Get and Sign MI Form 5081 Sales, Use and Withholding Taxes Annual Return 5081, Sales, Use and Withholding Taxes AnnualGet and Sig 2022-2026

Understanding the MI Form 5081

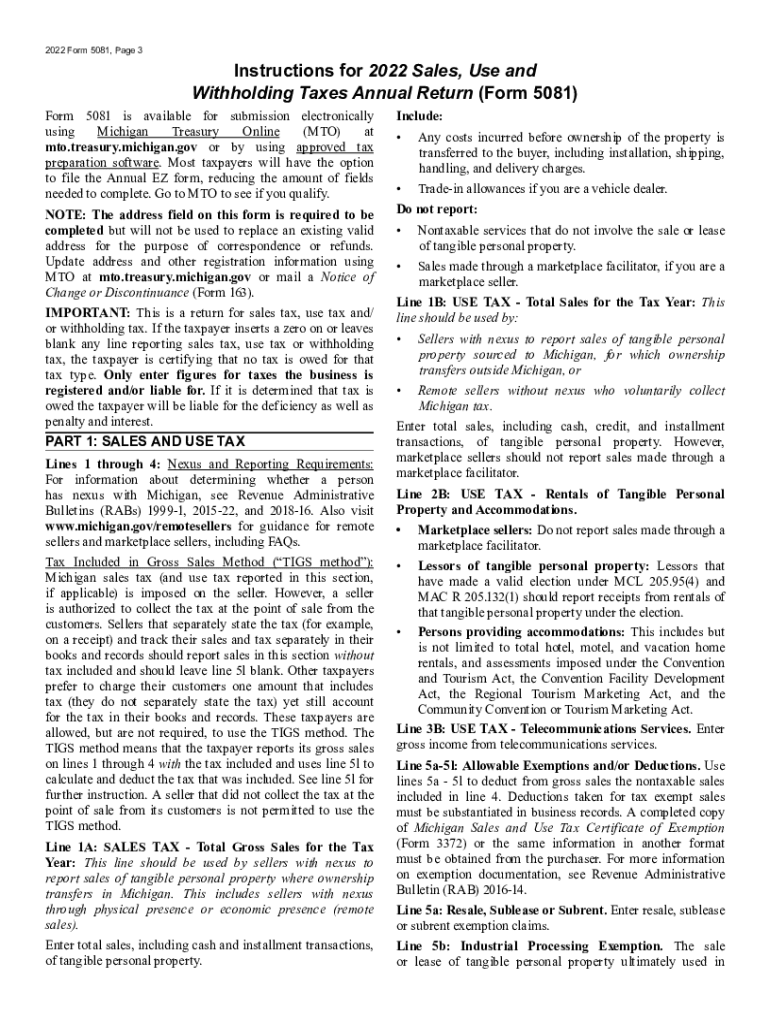

The MI Form 5081, officially known as the Sales, Use, and Withholding Taxes Annual Return, is a crucial document for businesses operating in Michigan. This form is primarily used to report sales and use tax collected, as well as withholding taxes for employees. It is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately.

Steps to Complete the MI Form 5081

Filling out the MI Form 5081 requires careful attention to detail. Here are the steps to complete the form:

- Gather necessary financial records, including sales receipts and payroll information.

- Enter the total sales and taxable sales figures in the designated sections.

- Calculate the total sales tax collected and any applicable use tax.

- Report the amount of withholding tax for employees.

- Double-check all entries for accuracy before submission.

Legal Use of the MI Form 5081

The legal use of the MI Form 5081 is governed by Michigan state tax laws. Accurate completion and timely filing of this form are essential to avoid penalties. The form serves as a legal declaration of the sales and use tax collected and the withholding taxes remitted, making it a vital document for both businesses and the state.

Filing Deadlines and Important Dates

Businesses must be aware of the filing deadlines for the MI Form 5081 to ensure compliance. Typically, the annual return is due by January thirty-first of the following year. It is important to stay informed about any changes in deadlines or requirements that may arise from state tax authorities.

Form Submission Methods

The MI Form 5081 can be submitted through various methods to accommodate different business needs:

- Online submission: Many businesses prefer to file electronically for convenience and speed.

- Mail: The completed form can be mailed to the appropriate state tax office.

- In-person: Businesses may also choose to submit the form in person at designated state offices.

Penalties for Non-Compliance

Failure to file the MI Form 5081 on time or inaccuracies in reporting can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal actions. It is crucial for businesses to understand the implications of non-compliance to avoid unnecessary financial burdens.

Quick guide on how to complete mi form 5081 sales use and withholding taxes annual returnget and sign 5081 sales use and withholding taxes annualget and sign

Complete MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig effortlessly on any device

Digital document management has become well-liked by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig without hassle

- Find MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tiresome searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Alter and eSign MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi form 5081 sales use and withholding taxes annual returnget and sign 5081 sales use and withholding taxes annualget and sign

Create this form in 5 minutes!

People also ask

-

What is the 5081 form 2023, and why is it important?

The 5081 form 2023 is a specific document required for various administrative purposes. Understanding the significance of this form can help businesses maintain compliance and streamline their operations. airSlate SignNow simplifies the process of accessing and eSigning the 5081 form 2023, making it easier for you to manage your paperwork.

-

How can airSlate SignNow help with the 5081 form 2023?

airSlate SignNow provides a user-friendly platform for businesses to send, fill out, and electronically sign the 5081 form 2023. The platform ensures that your documents are secure and easily accessible. This saves time and reduces the likelihood of errors associated with paper-based forms.

-

What are the pricing options for using airSlate SignNow for the 5081 form 2023?

airSlate SignNow offers various pricing plans to accommodate all business sizes, which include options for handling the 5081 form 2023. You can choose from monthly or yearly subscriptions, with discounts available for annual commitments. Each plan includes features specifically tailored to streamline the eSigning process.

-

What features does airSlate SignNow offer for processing the 5081 form 2023?

With airSlate SignNow, you can easily integrate templates, create workflows, and automate reminders for the 5081 form 2023. The platform also supports secure cloud storage for your signed documents. Additionally, you can track the status of your documents in real-time for enhanced oversight.

-

Is my data safe when using airSlate SignNow for the 5081 form 2023?

Yes, safeguarding your information is a top priority for airSlate SignNow. The platform employs robust encryption and security measures to protect your data when handling the 5081 form 2023. This ensures that only authorized users can access and sign your important documents.

-

Can I integrate airSlate SignNow with other software for managing the 5081 form 2023?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your ability to manage the 5081 form 2023. This flexibility allows you to use the platform alongside tools like CRMs and document management systems for a more efficient workflow.

-

How does airSlate SignNow simplify the signing process for the 5081 form 2023?

airSlate SignNow simplifies the signing process for the 5081 form 2023 by allowing users to eSign documents from any device, anywhere. The intuitive interface makes it easy to navigate and complete forms quickly. This flexibility is particularly beneficial for busy professionals who need to manage documentation on the go.

Get more for MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig

- Renovation contract for contractor north dakota form

- Concrete mason contract for contractor north dakota form

- Demolition contract for contractor north dakota form

- Framing contract for contractor north dakota form

- Security contract for contractor north dakota form

- Insulation contract for contractor north dakota form

- Paving contract for contractor north dakota form

- Site work contract for contractor north dakota form

Find out other MI Form 5081 Sales, Use And Withholding Taxes Annual ReturnGet And Sign 5081, Sales, Use And Withholding Taxes AnnualGet And Sig

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors