Massachusetts Resident Tax Form 2018

What is the Massachusetts Resident Tax Form

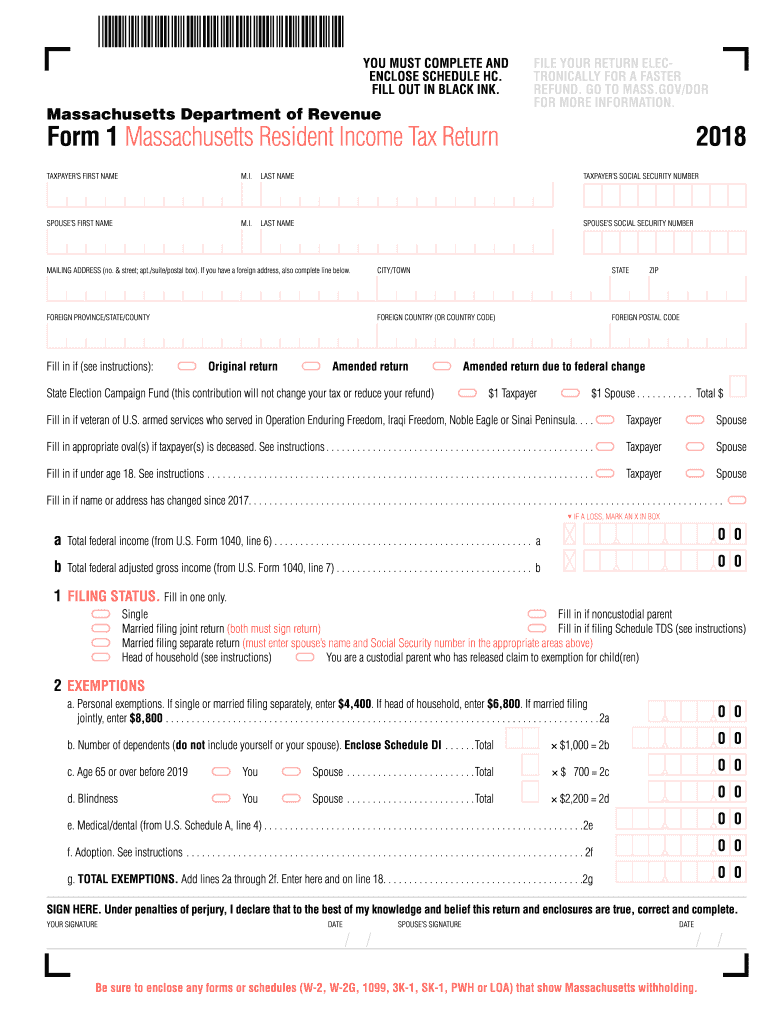

The Massachusetts Resident Tax Form, commonly referred to as Form 1, is the primary document used by residents of Massachusetts to report their income and calculate their state tax liability. This form is designed for individuals who are full-time residents of the state and need to report all sources of income, including wages, interest, dividends, and capital gains. The form allows taxpayers to claim various deductions and credits available under Massachusetts tax law, ensuring they pay the correct amount of state tax.

How to obtain the Massachusetts Resident Tax Form

Taxpayers can obtain the Massachusetts Resident Tax Form from several sources. The form is available for download on the Massachusetts Department of Revenue (DOR) website, where individuals can access the most current version. Additionally, physical copies of the form can often be found at local libraries, post offices, and municipal offices. For convenience, many taxpayers choose to fill out the form electronically through tax preparation software, which often includes the necessary forms and guidance for completion.

Steps to complete the Massachusetts Resident Tax Form

Completing the Massachusetts Resident Tax Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the appropriate sections of the form.

- Claim any deductions and credits that apply to your situation, such as the personal exemption or credit for taxes paid to other jurisdictions.

- Calculate your total tax liability and any refund or balance due.

- Review the form for accuracy before signing and dating it.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Massachusetts Resident Tax Form. The form can be filed electronically using approved tax software, which often provides a streamlined process for submission. Alternatively, individuals may choose to print the completed form and mail it to the appropriate address as specified by the Massachusetts DOR. For those who prefer in-person submissions, some local DOR offices may accept forms directly, although it is advisable to check ahead for availability and any specific requirements.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines for the Massachusetts Resident Tax Form to avoid penalties. Typically, the deadline for filing is April fifteenth of each year, aligning with the federal tax deadline. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may file to postpone their submission, as well as the deadlines for making payments on any taxes owed.

Key elements of the Massachusetts Resident Tax Form

The Massachusetts Resident Tax Form includes several key elements that taxpayers must complete:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Sections for reporting wages, interest, dividends, and other income sources.

- Deductions and Credits: Areas to claim allowable deductions and tax credits.

- Tax Calculation: A section for calculating total tax owed or refund due.

- Signature: A space for the taxpayer's signature and date to validate the form.

Quick guide on how to complete mass dor fillable formpdffillercom 2018 2019

Your assistance manual on how to prepare your Massachusetts Resident Tax Form

If you wish to learn how to finalize and submit your Massachusetts Resident Tax Form, here are a few concise guidelines to simplify tax declarations.

To start, simply register for your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an incredibly user-friendly and efficient document solution that enables you to modify, create, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit any section to adjust details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Massachusetts Resident Tax Form in just a few minutes:

- Set up your account and start editing PDFs within minutes.

- Browse our library to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Massachusetts Resident Tax Form in our editor.

- Fill out the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save your changes, print a copy, send it to your recipient, and download it to your device.

Refer to this guide for filing your taxes digitally with airSlate SignNow. Please keep in mind that submitting paper forms can lead to errors in returns and delays in refunds. Of course, before electronically filing your taxes, verify the submission guidelines on the IRS website for your state.

Create this form in 5 minutes or less

Find and fill out the correct mass dor fillable formpdffillercom 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

Create this form in 5 minutes!

How to create an eSignature for the mass dor fillable formpdffillercom 2018 2019

How to generate an electronic signature for your Mass Dor Fillable Formpdffillercom 2018 2019 in the online mode

How to generate an eSignature for the Mass Dor Fillable Formpdffillercom 2018 2019 in Google Chrome

How to create an eSignature for putting it on the Mass Dor Fillable Formpdffillercom 2018 2019 in Gmail

How to make an electronic signature for the Mass Dor Fillable Formpdffillercom 2018 2019 straight from your mobile device

How to make an eSignature for the Mass Dor Fillable Formpdffillercom 2018 2019 on iOS devices

How to make an electronic signature for the Mass Dor Fillable Formpdffillercom 2018 2019 on Android

People also ask

-

What are Massachusetts tax return forms?

Massachusetts tax return forms are official documents used by residents and businesses in Massachusetts to report their income and calculate their tax liability. These forms are necessary for accurately filing state taxes and ensuring compliance with Massachusetts tax laws.

-

How can airSlate SignNow help with filling out Massachusetts tax return forms?

airSlate SignNow streamlines the process of filling out Massachusetts tax return forms by providing easy-to-use templates and an intuitive interface. Users can quickly fill out, sign, and send these forms electronically, saving time and reducing errors often associated with manual completion.

-

Are there any costs associated with using airSlate SignNow for Massachusetts tax return forms?

airSlate SignNow offers various pricing plans to fit different business needs, including options for sending and eSigning Massachusetts tax return forms. You can choose a plan that aligns with your volume of documents, making it a cost-effective solution for managing tax-related paperwork.

-

Can I integrate airSlate SignNow with other software for preparing Massachusetts tax return forms?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your workflow for Massachusetts tax return forms efficiently. This integration means you can pull in data from other sources, reducing the need for repetitive data entry and minimizing mistakes.

-

Is it secure to use airSlate SignNow for submitting Massachusetts tax return forms?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure data storage, to protect your Massachusetts tax return forms. Your sensitive information remains private and secure throughout the signing and submission processes.

-

What are the benefits of using airSlate SignNow for Massachusetts tax return forms?

Using airSlate SignNow for Massachusetts tax return forms offers numerous benefits, including increased efficiency, enhanced accuracy, and simplified collaboration. The platform allows for real-time tracking and notifications, ensuring that you never miss a deadline.

-

Can I access my completed Massachusetts tax return forms through airSlate SignNow?

Yes, once you complete your Massachusetts tax return forms using airSlate SignNow, you can easily access and store them in your account. This feature ensures you have all your important tax documents readily available when necessary.

Get more for Massachusetts Resident Tax Form

- Pharmacy exception review request form astellasaccess com

- Ctc name change form

- Sample authorization letter for birth certificate form

- Dougherty county school system purchasing department reset vendor performance evaluation for dougherty county school system

- Student medical certificate form

- Industrial service survey results london transit commission form

- Aoda customer feedback form haver boecker canada wstyler

- Nechako lakes school district home form

Find out other Massachusetts Resident Tax Form

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement