CSU Member Claim Form Wells Fargo Insurance Services

What is the CSU Member Claim Form Wells Fargo Insurance Services

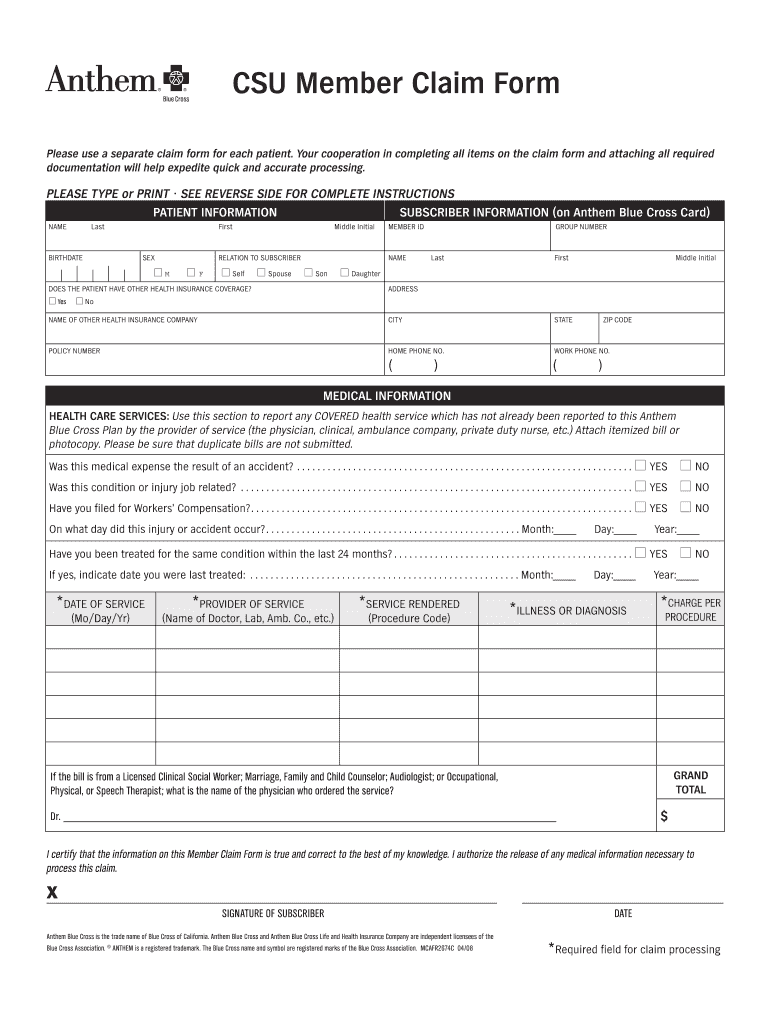

The CSU Member Claim Form Wells Fargo Insurance Services is a specific document designed for members of the California State University (CSU) system to submit claims related to their insurance policies. This form facilitates the process of reporting incidents and requesting compensation for covered losses. It is essential for members to understand the purpose of this form, as it serves as an official record of their claim and initiates the review process by the insurance provider.

Steps to complete the CSU Member Claim Form Wells Fargo Insurance Services

Completing the CSU Member Claim Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details, policy numbers, and specifics about the incident. Next, fill out the form carefully, providing detailed descriptions of the events leading to the claim. It is crucial to attach any supporting documentation, such as photographs or police reports, that substantiate the claim. Finally, review the completed form for errors before submission to ensure a smooth processing experience.

How to obtain the CSU Member Claim Form Wells Fargo Insurance Services

The CSU Member Claim Form can be obtained through various channels. Members can access the form online via the Wells Fargo Insurance Services website or through their CSU campus resources. Additionally, physical copies may be available at designated administrative offices within the CSU system. It is advisable to ensure that you have the most current version of the form to avoid any issues during the claim process.

Legal use of the CSU Member Claim Form Wells Fargo Insurance Services

The CSU Member Claim Form holds legal significance as it is used to document claims made under insurance policies. For the form to be legally binding, it must be filled out accurately and submitted in accordance with the terms outlined in the insurance policy. Compliance with relevant laws and regulations, such as the ESIGN Act, ensures that electronic submissions of the form are recognized as valid. This legal framework supports the authenticity of the signatures and the integrity of the submitted information.

Key elements of the CSU Member Claim Form Wells Fargo Insurance Services

Several key elements must be included in the CSU Member Claim Form to ensure its effectiveness. These elements typically consist of the claimant's personal information, policy details, a comprehensive description of the incident, and a list of any attached documents. Additionally, the form may require the claimant's signature and date to validate the submission. Including all necessary information helps expedite the claims process and increases the likelihood of a favorable outcome.

Form Submission Methods (Online / Mail / In-Person)

Submitting the CSU Member Claim Form can be done through various methods, providing flexibility for members. The form can be submitted online via the Wells Fargo Insurance Services portal, which allows for quick processing. Alternatively, members may choose to mail the completed form to the designated claims address or deliver it in person to their local CSU administrative office. Each method has its own timeline for processing, so members should consider their urgency when selecting a submission method.

Quick guide on how to complete csu member claim form wells fargo insurance services

Effortlessly prepare CSU Member Claim Form Wells Fargo Insurance Services on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly replacement for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Manage CSU Member Claim Form Wells Fargo Insurance Services on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign CSU Member Claim Form Wells Fargo Insurance Services without hassle

- Find CSU Member Claim Form Wells Fargo Insurance Services and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign CSU Member Claim Form Wells Fargo Insurance Services to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

How do I fill out the disability forms so well that my claim is approved?

Contact Barbara Case, the founder of USA: Providing Free Advocacy & Support She's incredible!

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the csu member claim form wells fargo insurance services

How to create an electronic signature for your Csu Member Claim Form Wells Fargo Insurance Services in the online mode

How to generate an electronic signature for your Csu Member Claim Form Wells Fargo Insurance Services in Google Chrome

How to generate an electronic signature for putting it on the Csu Member Claim Form Wells Fargo Insurance Services in Gmail

How to create an eSignature for the Csu Member Claim Form Wells Fargo Insurance Services straight from your smartphone

How to create an eSignature for the Csu Member Claim Form Wells Fargo Insurance Services on iOS

How to generate an electronic signature for the Csu Member Claim Form Wells Fargo Insurance Services on Android

People also ask

-

What is the CSU Member Claim Form Wells Fargo Insurance Services?

The CSU Member Claim Form Wells Fargo Insurance Services is a specific document designed for policyholders to submit claims related to their insurance. This form ensures that all necessary information is collected efficiently, enabling quick processing of claims. Using the CSU Member Claim Form can streamline your experience with Wells Fargo Insurance Services.

-

How do I fill out the CSU Member Claim Form Wells Fargo Insurance Services?

Filling out the CSU Member Claim Form Wells Fargo Insurance Services is straightforward. Begin by providing your personal and policy information, then detail the nature of your claim. Ensure all sections are completed accurately to avoid delays in processing.

-

What are the benefits of using the CSU Member Claim Form Wells Fargo Insurance Services?

Using the CSU Member Claim Form Wells Fargo Insurance Services helps expedite the claims process and ensures that you provide all necessary documentation in one submission. It also helps in maintaining organized records for your insurance claims with Wells Fargo. Additionally, using this form can improve communication with your insurance representative.

-

Is there a fee associated with submitting the CSU Member Claim Form Wells Fargo Insurance Services?

There is typically no fee for submitting the CSU Member Claim Form Wells Fargo Insurance Services. However, it’s always best to check your specific policy details or contact Wells Fargo Insurance Services for any potential charges related to claims processing.

-

Can I submit the CSU Member Claim Form Wells Fargo Insurance Services online?

Yes, you can submit the CSU Member Claim Form Wells Fargo Insurance Services online through the Wells Fargo Insurance Services portal. This digital submission option allows for a quicker and more efficient claims process, ensuring your documents are securely received and processed.

-

What information do I need to provide on the CSU Member Claim Form Wells Fargo Insurance Services?

On the CSU Member Claim Form Wells Fargo Insurance Services, you will need to provide personal information, policy details, and a description of the claim. Be prepared to include any supporting documents that may help substantiate your claim, as this can speed up the review process.

-

How long does it take to process the CSU Member Claim Form Wells Fargo Insurance Services?

The processing time for the CSU Member Claim Form Wells Fargo Insurance Services can vary, but typically it takes a few weeks. Factors such as the complexity of your claim and the volume of submissions can affect the timeline. Regularly checking in with Wells Fargo Insurance Services can help you stay updated on your claim status.

Get more for CSU Member Claim Form Wells Fargo Insurance Services

Find out other CSU Member Claim Form Wells Fargo Insurance Services

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online