Indiana Form Wh 4 Instructions Forms in Gov

Understanding the Indiana Form WH-4

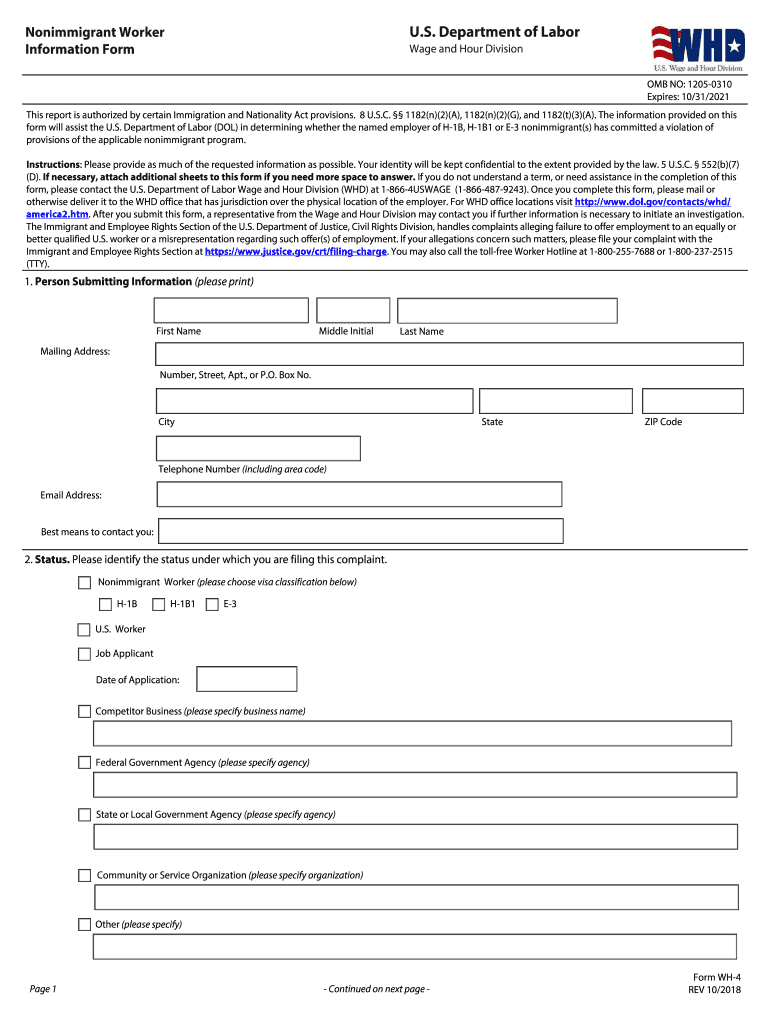

The Indiana Form WH-4 is a state-specific document used by employees to indicate their state tax withholding preferences. This form is essential for ensuring that the correct amount of state income tax is withheld from an employee's paycheck. By accurately completing the WH-4, employees can manage their tax liabilities effectively throughout the year. This form is particularly relevant for those who have recently changed their tax situation or moved to Indiana.

Steps to Complete the Indiana Form WH-4

Completing the Indiana Form WH-4 involves several straightforward steps. First, employees should gather their personal information, including their Social Security number and address. Next, they need to indicate their filing status, which can affect the withholding amount. The form includes sections where employees can specify additional withholding amounts if desired. After filling out the form, it should be signed and dated before submission to the employer's payroll department.

Legal Use of the Indiana Form WH-4

The Indiana Form WH-4 is legally binding once completed and submitted. It is crucial for both employers and employees to understand that this form must be filled out accurately to comply with state tax laws. Incorrect information can lead to improper withholding, resulting in potential penalties or unexpected tax liabilities for the employee. Employers are responsible for ensuring that they process the WH-4 correctly and adhere to state regulations regarding tax withholding.

Filing Deadlines and Important Dates

Employees should be aware of specific deadlines related to the Indiana Form WH-4. Typically, the form should be submitted to the employer as soon as there is a change in tax situation or when starting a new job. Additionally, employers must ensure that the withholding adjustments are made in a timely manner, aligning with the state’s payroll schedule. Keeping track of these dates helps prevent issues with tax withholding throughout the year.

Examples of Using the Indiana Form WH-4

There are various scenarios in which an employee might need to use the Indiana Form WH-4. For instance, if an employee has recently gotten married, they may wish to adjust their withholding based on their new filing status. Similarly, if an employee has taken on a second job, they might need to complete a WH-4 to ensure appropriate withholding from both sources of income. Understanding these examples can help employees make informed decisions about their tax withholding preferences.

Obtaining the Indiana Form WH-4

The Indiana Form WH-4 can be easily obtained from the Indiana Department of Revenue's website or through various state government resources. Employers may also provide copies of the form to new hires or employees requesting it. It is important to ensure that the most current version of the form is used, as outdated forms may not comply with current tax regulations.

Quick guide on how to complete indiana form wh 4 instructions formsingov

Complete Indiana Form Wh 4 Instructions Forms in gov effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents rapidly and without any delays. Manage Indiana Form Wh 4 Instructions Forms in gov on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to revise and eSign Indiana Form Wh 4 Instructions Forms in gov with ease

- Find Indiana Form Wh 4 Instructions Forms in gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Indiana Form Wh 4 Instructions Forms in gov and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana form wh 4 instructions formsingov

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it help with document management?

airSlate SignNow is a user-friendly eSignature platform that empowers businesses to send and eSign documents efficiently. Understanding how to wh 4 with the platform can streamline your document workflows and enhance productivity, making it easier to manage contracts and agreements.

-

How much does airSlate SignNow cost for businesses?

Pricing for airSlate SignNow is competitive and designed to fit various business needs. To learn how to wh 4 and budget for this solution, you can explore our pricing tiers, which offer customizable plans to suit every organization’s requirements.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features like customizable templates, secure storage, and real-time tracking of document status. By knowing how to wh 4, users can fully leverage these features to enhance collaboration and speed up the eSigning process.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is compliant with industry standards such as ESIGN and UETA. Understanding how to wh 4 can help ensure that your electronic signatures are legally binding and secure, providing peace of mind for your business transactions.

-

Can I integrate airSlate SignNow with other software applications?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Zapier. If you are looking to learn how to wh 4 with existing tools, these integrations can optimize your workflow and enhance your overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning?

By utilizing airSlate SignNow, businesses can reduce turnaround time for contracts and improve overall efficiency in document management. Understanding how to wh 4 allows you to take full advantage of these benefits, enabling faster decision-making and enhanced customer satisfaction.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to send and sign documents on the go. Learning how to wh 4 using the app ensures that you can manage your signing tasks from anywhere, providing flexibility to busy professionals.

Get more for Indiana Form Wh 4 Instructions Forms in gov

- Financial game plan form

- Education affidavit form

- Manufacturing data record adalah form

- Leading figures of the renaissance word search puzzle answer key form

- State bar of california osaac certificate application for out form

- Daily attendance arrival amp departure record form

- Event sponsorship agreement the gregory school gregoryschool form

- Volunteer waiver montgomery county food bank form

Find out other Indiana Form Wh 4 Instructions Forms in gov

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile