Delaware State Withholding Form 2018

What is the Delaware State Withholding Form

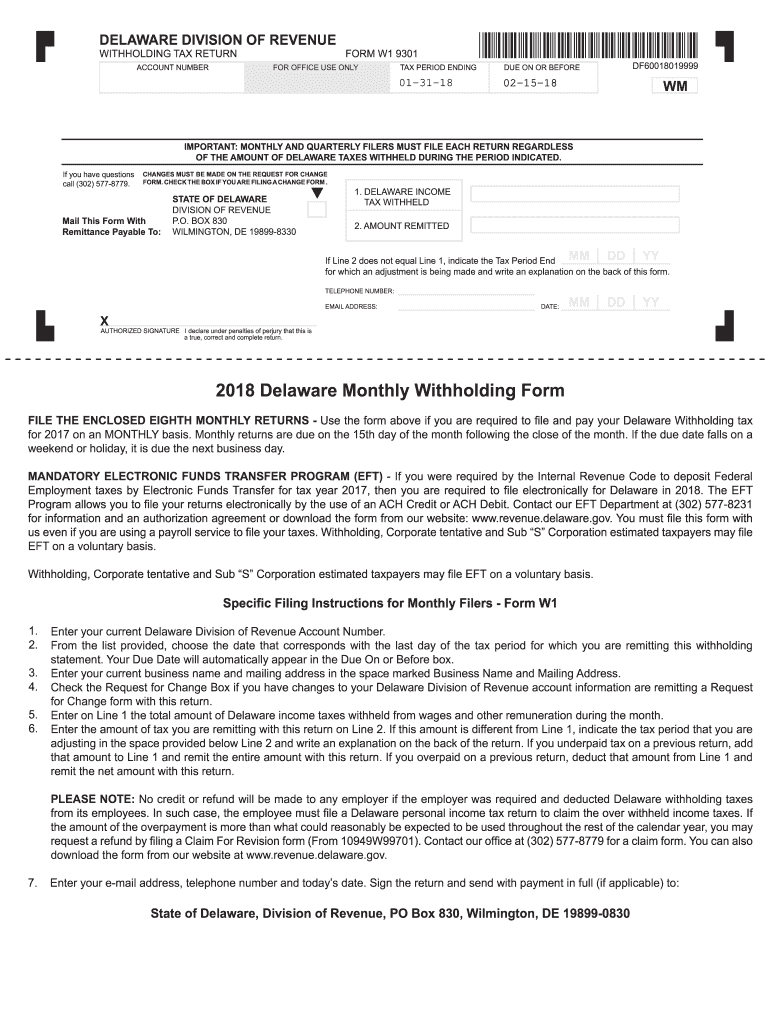

The Delaware State Withholding Form, often referred to as Form W-1, is a crucial document for employees and employers in Delaware. This form is used to determine the amount of state income tax that should be withheld from an employee's paycheck. It is essential for ensuring compliance with state tax laws and for the accurate reporting of income tax obligations. The form collects information about the employee’s filing status, allowances claimed, and additional withholding requests, which directly influence the withholding amount.

How to use the Delaware State Withholding Form

Using the Delaware State Withholding Form involves several steps to ensure accurate completion. First, employees need to fill out the form with their personal information, including name, address, and Social Security number. Next, they must indicate their filing status and the number of allowances they wish to claim. Employees may also choose to specify any additional amount they want withheld from their paychecks. Once completed, the form should be submitted to the employer, who will then use this information to calculate the appropriate state tax withholding from the employee's wages.

Steps to complete the Delaware State Withholding Form

Completing the Delaware State Withholding Form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Delaware State Withholding Form.

- Fill in your personal details, including your full name, address, and Social Security number.

- Select your filing status (single, married, etc.) and indicate the number of allowances you are claiming.

- If desired, specify any additional amount to be withheld from your paycheck.

- Review the completed form for accuracy and sign it.

- Submit the form to your employer for processing.

Legal use of the Delaware State Withholding Form

The Delaware State Withholding Form is legally binding once it is signed and submitted to the employer. It must be filled out accurately to ensure compliance with Delaware tax regulations. Employers are required to maintain this form on file for their records and must adhere to the withholding amounts specified by the employee. Failure to comply with the legal requirements associated with this form can result in penalties for both employees and employers.

Who Issues the Form

The Delaware State Withholding Form is issued by the Delaware Division of Revenue. This state agency is responsible for administering tax laws and ensuring that all tax-related forms are compliant with current regulations. Employees and employers can access the form through the Division of Revenue's official website or request it directly from the agency.

Form Submission Methods (Online / Mail / In-Person)

The Delaware State Withholding Form can be submitted through various methods, depending on employer preferences. Typically, employees can provide the completed form in person or via mail. Some employers may also offer the option to submit the form electronically through their payroll systems. It is important for employees to confirm the preferred submission method with their employer to ensure timely processing.

Quick guide on how to complete delaware state withholding form 2019

Complete Delaware State Withholding Form effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage Delaware State Withholding Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-oriented process now.

How to alter and eSign Delaware State Withholding Form effortlessly

- Locate Delaware State Withholding Form and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Delaware State Withholding Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware state withholding form 2019

Create this form in 5 minutes!

How to create an eSignature for the delaware state withholding form 2019

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Delaware state tax withholding form?

The Delaware state tax withholding form is a document required by the Delaware Division of Revenue for employers to report and withhold state income taxes from employees' wages. This form ensures compliance with state tax laws and helps streamline tax reporting processes.

-

How can airSlate SignNow help with Delaware state tax withholding form forms?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign Delaware state tax withholding form forms seamlessly. Our user-friendly solution simplifies the entire process, making it easy to manage tax documents electronically.

-

Are there any costs associated with using airSlate SignNow for Delaware state tax withholding form forms?

While airSlate SignNow offers a range of pricing plans, users can start with a free trial to explore its features. Pricing is competitive and designed to provide value for businesses that need to manage Delaware state tax withholding form forms and other documents efficiently.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as eSignature, document templates, and secure storage to help you manage Delaware state tax withholding form forms effectively. Additionally, workflow automation helps streamline the document signing process, saving time and reducing errors.

-

Is airSlate SignNow compliant with Delaware state tax regulations?

Yes, airSlate SignNow is fully compliant with Delaware state tax regulations. Our platform ensures that all Delaware state tax withholding form forms are created and processed in accordance with legal requirements, safeguarding your business against potential issues.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers integrations with popular software applications, making it easy to connect your existing systems to manage Delaware state tax withholding form forms seamlessly. This flexibility allows for a smooth data flow and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for Delaware state tax withholding form forms provides numerous benefits, including increased efficiency, reduced paperwork, and the ability to manage documents remotely. The eSigning feature accelerates approval processes, enabling faster turnaround times for tax compliance.

Get more for Delaware State Withholding Form

Find out other Delaware State Withholding Form

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed