gather necessary information, including the estate or trust's name, taxpayer identification number, and income details.

- Fill out the form, ensuring all fields are completed accurately.

- Calculate the payment amount based on the estimated tax liability.

- Review the form for any errors or omissions.

- Submit the completed form and payment by the specified deadline.

Filing Deadlines / Important Dates

Fiduciaries must be aware of the filing deadlines associated with Form M-8736. Typically, the form must be submitted by the original due date of the fiduciary income tax return, which is generally the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is important to mark these dates to ensure compliance and avoid penalties.

Required Documents

When completing Form M-8736, certain documents may be necessary to support the information provided. These may include:

- Previous year’s tax return for the estate or trust.

- Financial statements detailing income and expenses.

- Any supporting documentation that justifies the estimated tax payment.

Form Submission Methods

Form M-8736 can be submitted through various methods, providing flexibility for fiduciaries. The options include:

- Online Submission: Fiduciaries can submit the form electronically through the Massachusetts Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address specified by the Department of Revenue.

- In-Person: Fiduciaries may also choose to deliver the form in person at designated Department of Revenue offices.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form m 8736 fi

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 8736 fi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts M 8736 payment and form?

The Massachusetts M 8736 payment and form is a specific document required for certain tax-related transactions in Massachusetts. It facilitates the payment process and ensures compliance with state regulations. Understanding this form is crucial for businesses operating in Massachusetts.

-

How can airSlate SignNow help with the Massachusetts M 8736 payment and form?

airSlate SignNow streamlines the process of completing and submitting the Massachusetts M 8736 payment and form. Our platform allows users to easily eSign and send documents securely, ensuring that all necessary information is accurately captured. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the Massachusetts M 8736 payment and form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that simplify the Massachusetts M 8736 payment and form process, making it a cost-effective solution. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for the Massachusetts M 8736 payment and form?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. This includes popular accounting and document management software, making it easier to manage the Massachusetts M 8736 payment and form alongside your other business processes. Integration helps streamline operations and improve efficiency.

-

What features does airSlate SignNow offer for managing the Massachusetts M 8736 payment and form?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure eSigning to manage the Massachusetts M 8736 payment and form effectively. These tools help ensure that your documents are completed accurately and on time, reducing administrative burdens.

-

Can I track the status of my Massachusetts M 8736 payment and form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Massachusetts M 8736 payment and form in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

-

Is airSlate SignNow secure for handling the Massachusetts M 8736 payment and form?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data while handling the Massachusetts M 8736 payment and form. You can trust that your sensitive information is safe with us.

Get more for Massachusetts Department Of Revenue Form M 8736 Fi

- Residential category form

- Amvic consignment form

- Random case review form period i january 1 to june 30 period ii july 1 to december 31 reviewing physician aaaasf

- Tb printable copies form

- Newborn physical exam template pdf form

- Superior court of california county of search warrant electronic communication records phone email internet the people of the form

- Mary ramsey scholarship alpha delta kappa newtoncountyschools form

- Additional details for services you can shop for form

Find out other Massachusetts Department Of Revenue Form M 8736 Fi

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form