Form 941 PR Rev March Internal Revenue Service

Understanding the 2021 Form 941

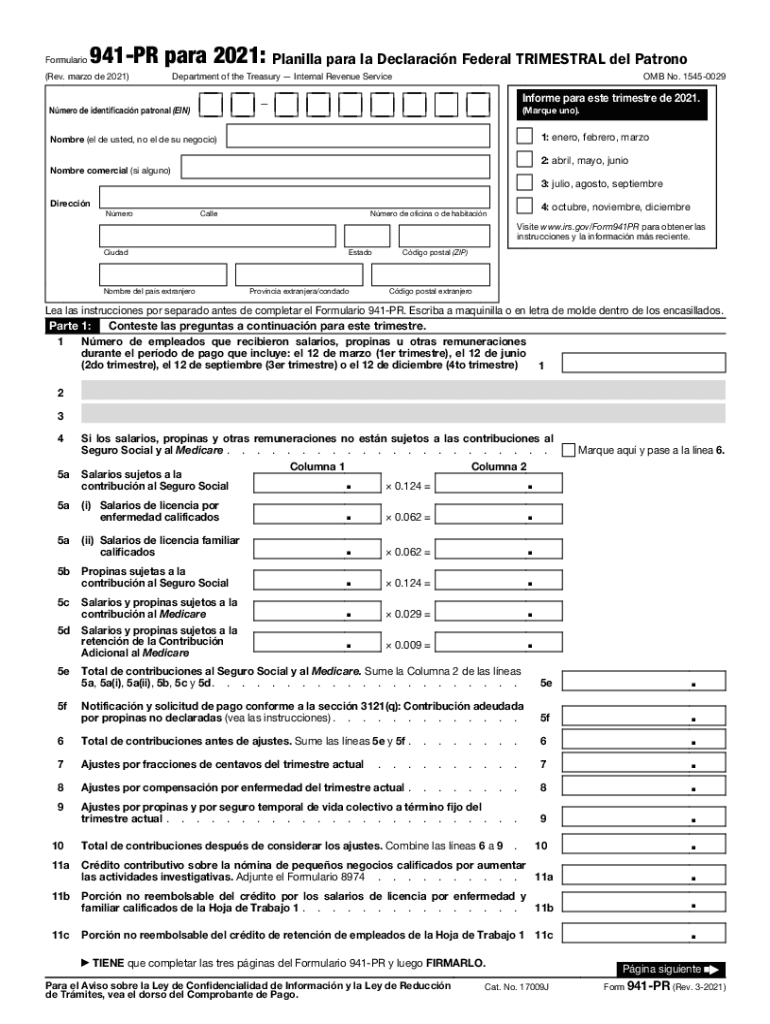

The 2021 Form 941 is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is submitted quarterly and is essential for maintaining compliance with federal tax regulations. Employers must accurately complete this form to ensure proper tax reporting and avoid penalties.

Steps to Complete the 2021 Form 941

Completing the 2021 Form 941 involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form sections, including the number of employees, total wages, and tax liability.

- Calculate the total taxes owed and any adjustments that may be necessary.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2021 Form 941

Employers must adhere to strict deadlines for submitting the 2021 Form 941. The due dates for each quarter are as follows:

- First quarter (January to March): Due by April 30, 2021

- Second quarter (April to June): Due by July 31, 2021

- Third quarter (July to September): Due by October 31, 2021

- Fourth quarter (October to December): Due by January 31, 2022

Legal Use of the 2021 Form 941

The 2021 Form 941 is legally binding and must be completed accurately to reflect the employer's tax obligations. Failure to file or inaccuracies can result in penalties from the IRS. Employers are encouraged to maintain records of submitted forms and any correspondence with the IRS regarding their filings.

Obtaining the 2021 Form 941

The 2021 Form 941 can be obtained directly from the IRS website or through authorized tax software providers. Employers can download a printable version or access a fillable form for electronic submission. It is important to ensure that the correct version of the form is used to avoid any compliance issues.

Form Submission Methods

Employers have several options for submitting the 2021 Form 941:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing a paper copy of the form to the designated IRS address based on the employer's location.

- In-person submission at local IRS offices, though this option may require an appointment.

Quick guide on how to complete form 941 pr rev march 2021 internal revenue service

Complete Form 941 PR Rev March Internal Revenue Service effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Form 941 PR Rev March Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest method to modify and eSign Form 941 PR Rev March Internal Revenue Service with ease

- Obtain Form 941 PR Rev March Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 941 PR Rev March Internal Revenue Service to ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 pr rev march 2021 internal revenue service

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2021 Form 941 and why is it important?

The 2021 Form 941 is the quarterly tax return used by employers to report wages paid and taxes withheld, including federal income tax and FICA taxes. It is crucial for compliance with IRS regulations, and understanding its requirements helps businesses avoid penalties and ensure accurate reporting.

-

How can airSlate SignNow assist with completing the 2021 Form 941?

airSlate SignNow simplifies the process of signing and submitting the 2021 Form 941 by providing easy-to-use eSignature and document management tools. With our platform, you can securely send, sign, and store your tax documents, ensuring a smooth compliance workflow.

-

What are the pricing options for using airSlate SignNow for form submission?

airSlate SignNow offers various pricing plans to fit different business needs, starting from a basic plan for small businesses to more comprehensive options for larger organizations. All plans include features to help with the 2021 Form 941, making document management and eSigning effective and cost-efficient.

-

Are there any specific features that help with the 2021 Form 941?

Yes, airSlate SignNow includes features like customizable templates, reminders for important deadlines, and real-time tracking for your 2021 Form 941 submissions. These tools make it easier to manage and complete your tax forms efficiently.

-

Can I integrate airSlate SignNow with my accounting software for filing the 2021 Form 941?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing for the smooth transfer of information needed for the 2021 Form 941. This integration enhances accuracy and helps to streamline your tax filing process.

-

What benefits does airSlate SignNow offer for managing the 2021 Form 941?

By using airSlate SignNow, businesses can enjoy reduced paperwork, improved accuracy, and faster turnaround times for document signing. These benefits translate to a more efficient way to handle the 2021 Form 941, ultimately saving time and resources.

-

Is airSlate SignNow secure for handling the 2021 Form 941?

Yes, airSlate SignNow prioritizes the security of your data, employing encryption and compliance with industry standards to protect sensitive information related to the 2021 Form 941. You can have peace of mind knowing that your documents are secure during the signing and submission process.

Get more for Form 941 PR Rev March Internal Revenue Service

Find out other Form 941 PR Rev March Internal Revenue Service

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed