Form 1 Massachusetts Resident Income Tax Return 2020-2026

What is the Form 1 Massachusetts Resident Income Tax Return

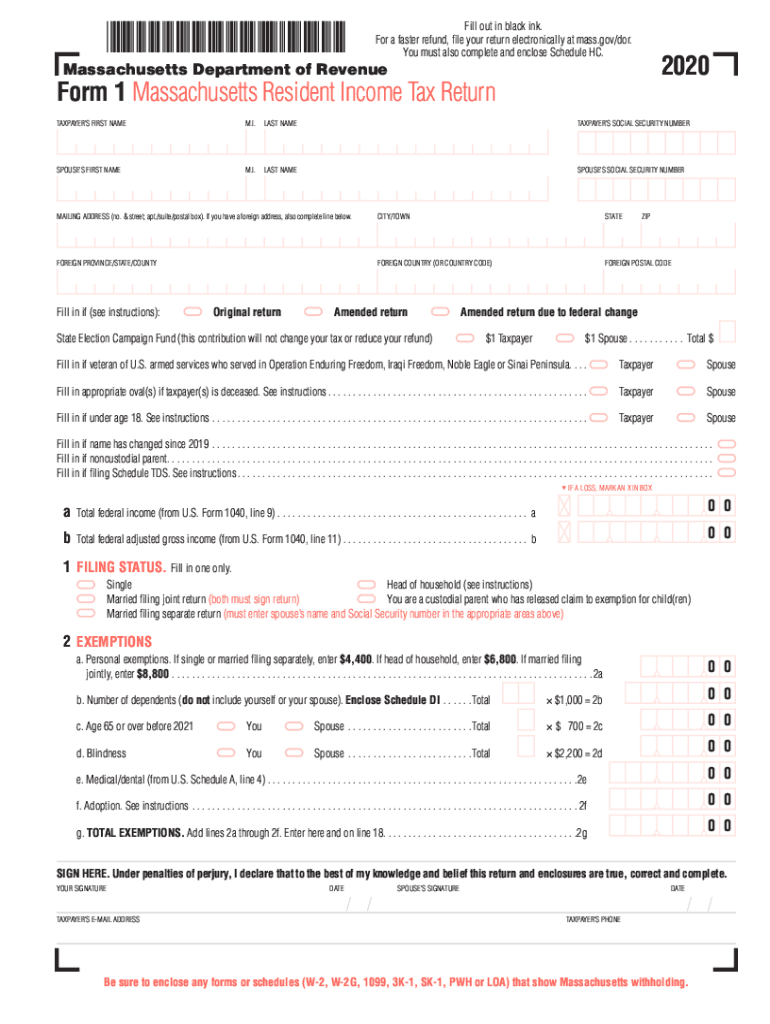

The Form 1 Massachusetts Resident Income Tax Return is a critical document for individuals residing in Massachusetts who need to report their income and calculate their tax liability. This form is specifically designed for residents and is used to declare various types of income, including wages, interest, dividends, and capital gains. Completing this form accurately is essential for compliance with state tax laws and to ensure that taxpayers receive any eligible refunds or credits.

Steps to Complete the Form 1 Massachusetts Resident Income Tax Return

Completing the Form 1 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately report all sources of income on the designated lines, ensuring to include any adjustments or deductions.

- Calculate tax liability: Use the provided tax tables to determine your tax owed based on your reported income.

- Claim credits and deductions: Identify any applicable credits or deductions that can reduce your tax liability.

- Sign and date the form: Ensure that you sign and date the form before submission, as an unsigned form may be considered invalid.

Legal Use of the Form 1 Massachusetts Resident Income Tax Return

The legal use of the Form 1 is governed by Massachusetts state tax regulations. It must be completed in accordance with the guidelines provided by the Massachusetts Department of Revenue. Submitting an accurate and timely Form 1 is essential to avoid penalties and ensure compliance with state laws. The information provided on this form is used by the state to assess individual tax obligations and verify income claims.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form 1 to avoid late penalties. Typically, the deadline for filing the Massachusetts Resident Income Tax Return is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, as well as the importance of timely payment of any taxes owed to avoid interest and penalties.

Required Documents

To complete the Form 1, taxpayers need to gather several important documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for deductions and credits, such as receipts for charitable contributions or educational expenses

Form Submission Methods

Taxpayers have several options for submitting the Form 1 Massachusetts Resident Income Tax Return:

- Online: Many taxpayers choose to file electronically using tax preparation software, which can streamline the process and reduce errors.

- By mail: Completed forms can be printed and mailed to the appropriate address as specified by the Massachusetts Department of Revenue.

- In-person: Some taxpayers may prefer to submit their forms in person at local tax offices, especially if they have questions or require assistance.

Quick guide on how to complete 2020 form 1 massachusetts resident income tax return

Effortlessly Prepare Form 1 Massachusetts Resident Income Tax Return on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your paperwork rapidly without any hold-ups. Handle Form 1 Massachusetts Resident Income Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 1 Massachusetts Resident Income Tax Return with Ease

- Locate Form 1 Massachusetts Resident Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet-ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Alter and electronically sign Form 1 Massachusetts Resident Income Tax Return to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1 massachusetts resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1 massachusetts resident income tax return

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is mass dor 2000 and how does it relate to airSlate SignNow?

Mass dor 2000 is a cutting-edge feature within airSlate SignNow that streamlines document signing and management. This feature allows users to efficiently process large volumes of documents, making it ideal for businesses that require quick and reliable eSignature solutions.

-

How much does airSlate SignNow with mass dor 2000 cost?

The pricing for airSlate SignNow with mass dor 2000 varies based on the plan you choose. We offer several pricing options to accommodate businesses of all sizes, ensuring that you get the best value for a robust eSigning solution.

-

What are the key features of mass dor 2000 in airSlate SignNow?

Mass dor 2000 includes features such as bulk sending of documents, advanced tracking capabilities, and seamless integrations with other business tools. These functionalities enhance productivity and ensure a smooth signing experience for users.

-

Are there any benefits to using mass dor 2000 for document management?

Yes, using mass dor 2000 offers numerous benefits, including signNow time savings and improved accuracy in document handling. It allows organizations to manage their workflows more efficiently while reducing the chances of errors during the signing process.

-

Can mass dor 2000 integrate with other software?

Absolutely! Mass dor 2000 easily integrates with popular CRM, project management, and cloud storage solutions. This capability ensures that your document management process is seamlessly connected with your existing workflows.

-

Is support available for users of mass dor 2000?

Yes, users of mass dor 2000 have access to comprehensive support from the airSlate SignNow team. Whether you need help with setup or have questions about features, our customer support is here to assist you effectively.

-

How does mass dor 2000 enhance compliance in document signing?

Mass dor 2000 enhances compliance by offering secure eSigning features that meet industry standards and regulations. This helps businesses ensure that their documents are signed in compliance with legal requirements, minimizing potential risks.

Get more for Form 1 Massachusetts Resident Income Tax Return

Find out other Form 1 Massachusetts Resident Income Tax Return

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later