5081 Instructions 5081 Instructions 2021

What is the form 5081?

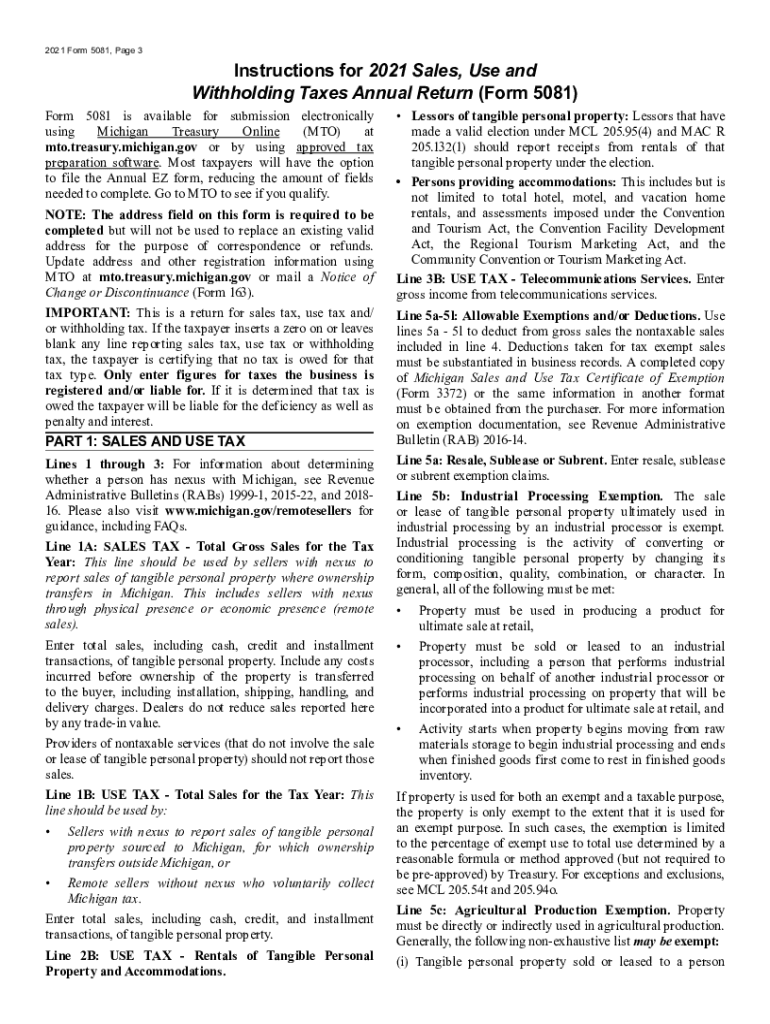

The form 5081 is a tax-related document used in Michigan, specifically for reporting and remitting various withholding taxes. This form is essential for businesses and individuals who need to comply with state tax regulations. The 5081 form serves as a declaration of the amount withheld from employee wages and other payments, ensuring that the state receives the appropriate tax revenue.

Steps to complete the form 5081

Completing the form 5081 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, employee information, and the total amount of taxes withheld. Next, accurately fill out each section of the form, ensuring that all figures are correct. After completing the form, review it for any errors, as inaccuracies can lead to penalties. Finally, submit the form either electronically or via mail, depending on your preference and the requirements set by the state.

Filing deadlines for the form 5081

It is important to be aware of the filing deadlines for the form 5081 to avoid penalties. Typically, the form must be submitted on a quarterly basis, with specific due dates depending on the reporting period. For example, the deadlines for the first quarter, second quarter, third quarter, and fourth quarter are set by the Michigan Department of Treasury. Failing to submit the form by these deadlines can result in late fees and interest on unpaid taxes.

Legal use of the form 5081

The legal use of the form 5081 is governed by Michigan tax laws. This form must be filled out accurately to ensure compliance with state regulations. The information provided on the form is used by the state to verify that businesses are correctly withholding and remitting taxes. Inaccuracies or failure to file can lead to legal repercussions, including fines and audits. Therefore, it is crucial to understand the legal implications of submitting the form.

Required documents for the form 5081

When preparing to complete the form 5081, certain documents are required to ensure accurate reporting. These documents typically include payroll records, employee tax withholding information, and any previous tax filings related to withholding. Having these documents on hand will facilitate the completion of the form and help ensure that all information is accurate and compliant with state regulations.

Form submission methods for the form 5081

The form 5081 can be submitted through various methods, providing flexibility for users. Options include online submission via the Michigan Department of Treasury's website, mailing a printed copy of the form, or submitting it in person at designated state offices. Each method has its own guidelines and requirements, so it is essential to choose the one that best suits your needs and to follow the specific instructions provided for that submission method.

Penalties for non-compliance with the form 5081

Non-compliance with the requirements of the form 5081 can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits by the state. Additionally, businesses may face increased scrutiny from tax authorities if they consistently fail to comply with reporting requirements. Understanding these penalties is crucial for maintaining good standing with state tax obligations.

Quick guide on how to complete 5081 instructions 5081 instructions

Effortlessly Prepare 5081 Instructions 5081 Instructions on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 5081 Instructions 5081 Instructions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign 5081 Instructions 5081 Instructions with Ease

- Locate 5081 Instructions 5081 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, via email, SMS, or sharing a link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 5081 Instructions 5081 Instructions and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5081 instructions 5081 instructions

Create this form in 5 minutes!

How to create an eSignature for the 5081 instructions 5081 instructions

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the form 5081 form used for?

The form 5081 form is essential for documenting various business processes. It serves as a formal template for collecting necessary information and obtaining signatures on important documents. Utilizing the form 5081 form ensures legal compliance and streamlines workflows.

-

How does airSlate SignNow help with the form 5081 form?

airSlate SignNow simplifies the process of filling out and sending the form 5081 form. Our platform allows users to easily upload, edit, and securely eSign documents, ensuring that the form 5081 form is handled efficiently. This enhances overall productivity and reduces the time spent on paperwork.

-

Is there a cost associated with using the form 5081 form on airSlate SignNow?

Pricing for using the form 5081 form on airSlate SignNow varies based on the selected plan. We offer several options to fit different business needs, ensuring cost-effective access to all features, including sending and eSigning the form 5081 form. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for the form 5081 form?

airSlate SignNow provides advanced features for managing the form 5081 form, including customizable templates, real-time collaboration, and automated reminders. Users can easily track the status of the form 5081 form and receive notifications when it’s completed. This flexibility makes document management straightforward.

-

Can I integrate airSlate SignNow with other applications for the form 5081 form?

Yes, airSlate SignNow allows integration with numerous applications to enhance the process of managing the form 5081 form. You can connect with popular tools like Google Drive, Salesforce, and more, making access and sharing seamless. This integration capability supports better workflow automation.

-

What benefits does using the form 5081 form with airSlate SignNow provide?

Using the form 5081 form with airSlate SignNow offers several advantages, such as increased efficiency, improved accuracy, and enhanced security. Electronic signatures reduce the chances of errors and expedite the approval process, allowing businesses to focus on core activities. Additionally, compliance and audit trails are automatic.

-

Is it secure to send the form 5081 form through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, employing encryption and secure access protocols to protect your form 5081 form and sensitive information. Our platform complies with industry standards, ensuring that your documents are safe from unauthorized access. You can trust us for your digital signatures.

Get more for 5081 Instructions 5081 Instructions

Find out other 5081 Instructions 5081 Instructions

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile