Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions Form

What is the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions

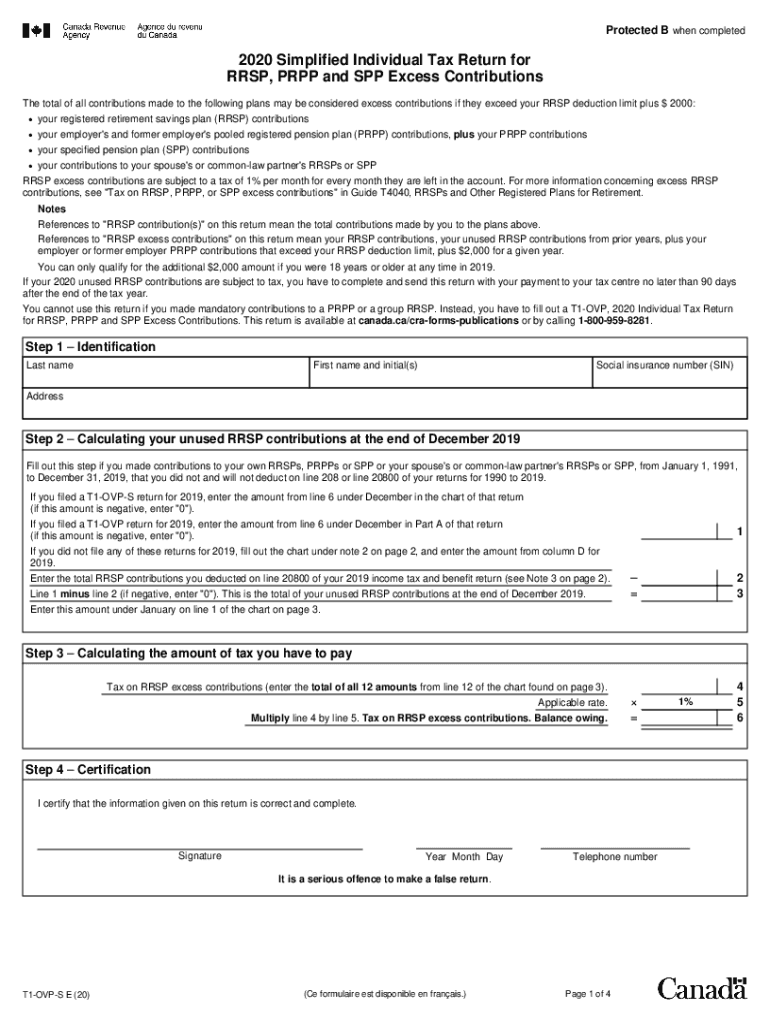

The Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions, commonly referred to as the t1 ovp form, is designed for individuals who have made excess contributions to their Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP). This form allows taxpayers to report and rectify these excess contributions, ensuring compliance with tax regulations. It helps in calculating any applicable penalties and reclaiming any overpaid taxes associated with these contributions.

Steps to Complete the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions

Completing the t1 ovp form involves several key steps:

- Gather necessary documentation, including your RRSP contribution receipts and any relevant tax information.

- Fill out the personal information section, ensuring that your name, address, and Social Security number are accurate.

- Report the total excess contributions made to your RRSP, PRPP, or SPP for the tax year.

- Calculate any penalties for excess contributions using the provided guidelines on the form.

- Sign and date the form to validate your submission.

Legal Use of the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions

The t1 ovp form is legally recognized for reporting excess contributions to retirement savings plans. It complies with the Canada Revenue Agency (CRA) regulations, ensuring that taxpayers can accurately report their financial activities. Submitting this form allows individuals to address any discrepancies in their tax filings and avoid potential penalties associated with excess contributions.

Required Documents for the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions

To successfully complete the t1 ovp form, you will need the following documents:

- RRSP contribution receipts for the tax year in question.

- Any tax documents related to your PRPP or SPP contributions.

- Previous tax returns, if applicable, to reference prior contributions.

- Identification documents, such as your Social Security number or taxpayer identification number.

Form Submission Methods for the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions

The t1 ovp form can be submitted through various methods, including:

- Online submission via the CRA's secure portal, which allows for quicker processing.

- Mailing a hard copy of the completed form to the designated CRA address.

- In-person submission at local CRA offices, if preferred.

Examples of Using the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions

Individuals may find themselves needing to use the t1 ovp form in various scenarios, such as:

- Exceeding the annual contribution limit for their RRSP due to unexpected income increases.

- Contributing to both an RRSP and a PRPP, leading to unintentional excess contributions.

- Receiving tax advice that results in additional contributions beyond the allowable limit.

Quick guide on how to complete 2020 simplified individual tax return for rrsp prpp and spp excess contributions

Easily Prepare Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions on Any Gadget

Managing documents online has become increasingly popular among companies and individuals alike. It offers a perfect eco-conscious alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any hindrances. Handle Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Alter and eSign Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions Effortlessly

- Obtain Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 simplified individual tax return for rrsp prpp and spp excess contributions

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is a t1 ovp form?

The t1 ovp form is a specific document that facilitates the process of electronic signing and document management. With airSlate SignNow, users can easily create, send, and eSign their t1 ovp forms efficiently, ensuring all legal requirements are met.

-

How can I create a t1 ovp form using airSlate SignNow?

Creating a t1 ovp form with airSlate SignNow is straightforward. Simply upload your document, add the necessary fields for signatures and information, and then share it with the recipients for eSigning. Our user-friendly interface streamlines this process signNowly.

-

Is there a cost associated with using the t1 ovp form feature?

Yes, using the t1 ovp form feature is part of the airSlate SignNow subscription plans. We offer various pricing tiers that cater to different business needs, allowing you to choose the plan that provides the best value for your requirements.

-

What are the benefits of using the t1 ovp form with airSlate SignNow?

Using the t1 ovp form with airSlate SignNow provides numerous benefits, including quicker turnaround times for signatures and reduced paperwork. It also enhances compliance by maintaining secure and organized document trails, which is crucial in today's digital environment.

-

Can I track the status of my t1 ovp forms?

Absolutely! With airSlate SignNow, you can easily track the status of your t1 ovp forms in real time. The platform provides notifications and updates, allowing you to know when your document has been viewed, signed, or completed.

-

What integrations are available for the t1 ovp form in airSlate SignNow?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Microsoft Office. These integrations enhance the functionality of your t1 ovp forms, allowing smooth workflows and data synchronization across platforms.

-

Is it secure to send and store t1 ovp forms using airSlate SignNow?

Yes, airSlate SignNow prioritizes security, ensuring that all your t1 ovp forms are encrypted both in transit and at rest. Our platform complies with industry standards for security and data protection, giving you peace of mind while managing your documents.

Get more for Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions

- Csc pds form

- Basic cheer motions pdf 302417020 form

- Blank uk postcode map form

- Telephone bid summary form schools nyc

- 9780134633282 pdf form

- Grade 8 long night of little boats close reading exemplar form

- Fillable online authorization to retrieve tsi placement test form

- Automatic authorization of returns form

Find out other Simplified Individual Tax Return For RRSP, PRPP, And SPP Excess Contributions

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile