DF60018019999 2020-2026

What is the DF60018019999

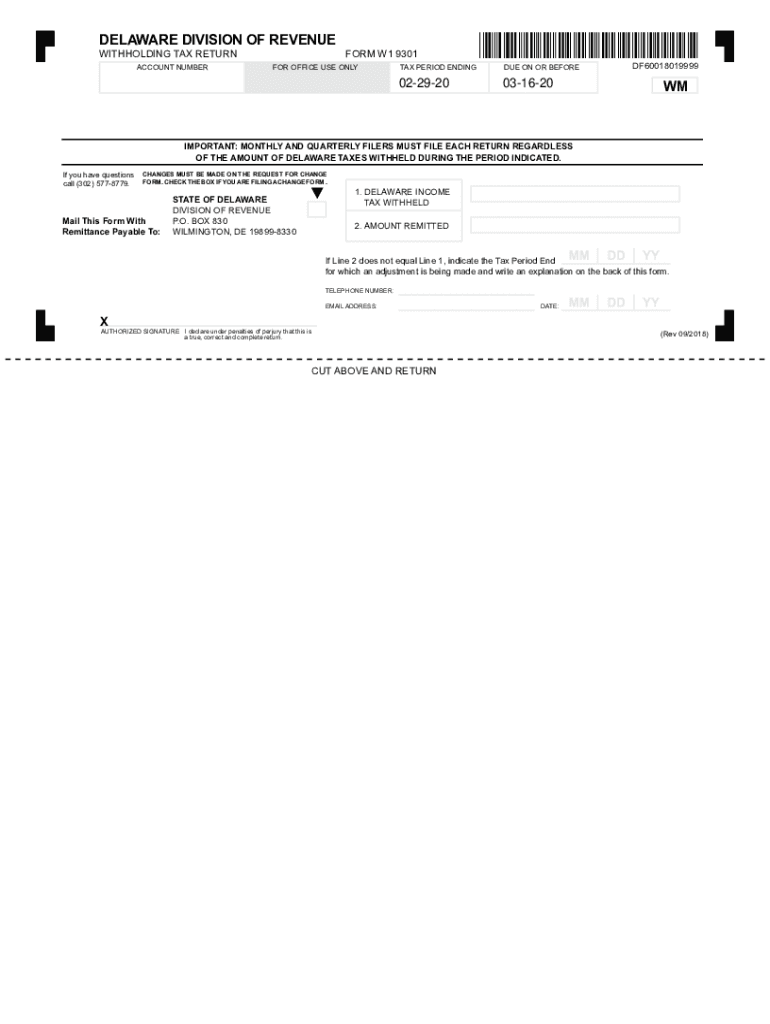

The DF60018019999 is a specific form used for reporting Delaware state income tax withholding. This form is crucial for employers who need to report the amount of income tax withheld from employees' wages. It serves as a record of the withholding amounts and ensures compliance with state tax regulations. Understanding this form is essential for both employers and employees to maintain accurate tax records.

Steps to complete the DF60018019999

Completing the DF60018019999 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee details and the total amount withheld during the reporting period. Next, accurately fill out each section of the form, ensuring that all figures are correct. After completing the form, review it for any errors before submission. Finally, submit the form by the specified deadline to avoid any penalties.

Legal use of the DF60018019999

The DF60018019999 is legally binding when completed and submitted in accordance with Delaware state laws. Employers are required to use this form to report withholding amounts accurately. Failure to comply with the legal requirements associated with this form can result in penalties, including fines or additional scrutiny from state tax authorities. It is essential to adhere to all guidelines to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the DF60018019999 are critical to avoid penalties. Typically, this form must be submitted monthly, with specific due dates set by the Delaware Division of Revenue. Employers should keep track of these dates to ensure timely submission. Missing a deadline can result in late fees and complications with tax reporting.

Who Issues the Form

The DF60018019999 is issued by the Delaware Division of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers can obtain the form directly from the Division of Revenue's official website or through other state resources.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the DF60018019999. The form can be submitted online through the Delaware Division of Revenue's electronic filing system, which is often the most efficient method. Alternatively, employers may choose to mail the completed form or submit it in person at designated state offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Non-compliance with the requirements of the DF60018019999 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. It is crucial for employers to understand their responsibilities regarding this form to avoid these consequences. Regularly reviewing filing practices and ensuring timely submissions can help mitigate the risk of non-compliance.

Quick guide on how to complete df60018019999

Effortlessly prepare DF60018019999 on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle DF60018019999 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign DF60018019999 effortlessly

- Find DF60018019999 and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign DF60018019999 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct df60018019999

Create this form in 5 minutes!

How to create an eSignature for the df60018019999

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a Delaware withholding form?

A Delaware withholding form is a document used by employers to report and withhold the appropriate state taxes from employee wages. It's essential for compliance with Delaware tax laws and ensuring that your business remains in good standing. Utilizing airSlate SignNow can streamline the process of obtaining and submitting these forms efficiently.

-

How can airSlate SignNow help me manage my Delaware withholding form?

airSlate SignNow provides a user-friendly platform to easily create, sign, and store your Delaware withholding form online. This eliminates the hassles of paperwork and enhances document management. With our solution, you can easily track edits and who has signed the document, ensuring compliance and organization.

-

Is airSlate SignNow cost-effective for handling Delaware withholding forms?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it a cost-effective solution for handling Delaware withholding forms. Our plans provide excellent value, especially for businesses that frequently manage multiple documents. With affordable pricing, you can fast-track your document workflow without breaking the bank.

-

What features does airSlate SignNow offer for Delaware withholding forms?

Our platform includes features like customizable templates, eSignature capabilities, and collaboration tools to simplify the process of managing Delaware withholding forms. Additionally, you can automate reminders and notifications to ensure timely submissions. These features enhance efficiency and accuracy in your document processes.

-

Can I integrate airSlate SignNow with other tools for managing my Delaware withholding form?

Yes, airSlate SignNow offers integrations with various popular software solutions, allowing you to streamline your workflow when managing Delaware withholding forms. Whether you use CRM systems, accounting software, or project management tools, our platform can connect seamlessly to help maintain your productivity. This integration simplifies your processes and reduces the amount of manual work required.

-

What are the benefits of using airSlate SignNow for Delaware withholding forms?

Using airSlate SignNow for your Delaware withholding forms provides numerous benefits, including enhanced security, time savings, and improved accuracy. Our platform ensures that your documents are safely stored and easily accessible, which increases efficiency. Additionally, electronic signatures reduce turnaround times signNowly, allowing you to focus more on your business.

-

Is it easy to obtain a Delaware withholding form with airSlate SignNow?

Absolutely! Obtaining a Delaware withholding form using airSlate SignNow is straightforward. You can easily access custom templates, fill in the necessary information, and send it for eSignature, streamlining the process signNowly. Our user-friendly interface makes it accessible for users of all technical levels.

Get more for DF60018019999

Find out other DF60018019999

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe